Abbott's EPD Growth Beats Market Trends: Here's How to Play the Stock

Abbott Laboratories’ ABT Established Pharmaceuticals Division (“EPD”) operates solely in emerging geographies, with leading positions in many of the largest and fastest-growing pharmaceutical markets (including India, China, and countries across Asia, Latin America and the Middle East) for branded generics in the world. Banking on the successful execution of the company’s branded generic operating model, EPD is well-positioned for sustained growth in these expanding pharmaceutical markets.

Per a report by Triodos Investment Management, growth in emerging markets may decelerate to approximately 3.7% in 2025, below the 4% average of the past decade, caused by the ongoing geopolitical developments and new tariffs.

However, Abbott’s EPD sales in the second quarter of 2025 increased 6.9% on a reported basis and 7.7% organically. More than half of its top 15 markets, now surpassing $1 billion in quarterly sales for the first time, posted double-digit gains. Abbott’s strategic focus on biosimilars further strengthens its prospects, with 10 regulatory approval submissions completed across emerging markets. Furthermore, Abbott continues to sustain its long track record of delivering strong growth, which includes a five-year CAGR for EPD of 8%.

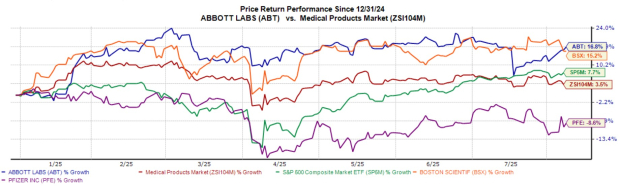

Year to date, Abbott shares have reached roughly 16.8%, outpacing the broader Medical Product industry and the S&P 500 benchmark, which have improved about 3.5% and 7.7%, respectively. During this time, Abbott has also outpaced key peers such as Pfizer PFE and Boston Scientific BSX. While shares of PFE, a pharmaceutical corporation with a broad portfolio of drugs and vaccines, declined 8.6%, those of Boston Scientific, which also operates in the emerging markets, advanced 15.1%.

ABT YTD Price Comparison

Image Source: Zacks Investment Research

Major Tailwinds Driving ABT Stock

Robust Growth in Core Diagnostics: Abbott continues to expand its Diagnostics business, which accounted for 19.5% of the total revenues in the second quarter of 2025. The company is witnessing increased global demand for routine diagnostic (excluding COVID-19 testing sales). Strong demand for its respiratory disease tests for flu, strep throat, and RSV is fueling growth across various settings like hospitals, labs and pharmacies. Core Lab Diagnostics, excluding China, grew 8% in the quarter, with strong momentum in the United States, Europe and Latin America. Moreover, a $0.5 billion investment in Illinois and Texas facilities, as well as the upcoming launch of the Alinity system, target further expansion into the $1 billion molecular testing market.

Strong Momentum in Diabetes Care: Abbott’s Diabetes Care business is growing, driven by strong sales of its FreeStyle Libre CGM system, which is now the top choice for both Type 1 and Type 2 diabetic patients globally. Abbott also has two FDA-cleared over-the-counter CGMs, Lingo and Libre Rio, expanding access to over 6 million users worldwide.

In the second quarter, CGM sales exceeded $1.9 billion, up 19.6% organically, with U.S. Libre sales rising nearly 26%. The upcoming dual-analyte sensor with ketone monitoring is expected to further boost Abbott’s CGM leadership.

Steady 2025 Financial Guidance: Abbott expects full-year 2025 organic sales growth, excluding COVID-19 testing-related sales, to be in the range of 7.5-8.0%, or 6.0-7.0% when including COVID-19 testing-related sales. It projects full-year 2025 adjusted operating margin to be approximately 23.5% of sales. Full-year adjusted diluted earnings per share are expected to be in the range of $5.10-$5.20.

Estimates for ABT Heading South

The Zacks Consensus Estimate for Abbott’s 2025 sales and EPS implies a year-over-year improvement of 6.5% and 10.3%, respectively. However, the bottom-line estimates have shown downward movement in the past 30 days.

Image Source: Zacks Investment Research

ABT’s Downsides

Abbott continues to face a challenging business environment caused by trade tensions and the ongoing complex geopolitical situation globally. The deteriorating global economic environment continues to reduce demand for several MedTech products, leading to lower sales and product pricing, while increasing the cost of goods and operating expenses. In the second quarter, Abbott’s adjusted SG&A expenses increased 5.3% year over year.

In addition, the Chinese government’s adoption of volume-based procurement (VBP) policies is adversely impacting Abbott’s Diagnostics and EPD businesses in China. In Diagnostics, the VBP impact and delayed recovery in testing volumes are projected to be a $700 million headwind to full-year 2025 sales.

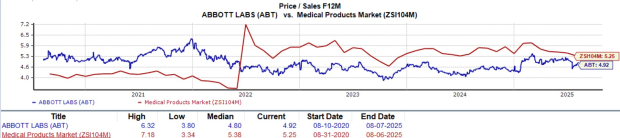

ABT Stock Valuation

With a forward five-year price-to-sales (P/S) of 4.92X, Abbott’s shares are trading at a discount compared with the industry average of 5.38X. It has a Value Score of C at present.

Image Source: Zacks Investment Research

Meanwhile, PFE’s five-year P/S of 1.21X is also lower than the industry average. But, BSX’s shares are trading at a premium (five-year P/S of 7.12X) compared with the industry average.

How to Play ABT Stock?

Abbott is demonstrating strong execution across key growth areas despite ongoing pricing pressures, increased costs, and regulatory headwinds, particularly in China. Its Diagnostics segment is expanding steadily, driven by robust global demand for routine and respiratory disease testing, alongside strategic investments and the upcoming launch of its Alinity system. Meanwhile, Diabetes Care continues to show strong momentum, with FreeStyle Libre leading globally and new OTC CGMs expanding access to over 6 million users. Backed by solid operational performance and a projected high single-digit organic sales growth (ex-COVID testing), Abbott remains on track to deliver consistent earnings and margin performance in 2025.

Abbott stock has excelled both the industry and its peers. Given its discounted valuation, the stock presents a solid investment option for investors.

Abbott carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

See our %%CTA_TEXT%% report – free today!

7 Best Stocks for the Next 30 DaysWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT): Free Stock Analysis Report

Boston Scientific Corporation (BSX): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English