Inter & Co (INTR) Is Up 11.3% After Posting Strong Q2 2025 Net Income Growth - What's Changed

- Inter & Co, Inc. recently reported its second quarter and first half 2025 results, posting net income of R$315.13 million for the quarter and R$601.72 million for the six months, both showing significant increases over the same periods a year earlier.

- This strong financial performance reflects higher profitability and earnings per share, highlighting the company's improved operations and growth momentum.

- Given the substantial rise in quarterly net income, we'll examine how this earnings strength could impact Inter & Co's broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Inter & Co Investment Narrative Recap

To be a shareholder in Inter & Co, you need to believe in the scalability and resilience of its digital banking platform, particularly as it aims to sustain rapid user and product adoption in Brazil’s highly competitive fintech sector. The recent surge in earnings is encouraging and may provide short-term support to confidence around its top-line growth; however, given persistent risks from growing bad loans and market competition, the results do not materially shift the biggest risks facing the business today.

Among the recent announcements, the August 6 earnings report stands out for signaling accelerated revenue and net income growth, reinforcing ongoing momentum behind Inter & Co’s client acquisition and product cross-sell strategies. These results closely relate to the company's main near-term catalyst of rapid user growth and engagement, though they also invite scrutiny on how sustainable this level of profitability can remain amid a challenging lending environment.

Yet, it is important not to overlook the rising ratio of bad loans, something every investor should keep an eye on, especially if...

Read the full narrative on Inter & Co (it's free!)

Inter & Co's narrative projects R$13.6 billion revenue and R$2.9 billion earnings by 2028. This requires 36.8% yearly revenue growth and an earnings increase of R$1.8 billion from R$1.1 billion today.

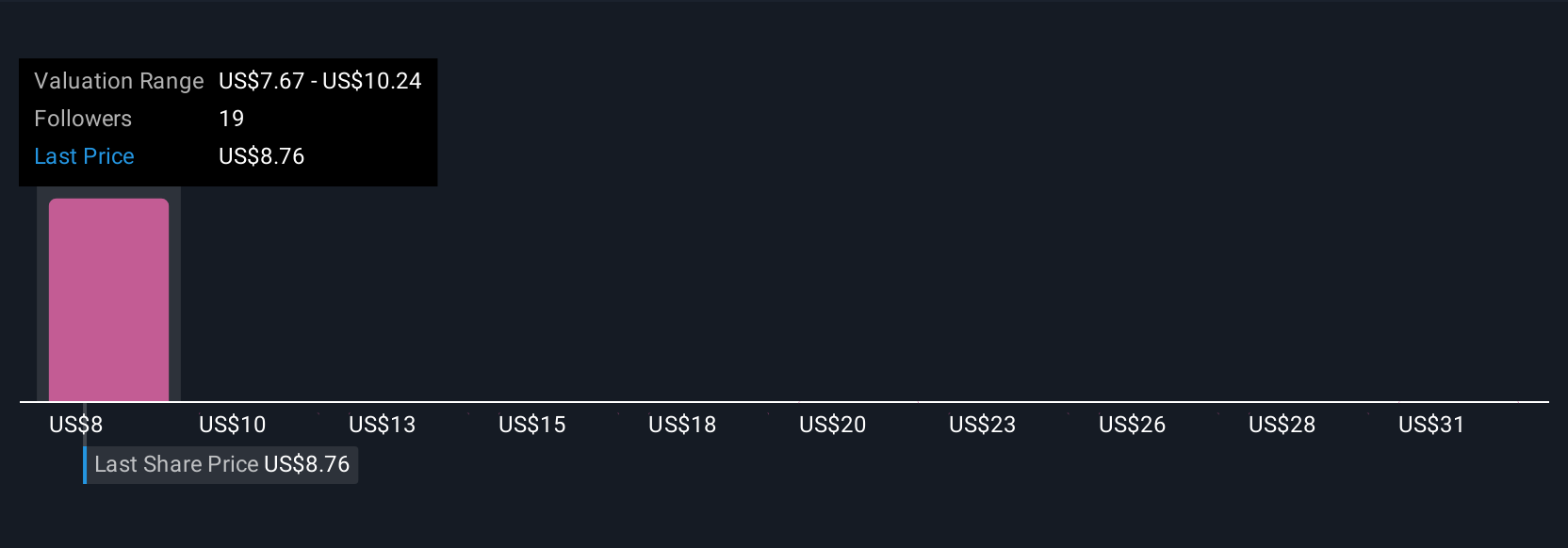

Uncover how Inter & Co's forecasts yield a $7.34 fair value, in line with its current price.

Exploring Other Perspectives

Five retail investors in the Simply Wall St Community estimate fair value between R$7.34 and R$33.30, with wide-ranging outlooks. Rapid user growth continues to support optimism, but future results could be shaped by credit portfolio risk, so be sure to explore multiple viewpoints.

Explore 5 other fair value estimates on Inter & Co - why the stock might be worth over 4x more than the current price!

Build Your Own Inter & Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inter & Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inter & Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inter & Co's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English