Mastercard Stock: Analyst Estimates & Ratings

Mastercard Incorporated (MA), headquartered in Purchase, New York, provides transaction processing and other payment-related products and services. Valued at $516.1 billion by market cap, the company offers payment processing services for credit and debit cards, electronic cash, automated teller machines, and travelers' checks.

Shares of this payments giant have outperformed the broader market over the past year. MA has gained 27% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 21.1%. In 2025, MA stock is up 8.1%, surpassing SPX’s 7.9% rise on a YTD basis.

Zooming in further, MA’s outperformance looks less pronounced compared to the Amplify Digital Payments ETF (IPAY). The exchange-traded fund has gained about 25.6% over the past year. Moreover, MA’s gains on a YTD basis outshine the ETF’s 1.3% losses over the same time frame.

Mastercard's outperformance is driven by its strategic integration of stablecoins, including USDG, USDC, PYUSD, and FIUSD, through its partnership with Paxos's Global Dollar Network. The company is also expanding its digital wallet capabilities with integrations like MetaMask, OKX, and Crypto.com, and enabling card-based spending via its Multi-Token Network and Mastercard Move settlement platform across 150 million merchants.

On Jul. 31, MA shares closed up more than 1% after reporting its Q2 results. Its adjusted EPS of $4.15 exceeded Wall Street's expectations of $4.05. The company’s revenue was $8.1 billion, topping Wall Street forecasts of $8 billion.

For the current fiscal year, ending in December, analysts expect MA’s EPS to grow 11.6% to $16.29 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

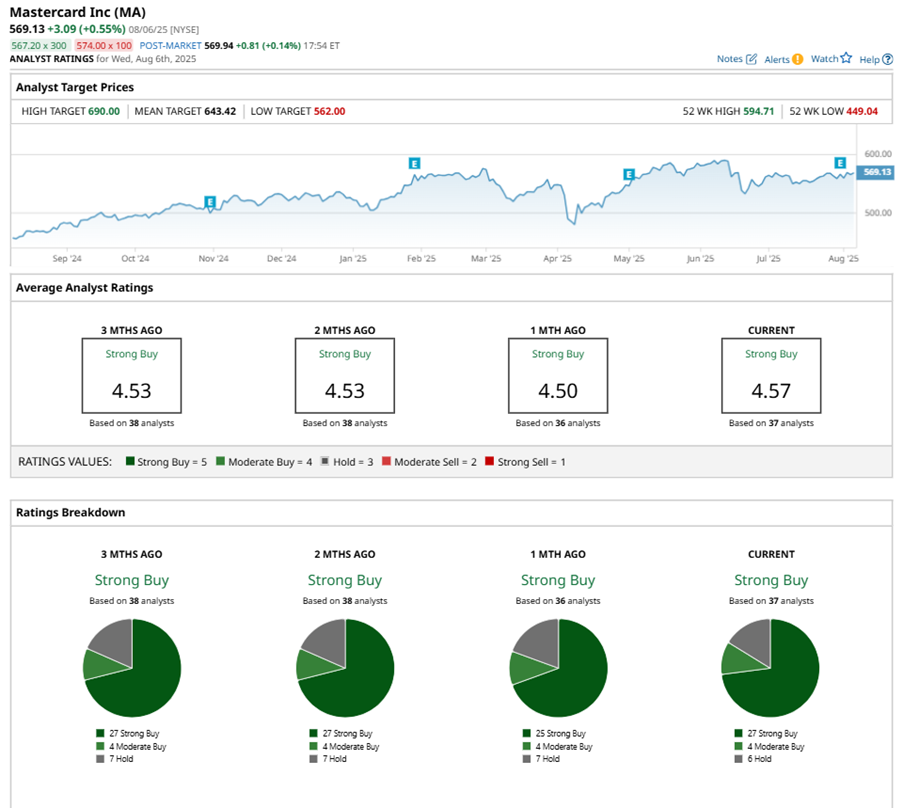

Among the 37 analysts covering MA stock, the consensus is a “Strong Buy.” That’s based on 27 “Strong Buy” ratings, four “Moderate Buys,” and six “Holds.”

This configuration is more bullish than a month ago, with 25 analysts suggesting a “Strong Buy.”

On Aug. 1, JPMorgan Chase & Co. (JPM) analyst Tien Tsin Huang maintained a “Buy” rating on MA and set a price target of $463.

The mean price target of $643.42 represents a 13.1% premium to MA’s current price levels. The Street-high price target of $690 suggests an upside potential of 21.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English