AmEx Gets a Taste of Toast: And a Bigger Bite of Hospitality?

American Express Company AXP has formed a multi-year strategic partnership with Toast, Inc. TOST, a restaurant technology platform, to elevate hospitality experiences. As part of this move, AmEx is integrating guest data from its restaurant reservation platforms, Resy and Tock, into Toast’s hardware and software systems. This means servers using Toast Go handhelds or POS terminals will now be able to access real-time guest preferences, enabling more personalized service.

In addition, Resy and Tock listings will become visible on Toast’s platforms, like Local by Toast and Toast Tables. This partnership is important because it strengthens AmEx’s position in the restaurant and hospitality ecosystem. By merging its dining network with Toast’s operational tools, AXP creates a more seamless guest experience while expanding its influence over the customer journey, from reservation to payment.

It also helps differentiate AXP from competitors by linking card membership to exclusive, data-enhanced hospitality services. Financially, AmEx stands to benefit through increased cardmember engagement and spending. More personalized experiences can drive higher loyalty and usage of AmEx cards at participating venues.

Restaurants using Toast may prefer AmEx partnerships due to the enhanced marketing, visibility and data access, potentially improving retention and attracting more restaurants to its platform. Overall, the collaboration positions AXP to deepen customer relationships and expand merchant acceptance, while Toast gains access to new traffic sources and tools to boost hospitality outcomes. Moves like this signal AmEx’s growing focus on tech-savvy Millennials and Gen-Z consumers, who tend to spend more than their older counterparts.

AmEx’s Full-Course Advantage Over Visa & Mastercard

AmEx sets itself apart from peers like Visa Inc. V and Mastercard Incorporated MA by integrating deeply into the hospitality journey, not just at payment, but from reservation to service. Through partnerships and acquisitions, AXP offers personalized dining experiences, like servers accessing guest preferences in real time. This end-to-end control allows AmEx to create value beyond transactions, reinforcing its premium image. Visa and Mastercard, as payments-focused networks, lack similar consumer-facing platforms. By owning key touchpoints and enhancing loyalty through exclusive services, AXP positions itself as more than a payment processor; it's a hospitality partner, offering benefits that peers cannot easily replicate.

AmEx’sPrice Performance, Valuation and Estimates

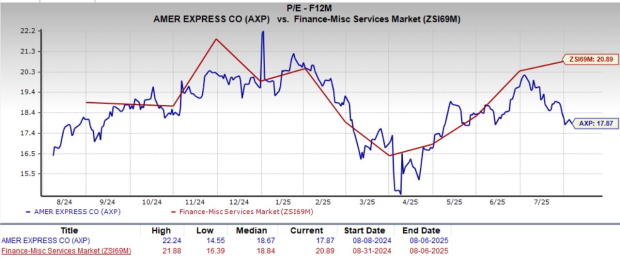

Shares of AXP have declined 0.5% in the year-to-date period against the industry’s growth of 2.3%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation standpoint, AmEx trades at a forward price-to-earnings ratio of 17.87X, down from the industry average of 20.89. AXP carries a Value Score of B.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

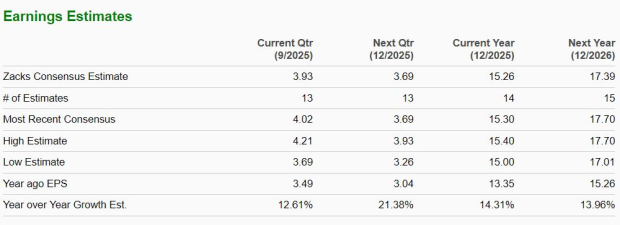

The Zacks Consensus Estimate for AmEx’s 2025 earnings is pegged at $15.26 per share, implying a 14.3% jump from the year-ago period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

Toast, Inc. (TOST): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English