CT Vision S.L. (International) Holdings Limited (HKG:994) Stock Rockets 28% But Many Are Still Ignoring The Company

Despite an already strong run, CT Vision S.L. (International) Holdings Limited (HKG:994) shares have been powering on, with a gain of 28% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 4.8% isn't as impressive.

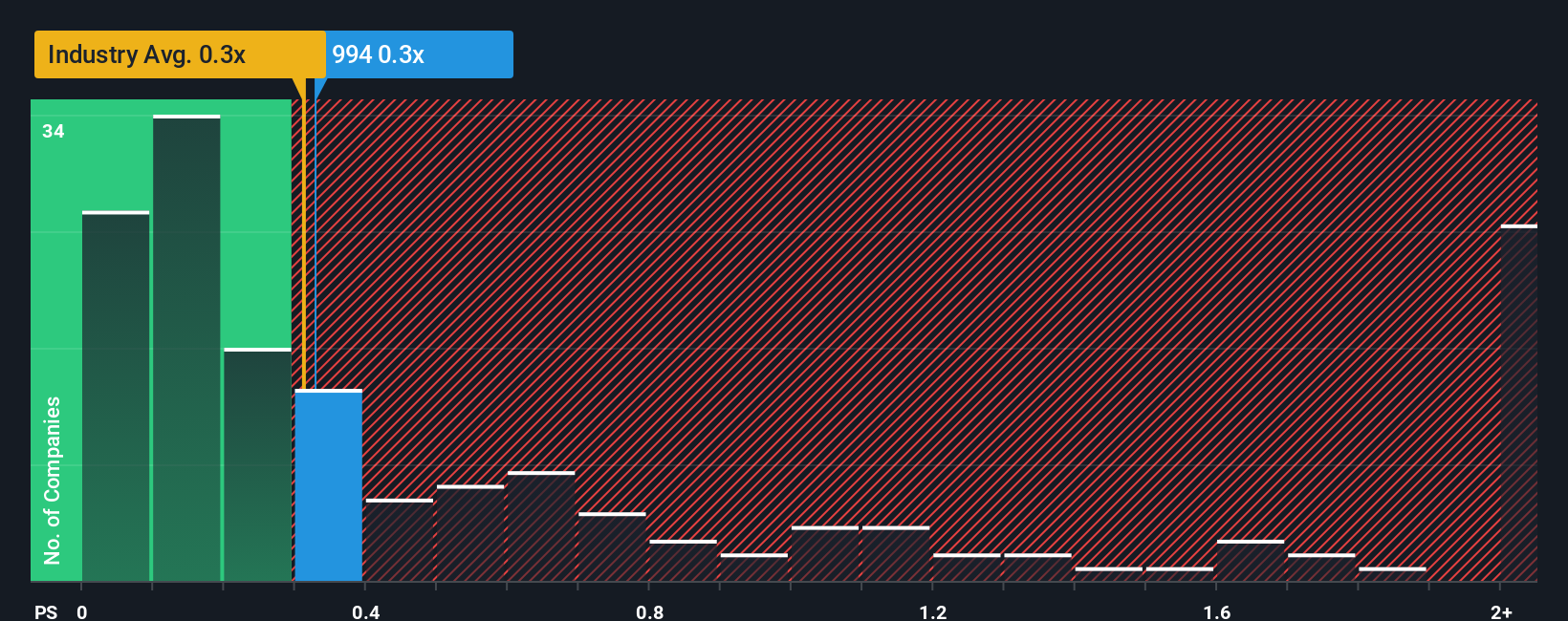

Although its price has surged higher, there still wouldn't be many who think CT Vision S.L. (International) Holdings' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when it essentially matches the median P/S in Hong Kong's Construction industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for CT Vision S.L. (International) Holdings

How Has CT Vision S.L. (International) Holdings Performed Recently?

Recent times have been quite advantageous for CT Vision S.L. (International) Holdings as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CT Vision S.L. (International) Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like CT Vision S.L. (International) Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 61%. The latest three year period has also seen an excellent 169% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 16% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that CT Vision S.L. (International) Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does CT Vision S.L. (International) Holdings' P/S Mean For Investors?

CT Vision S.L. (International) Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that CT Vision S.L. (International) Holdings currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 2 warning signs for CT Vision S.L. (International) Holdings (1 is concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English