Is OPKO Health's (OPK) Buyback Amid Losses a Sign of Strategic Conviction or Financial Strain?

- OPKO Health reported weak second quarter 2025 results, with revenue at US$156.81 million and a net loss of US$148.44 million, and reaffirmed its full-year revenue guidance between US$640 million and US$660 million.

- The company also completed a major share buyback, repurchasing 5.77% of shares for US$58.4 million despite ongoing financial pressures.

- We’ll now examine how this combination of weak results and continued buybacks influences OPKO Health’s investment narrative and outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

OPKO Health Investment Narrative Recap

To be an OPKO Health shareholder right now means believing in the company’s ability to deliver on its pipeline and partnerships despite ongoing unprofitability and weak recent results. The latest Q2 numbers, with declining revenue and a sharp rise in net loss, reinforce ongoing risks in execution and cash flow, but do not materially alter the central short-term catalyst: progress in the Pharmaceuticals segment, notably through upcoming clinical trial updates. The biggest risk remains the company’s ability to stabilize and grow revenue amid operational challenges.

Among recent announcements, the completed buyback of 5.77% of outstanding shares stands out. While substantial repurchases can be seen as a positive signal for capital allocation efficiency, their impact may be muted if financial pressures continue and core business performance does not improve, especially as consistent losses weigh on the company’s outlook.

However, investors should take special note of the ongoing risk of revenue pressure following the LabCorp transaction, as this could further...

Read the full narrative on OPKO Health (it's free!)

OPKO Health's narrative projects $828.6 million in revenue and $37.9 million in earnings by 2028. This requires 6.3% yearly revenue growth and a $76.9 million increase in earnings from the current level of -$39.0 million.

Uncover how OPKO Health's forecasts yield a $3.62 fair value, a 185% upside to its current price.

Exploring Other Perspectives

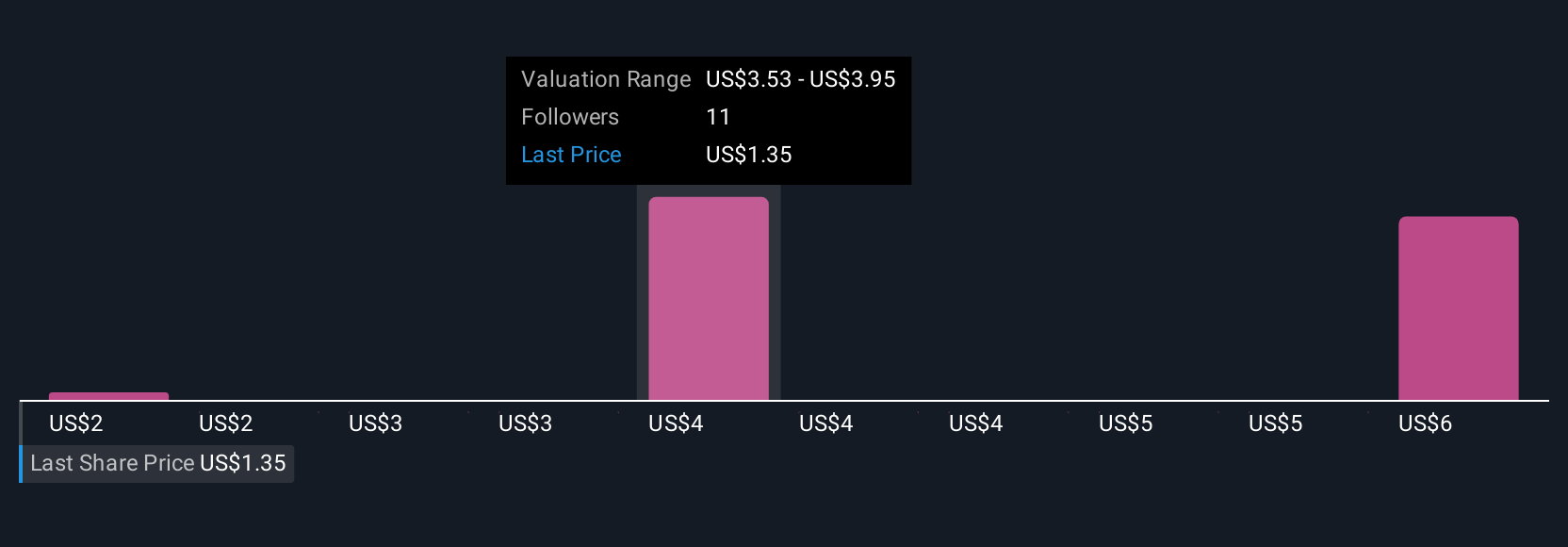

Fair value estimates from the Simply Wall St Community stretch from US$1.85 to US$6.06, with three viewpoints captured. With core business revenues under ongoing pressure, these differing perspectives reflect how much future improvement and risk you may be willing to consider.

Explore 3 other fair value estimates on OPKO Health - why the stock might be worth over 4x more than the current price!

Build Your Own OPKO Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPKO Health research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free OPKO Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPKO Health's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English