Khoon Group Limited (HKG:924) Could Be Riskier Than It Looks

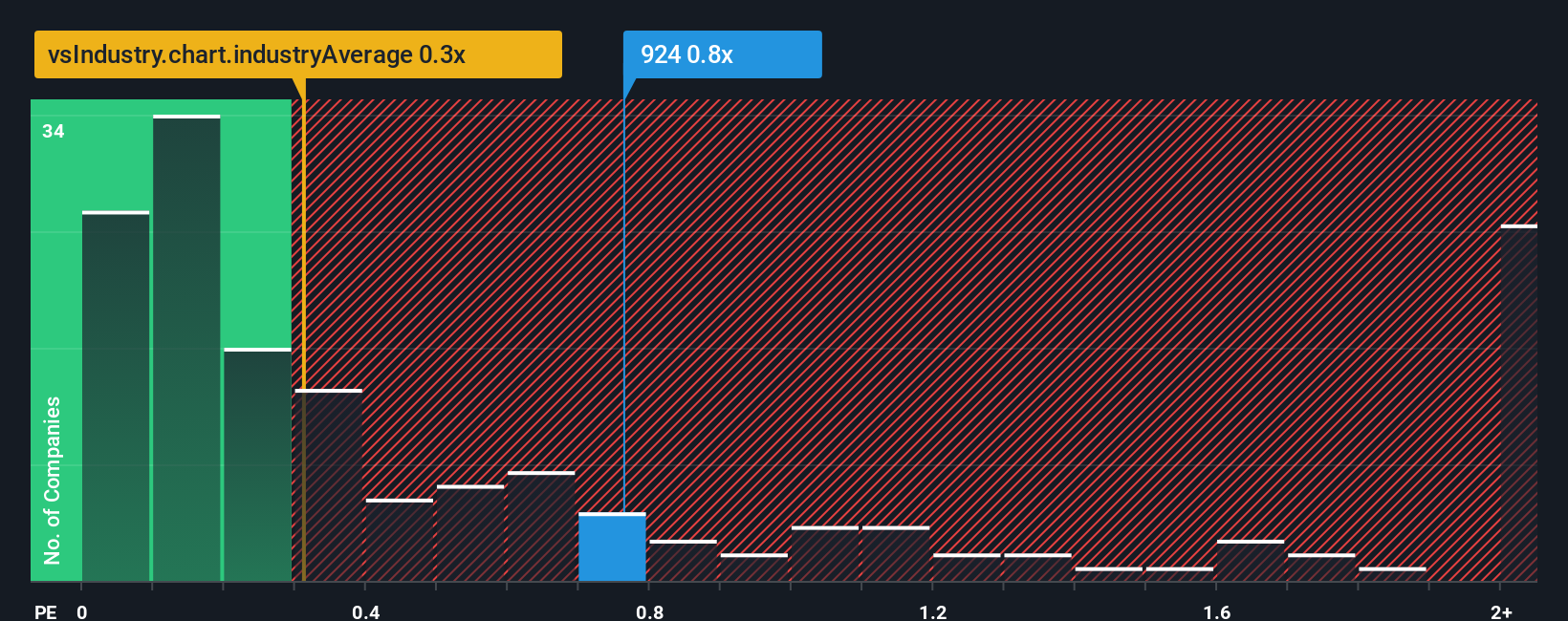

There wouldn't be many who think Khoon Group Limited's (HKG:924) price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S for the Construction industry in Hong Kong is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Khoon Group

How Has Khoon Group Performed Recently?

Khoon Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Khoon Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Khoon Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Khoon Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. Pleasingly, revenue has also lifted 261% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 16% shows it's noticeably more attractive.

In light of this, it's curious that Khoon Group's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Khoon Group revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Having said that, be aware Khoon Group is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English