How Investors Are Reacting To Sabra Health Care REIT (SBRA) After Its Major Capital Raises and Upgraded Guidance

- Sabra Health Care REIT announced strong second quarter earnings, updated its annual guidance, and completed several significant capital market transactions, including a US$500 million term loan and a US$390.7 million equity offering, in the past week.

- These developments underscore Sabra’s continued focus on expanding its managed senior housing portfolio and strengthening its financial position with debt refinancing and fresh equity capital.

- We’ll examine how Sabra’s successful capital raise and debt refinancing impact its investment narrative and growth outlook in senior housing.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Sabra Health Care REIT Investment Narrative Recap

To own shares in Sabra Health Care REIT, you need to believe in the enduring and growing demand for senior housing, fueled by an aging population and limited new supply. Recent earnings results and capital raises reinforce Sabra's positioning for future growth in this market. While effective deployment of capital remains key to short-term performance, the main risk tied to operator transitions and portfolio shakeups has not been materially changed by the latest financing news.

Among Sabra’s recent announcements, the completed US$390.7 million follow-on equity offering stands out for its ability to provide fresh capital for acquisitions and financial flexibility. This offering directly supports Sabra’s growth catalyst of expanding into higher-yield senior housing properties, a move that could help offset execution risks as the company transitions assets to new operators.

However, even with these advantages, investors should be mindful of the potential impact if new senior housing operators underperform and...

Read the full narrative on Sabra Health Care REIT (it's free!)

Sabra Health Care REIT is forecast to reach $916.5 million in revenue and $209.0 million in earnings by 2028. This outlook assumes annual revenue growth of 7.7% and a $26.7 million increase in earnings from $182.3 million currently.

Uncover how Sabra Health Care REIT's forecasts yield a $20.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

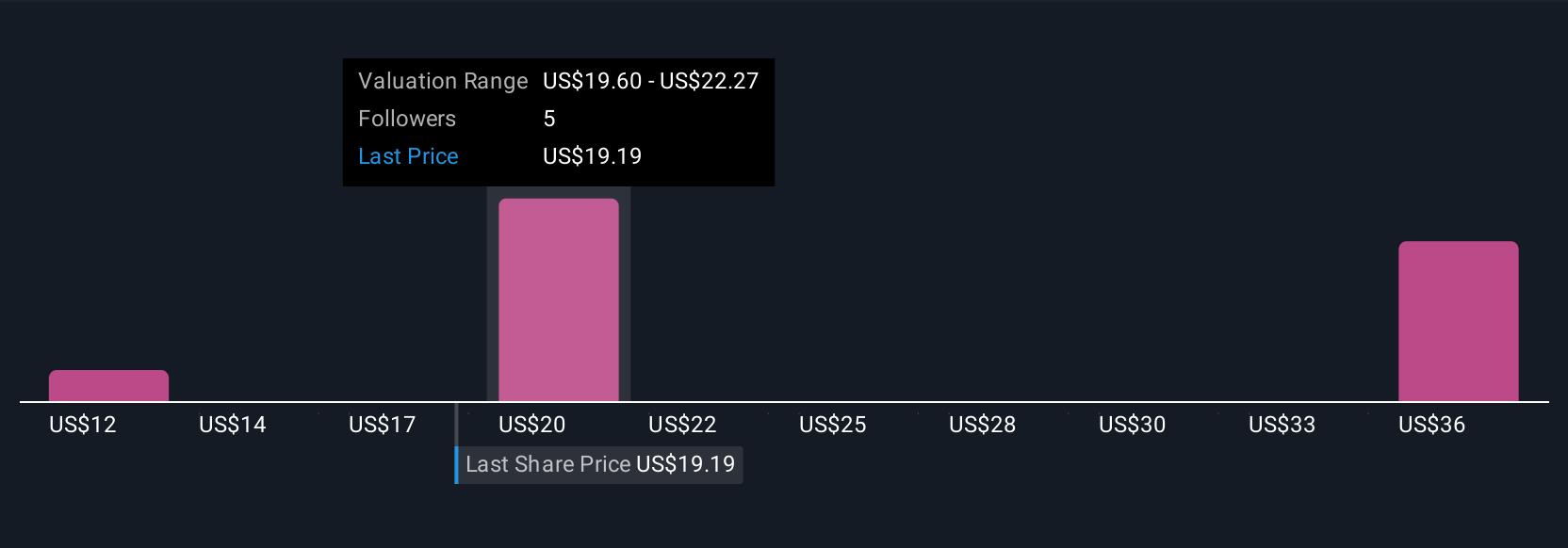

Simply Wall St Community members provided three fair value estimates for Sabra, ranging from US$11.59 to US$37.71 per share. This diversity of opinion reflects different views on Sabra's growth potential and underscores how crucial successful operator transitions could be for future returns.

Explore 3 other fair value estimates on Sabra Health Care REIT - why the stock might be worth 38% less than the current price!

Build Your Own Sabra Health Care REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sabra Health Care REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sabra Health Care REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sabra Health Care REIT's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English