DOCS Stock Up in Pre-Market Post Q1 Earnings Beat, Gross Margin Down

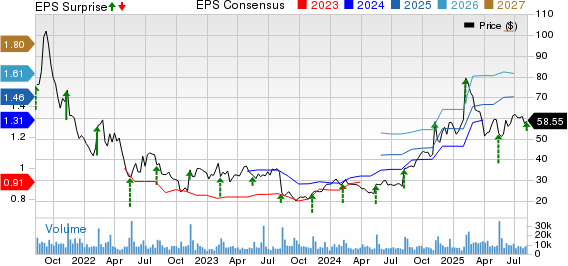

Doximity, Inc. DOCS delivered adjusted earnings per share (EPS) of 36 cents in the first quarter of fiscal 2026, which increased 28.6% year over year. The figure surpassed the Zacks Consensus Estimate by 16.1%.

GAAP EPS for the quarter was 27 cents, reflecting an uptick of 28.6% from the year-ago figure.

DOCS’ Revenues in Detail

Doximity registered revenues of $145.9 million in the fiscal first quarter, up 15.2% year over year. The figure surpassed the Zacks Consensus Estimate by 4.5%.

Shares of this company gained nearly 7.7% in today’s pre-market trading.

Doximity’s Segment Details

Doximity derives revenues from two sources: Subscription and Other.

In the first quarter of fiscal 2026, the Subscription revenues totaled $137.9 million, up 14.9% year over year. This was driven by the addition of new subscription customers and the expansion of existing customers. The expansion of existing customers was primarily driven by average revenue per existing Marketing Solutions customers increasing 14% as a result of adding new and growing existing brands and service lines.

The Other revenues totaled $8 million, up 19.8% year over year.

DOCS’ Margin Trend

In the quarter under review, Doximity’s gross profit rose 15% year over year to $130.1 million. However, the gross margin contracted 13 basis points (bps) to 89.2%.

Sales and marketing expenses increased 3.2% year over year to $36.4 million, while research and development expenses increased 18.7% year over year to $26.8 million. General and administrative expenses increased 34.4% year over year to $12.4 million. Total operating expenses of $75.6 million rose 12.7% year over year.

The operating profit totaled $54.5 million, reflecting an 18.4% uptick from the prior-year quarter. The operating margin in the fiscal first quarter expanded 101 bps to 37.4%.

Doximity’s Financial Position

Doximity exited first-quarter fiscal 2026 with cash and cash equivalents of $137.3 million compared with $209.6 million at fiscal 2025-end.

Net cash provided by operating activities at the end of first-quarter fiscal 2026 was $62.1 million compared with $41.2 million a year ago.

DOCS’ Guidance

Doximity has provided its financial outlook for the second quarter of fiscal 2026 and upped its outlook for the full fiscal year.

For the fiscal second quarter, the company expects revenues in the range of $157 million-$158 million. The Zacks Consensus Estimate is pegged at $150.4 million.

DOCS now projects its full fiscal year revenues between $628 million and $636 million, up from the prior outlook of $619 million and $631 million. The Zacks Consensus Estimate is pegged at $625.7 million.

Our Take on Doximity

Doximity exited the first quarter of fiscal 2026 with better-than-expected results and solid top and bottom-line results. Robust performances by both its revenue sources were encouraging. The operating margin expansion also bodes well.

On the earnings call, management shared a few updates about its performance during the quarter. Per them, the unique active users on a quarterly, monthly and daily basis all grew in double-digit percentages year over year, while a record number of unique active prescribers used Doximity’s workflow tools to provide better care for their patients. The company also recently launched Doximity AI scribe. These look promising for the stock.

However, the gross margin contraction during the quarter was disappointing.

DOCS’ Zacks Rank and Key Picks

Doximity currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are GE HealthCare Technologies Inc. GEHC, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

GE HealthCare, sporting a Zacks Rank #1 (Strong Buy), reported second-quarter 2025 adjusted EPS of $1.06, beating the Zacks Consensus Estimate by 16.5%. Revenues of $5.01 billion outpaced the consensus mark by 0.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

GE HealthCare has a long-term estimated growth rate of 5.8%. GEHC’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.5%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, beating the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank #1.

West Pharmaceutical has a long-term estimated growth rate of 8.4%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2 (Buy).

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

See our %%CTA_TEXT%% report – free today!

7 Best Stocks for the Next 30 DaysWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX): Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST): Free Stock Analysis Report

Doximity, Inc. (DOCS): Free Stock Analysis Report

GE HealthCare Technologies Inc. (GEHC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English