Hologic's Diagnostics Arm Set for Long-Term Upside: What's Behind It?

Hologic’s HOLX Diagnostics unit, the largest by revenues, has been the most impacted by geopolitical headwinds this year. Cuts in USAID funding have affected its HIV testing business in Africa, while a challenging operating environment in China has weighed on its Cytology business. As a result, Diagnostics posted just 0.9% year-over-year reported growth in the third quarter of fiscal 2025. Despite these hurdles, the underlying growth drivers in the segment continue to remain strong.

One is the BV, CV/TV assay, which has become Hologic’s second-largest assay globally after shifting from a primarily lab-developed test (LDT) approved in 2019 to an in-vitro diagnostics (IVD) test on the high-throughput Panther instrument. The company is working to reach the estimated 60% of U.S. women who are not tested when they experience vaginitis, applying the same approach it uses to expand sexually transmitted infection (STI) testing.

Additionally, Panther Fusion, an add-on module to the base Panther platform, is gaining nice traction this year as customers adopt more menus. The system uses PCR chemistry to run Hologic’s suite of respiratory assays, including influenza, while offering an expanded IVD menu and Open Access functionality for LDTs. Open Access testing kits contributed to Fusion’s solid growth in the fiscal third quarter. Over the next several years, Hologic plans to broaden the menu by launching an IVD test for GI and hospital-acquired infections, positioning the sidecar to play a key role in future Diagnostics growth.

The company is also currently in the early stages of its Biotheranostics opportunity. Acquired in 2021, the asset marked Hologic’s entry into the lab-based oncology space, an expanding and longtime area of interest. Biotheranostics’ Breast Cancer Index test — the only commercially available test validated to inform the decision regarding extended endocrine therapy — continues to see strong adoption.

Latest Updates From Hologic’s Diagnostics Peers

Abbott’s ABT Diagnostics sales declined 1.5% in the second quarter of 2025, mainly due to the year-over-year decrease in COVID-19 testing sales and the impact of volume-based procurement programs in China. Together, these are expected to weigh on ABT’s full-year Diagnostics sales growth by around $700 million or 750 basis points. Excluding China, Abbott’s Core Lab Diagnostics grew 8%, reflecting strong underlying demand in the global markets.

Danaher’s DHR core sales growth in the molecular diagnostics business witnessed growth in the second quarter of 2025, as gains in non-respiratory testing more than offset declines in core sales of respiratory tests. Danaher also announced a new partnership with AstraZeneca to develop diagnostic tools that identify patients most likely to benefit from precision medicine treatments. This collaboration is leveraging the newly launched Danaher Centers to enable precision medicine to streamline the end-to-end development process.

HOLX Stock Performance, Valuation and Estimates

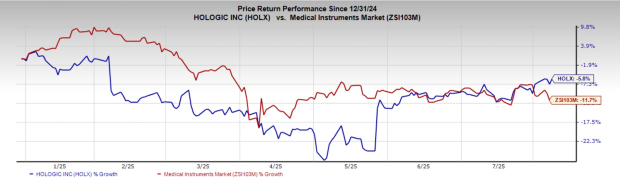

Year to date, Hologic shares have declined 5.8% compared with the industry’s 11.7% fall.

Image Source: Zacks Investment Research

Hologic is trading at a forward five-year price-to-earnings of 15.05X, lower than the industry average of 27.49X. The stock carries a Value Score of B at present.

Image Source: Zacks Investment Research

See how analysts are projecting Hologic’s EPS for fiscal 2025 and 2026.

Image Source: Zacks Investment Research

HOLX stock currently carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

See our %%CTA_TEXT%% report – free today!

7 Best Stocks for the Next 30 DaysWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT): Free Stock Analysis Report

Danaher Corporation (DHR): Free Stock Analysis Report

Hologic, Inc. (HOLX): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English