This CACI International Analyst Is No Longer Bullish; Here Are Top 5 Downgrades For Wednesday

Benzinga·08/06/2025 12:18:26

Listen to the news

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- Canaccord Genuity analyst Maria Ripps downgraded the rating for Vivid Seats Inc. (NASDAQ:SEAT) from Buy to Hold and lowered the price target from $80 to $23. Vivid Seats shares closed at $1.02 on Tuesday. See how other analysts view this stock.

- Keybanc analyst Jeffrey Hammond downgraded the rating for Atkore Inc. (NYSE:ATKR) from Overweight to Sector Weight. Atkore shares closed at $56.39 on Tuesday. See how other analysts view this stock.

- Piper Sandler analyst Paul Newsome downgraded Kemper Corporation (NYSE:KMPR) from Overweight to Underweight and lowered the price target from $75 to $50. Kemper shares closed at $61.49 on Tuesday. See how other analysts view this stock.

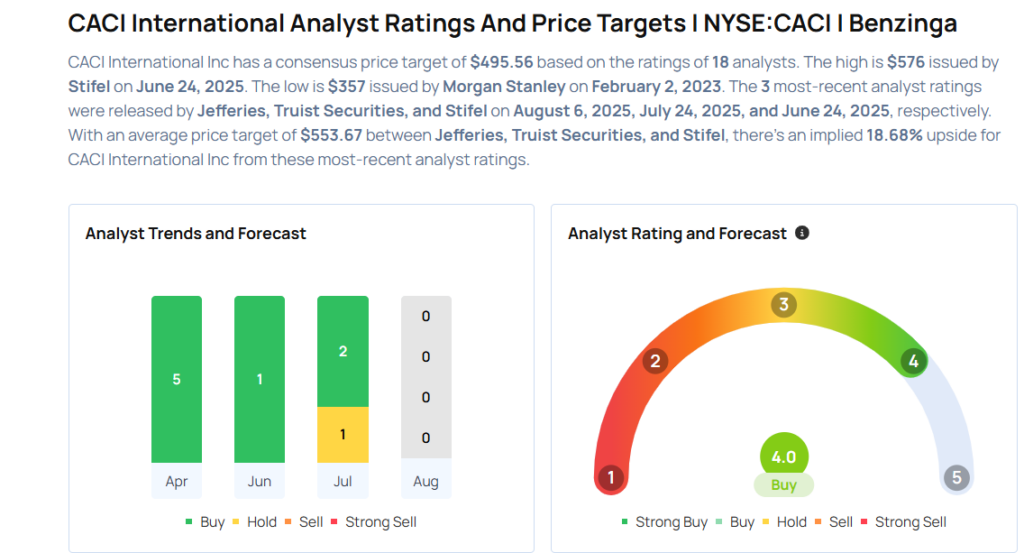

- Jefferies analyst Sheila Kahyaoglu downgraded the rating for CACI International Inc (NYSE:CACI) from Buy to Hold and lowered the price target from $570 to $535 CACI International shares closed at $471.53 on Tuesday. See how other analysts view this stock.

- Goldman Sachs analyst Timothy Zhao downgraded New Oriental Education & Technology Group Inc. (NYSE:EDU) from Buy to Neutral and slashed the price target from $58 to $50. New Oriental Education shares closed at $46.62 on Tuesday. See how other analysts view this stock.

Considering buying CACI stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkRisk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.