Freeport's Q2 Volumes Rise: Tepid Outlook Points to Challenges Ahead

Freeport-McMoRan Inc.’s FCX second-quarter 2025 results show increases in sales volumes. Its copper sales volumes increased around 9% year over year, reaching 1,016 million pounds, primarily driven by shipment timing. The company sold 522,000 ounces of gold, reflecting around 45% year-over-year growth. FCX also sold 22 million pounds of molybdenum, up about 4.8% from the year-ago quarter.

Freeport has provided a tepid copper sales volume outlook for the third quarter, which suggests flat to modestly lower volumes on a sequential basis. FCX expects copper sales volumes of 990 million pounds, indicating a 4% year-over-year decline. It has also provided a weaker gold and molybdenum sales volumes guidance of 350,000 ounces and 18 million pounds, respectively, reflecting sequential and year-over-year declines. The lack of growth in volumes may impact the company’s performance.

Sales volume growth underpins Freeport’s ability to leverage higher copper and gold prices, maintain margin expansion and deliver on targets for 2025. Despite gains in realized prices, volume growth would be critical to sustain revenues and margins in the coming quarters.

Among FCX’s peers, Southern Copper Corporation SCCO logged lower copper sales volumes in the second quarter, which weighed on its top line. Southern Copper sold 224,063 tons of copper in the quarter, declining 3% year over year. Southern Copper, however, saw higher molybdenum sales volumes, which rose 2.7% year over year.

BHP Group Limited BHP saw higher year-over-year copper sales in the fourth quarter of fiscal 2025 (ended June 30, 2025). BHP Group’s copper sales for the quarter rose roughly 1% to 526 kt. This led BHP Group’s total copper sales to 2,053.3 kt for fiscal 2025, which marks a 14% year-over-year growth.

The Zacks Rundown for FCX

Shares of Freeport-McMoRan are up 4.7% year to date against the Zacks Mining - Non Ferrous industry’s decline of 1.1%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

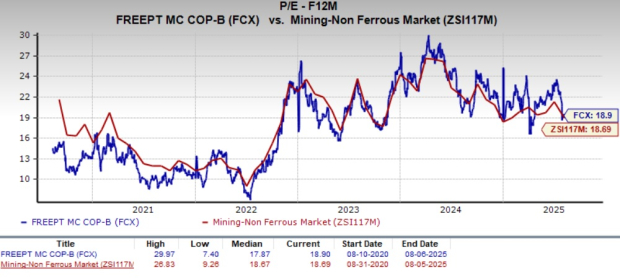

From a valuation standpoint, FCX is currently trading at a forward 12-month earnings multiple of 18.9, a modest 1% premium to the industry average of 18.69X. It carries a Value Score of A.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for FCX’s 2025 and 2026 earnings implies a year-over-year rise of 20.3% and 31.9%, respectively. The EPS estimates for 2025 and 2026 have been trending higher over the past 60 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

FCX stock currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Freeport-McMoRan Inc. (FCX): Free Stock Analysis Report

BHP Group Limited Sponsored ADR (BHP): Free Stock Analysis Report

Southern Copper Corporation (SCCO): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English