Citigroup's NII Rises Y/Y in 1H25: Will This Momentum Continue?

Citigroup, Inc. C is demonstrating resilience and steady growth in its core banking operations, with net interest income (NII) showing an encouraging upward trend in 2025. In the first half of 2025, the company’s NII rose 8% year over year to $29.2 million. The rise was primarily driven by an increase in average deposit and loan balances, as well as higher deposit spreads.

Going forward, Citigroup’s NII outlook remains favorable, supported by a stable interest rate environment and solid balance sheet trends. While the Federal Reserve maintains a cautious approach due to ongoing global trade uncertainties and tariff-related pressures, interest rates are expected to hold steady in the near term, which bodes well for Citigroup.

The steady interest rate environment should ease pressure on funding and deposit costs, enabling the bank to preserve margins and capitalize on its expanding loan portfolio. Additionally, Citigroup’s broad geographic reach and well-diversified business model position it to navigate shifting economic and interest rate cycles effectively. These factors enhance its capacity to sustain NII growth in the upcoming period.

Reflecting its optimism, Citigroup’s management raised its 2025 NII guidance (excluding Markets) during its second-quarter earnings release. The bank expects NII to grow 4% year over year in 2025, up from the previously mentioned 2-3% rise. In 2024, Citigroup’s NII stood at $54.9 billion.

How C Compares With BAC & WFC in Terms of NII

Bank of America BAC is also witnessing a rise in NII. In the first half of 2025, the metric rose 4.9% year over year to $29.1 million, driven by decent loan demand, higher-for-longer interest rates and a robust deposit balance. Though the Federal Reserve lowered interest rates last year, it is now pursuing a cautious rate-cutting approach because of tariff-related headwinds. Hence, interest rates are likely to remain high for longer. As such, Bank of America is expected to witness solid improvement in NII and net interest yield going forward. Bank of America expects a sequential rise in NII for each of the quarters this year, with annual growth of 6-7%.

On the contrary, Wells Fargo WFC has been experiencing a declining trend in recent years. In the first six months of 2025, its net interest income (NII) dropped nearly 4% year over year to $23.2 billion. This decline was primarily driven by the effects of lower interest rates on floating-rate assets and unfavorable changes in the deposit mix. As interest rates are expected to remain relatively high in the near term, Wells Fargo’s NII is likely to remain under pressure in the near term. Wells Fargo expects its 2025 NII to be in line with the 2024 reported figure of $47.7 billion, indicating limited growth ahead.

C’s Price Performance, Valuation & Estimates

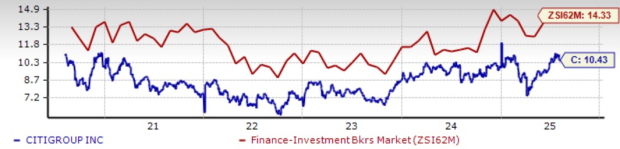

Shares of Citigroup have gained 33.9% year to date compared with the industry’s growth of 21.8%.

Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

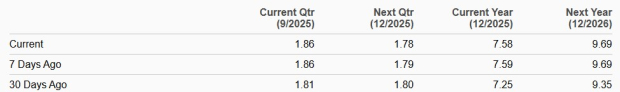

From a valuation standpoint, C trades at a forward price-to-earnings (P/E) ratio of 10.43X, below the industry’s average of 14.33X.

Price-to-Earnings F12M

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for C’s 2025 and 2026 earnings implies year-over-year rallies of 27.4% and 27.7%, respectively. Estimates for 2025 and 2026 have been revised upward over the past 30 days.

Earnings Estimates

Image Source: Zacks Investment Research

Citigroup currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English