Top 3 Dividend Stocks For Reliable Income

As the U.S. stock market experiences fluctuations due to ongoing tariff concerns and mixed corporate earnings, investors are seeking stability in the form of reliable income streams. In such a climate, dividend stocks can offer consistent returns by providing regular payouts, making them an attractive option for those looking to navigate uncertain economic conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 6.08% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.83% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.33% | ★★★★★★ |

| Ennis (EBF) | 5.52% | ★★★★★★ |

| Employers Holdings (EIG) | 3.14% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 4.11% | ★★★★★☆ |

| Dillard's (DDS) | 5.61% | ★★★★★★ |

| CompX International (CIX) | 5.22% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.96% | ★★★★★★ |

| Citizens & Northern (CZNC) | 6.07% | ★★★★★☆ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

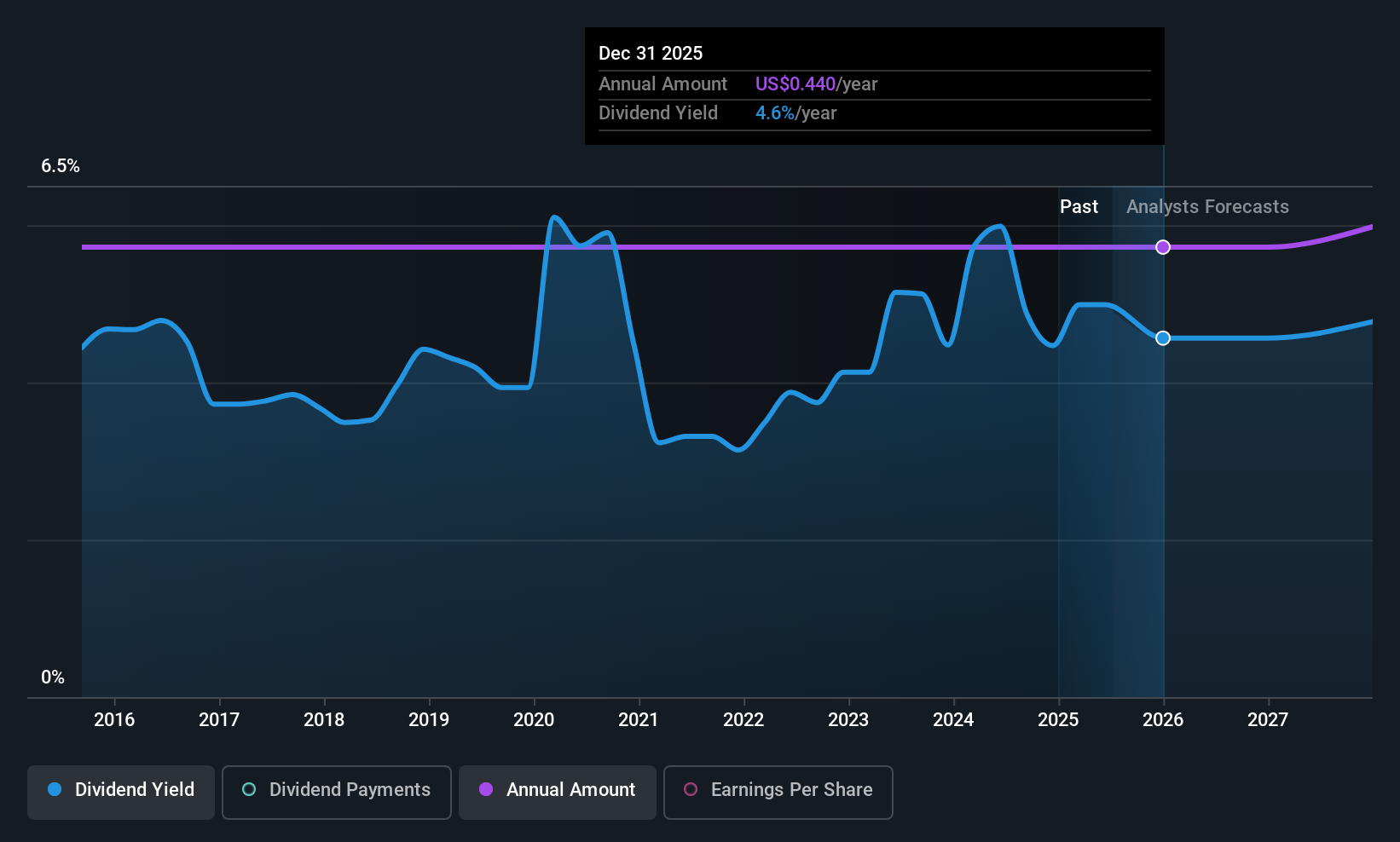

Valley National Bancorp (VLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valley National Bancorp, with a market cap of $5.24 billion, operates as the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management financial services.

Operations: Valley National Bancorp generates revenue through its diverse offerings in commercial banking, private banking, retail financial services, insurance products, and wealth management solutions.

Dividend Yield: 4.7%

Valley National Bancorp offers a stable dividend yield of 4.73%, ranking in the top 25% of U.S. dividend payers, although dividends have not grown over the past decade. The payout ratio is currently sustainable at 55.9% and forecasted to improve to 37.7%. Recent earnings reports show significant growth, with net income rising to US$133.17 million for Q2 2025, supporting its ability to maintain dividends despite some volatility in payments historically.

- Get an in-depth perspective on Valley National Bancorp's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Valley National Bancorp is priced lower than what may be justified by its financials.

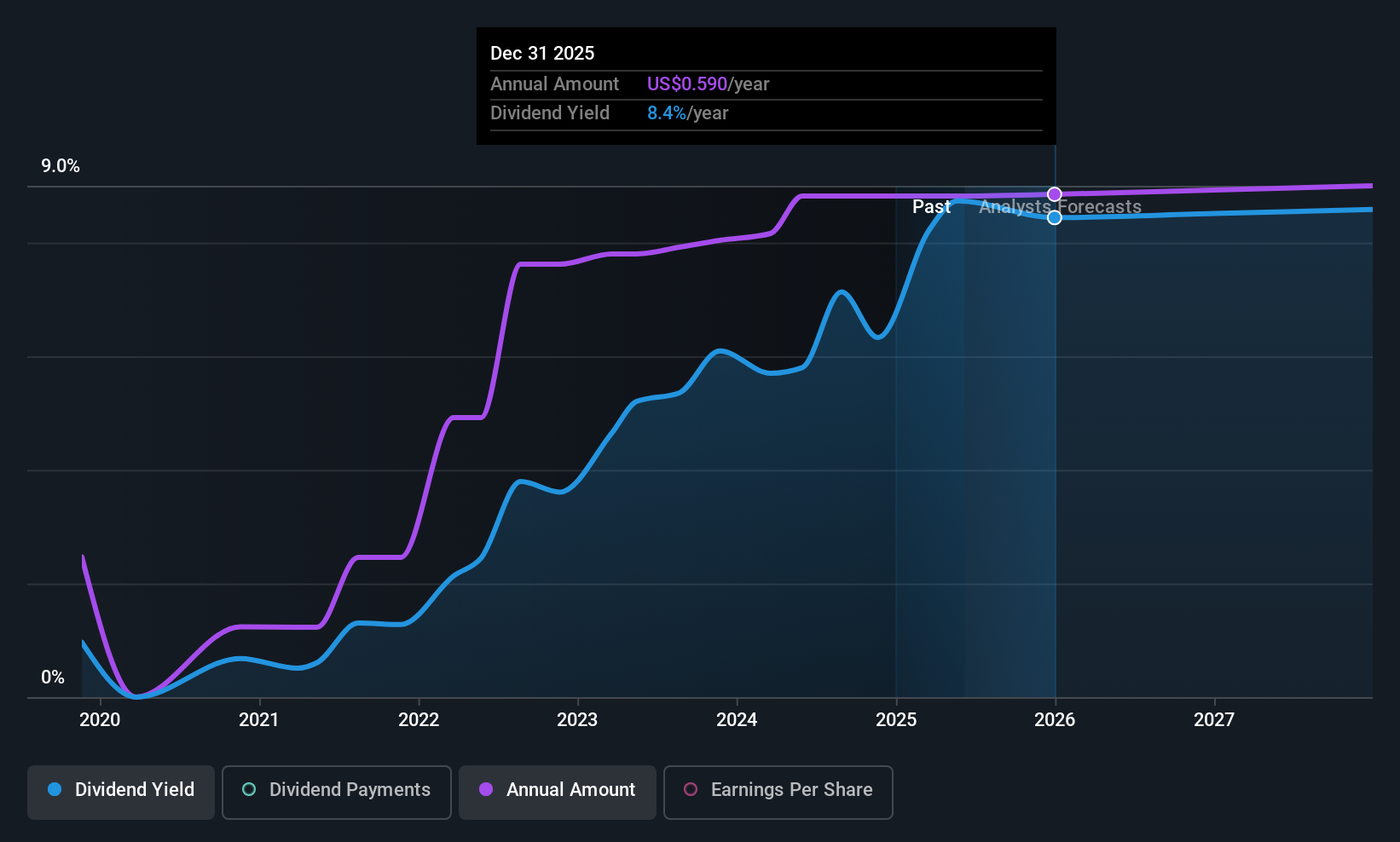

GeoPark (GPRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoPark Limited is an oil and natural gas exploration and production company active in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries with a market cap of $327.41 million.

Operations: GeoPark Limited generates revenue primarily from its Oil & Gas - Exploration & Production segment, which amounted to $630.77 million.

Dividend Yield: 8.9%

GeoPark's dividend yield of 8.86% places it in the top 25% of U.S. dividend payers, supported by a low payout ratio of 38.5%. Despite this, its dividends have been volatile over the past six years and are not considered stable due to inconsistent payments and a high debt level. Recent earnings showed a decline with Q2 sales dropping to US$119.79 million and net loss at US$10.34 million, raising concerns about future dividend sustainability despite recent affirmations of quarterly payouts totaling approximately US$7.5 million.

- Navigate through the intricacies of GeoPark with our comprehensive dividend report here.

- According our valuation report, there's an indication that GeoPark's share price might be on the cheaper side.

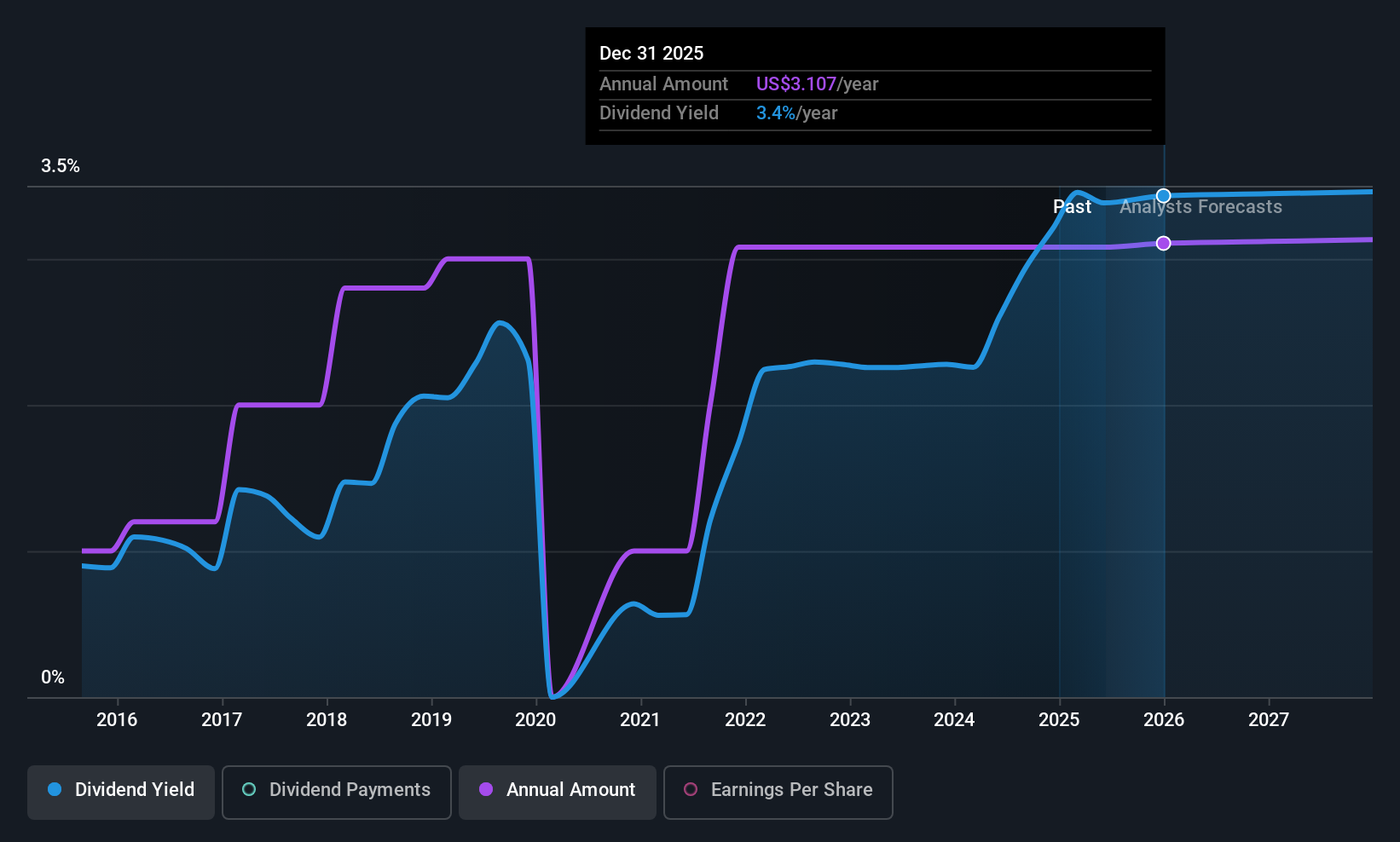

Lear (LEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lear Corporation specializes in the design, development, engineering, manufacturing, assembly, and supply of automotive seating and electrical distribution systems for original equipment manufacturers across multiple continents, with a market cap of approximately $4.94 billion.

Operations: Lear Corporation's revenue segments consist of $16.93 billion from Seating and $5.98 billion from e-Systems.

Dividend Yield: 3.3%

Lear Corporation's dividend yield of 3.25% is below the top 25% of U.S. dividend payers, but its dividends are well-covered by earnings and cash flows, with payout ratios at 35.7% and 34.3%, respectively. Despite a volatile dividend history over the past decade, recent affirmations indicate stability with a quarterly cash dividend of $0.77 per share declared in May 2025. The company recently extended its $2 billion revolving credit facility to July 2030, enhancing financial flexibility amidst raised revenue guidance for this year to approximately $22.8 billion.

- Unlock comprehensive insights into our analysis of Lear stock in this dividend report.

- Upon reviewing our latest valuation report, Lear's share price might be too pessimistic.

Turning Ideas Into Actions

- Access the full spectrum of 142 Top US Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English