Does Avista's (AVA) Dividend Payout Signal Steadfast Confidence in Long-Term Earnings?

- On August 6, 2025, Avista Corporation's board declared a quarterly dividend of US$0.49 per share payable September 15 and reported higher sales but lower net income for the second quarter, while confirming full-year 2025 earnings guidance between US$2.52 and US$2.72 per diluted share.

- Despite near-term profit pressure, Avista's decision to maintain both its earnings guidance and dividend signals confidence in its financial outlook and future earnings growth.

- We’ll explore what Avista’s reconfirmed long-term earnings growth and dividend declaration could mean for its investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Avista Investment Narrative Recap

Owning Avista shares often hinges on trusting the company's ability to generate steady, long-term earnings growth as a regulated utility, balanced by real risks tied to regional regulation, extreme weather, and infrastructure investment needs. The board's latest dividend declaration and unchanged 2025 earnings guidance suggest recent profit softness, seen in lower second-quarter net income, isn't viewed as materially altering the path of the business or its most important near-term catalyst: capital investment-driven earnings expansion. The short-term risk of regional regulatory setbacks or wildfire costs remains, but is not clearly impacted by these updates.

Among the recent company announcements, the confirmed full-year earnings guidance of US$2.52 to US$2.72 per diluted share stands out, directly reinforcing Avista’s message of financial reliability, even after quarterly profit volatility. This outlook is particularly relevant to those watching for signals of strength or weakness in Avista’s ability to sustain dividend payments and reinvest for future growth, which are central themes for regulated utilities facing mounting capex requirements.

By contrast, investors should be aware that increased capital spending, while a key driver for future growth, could also pressure free cash flow and heighten sensitivity to regulatory outcomes if cost recovery is limited...

Read the full narrative on Avista (it's free!)

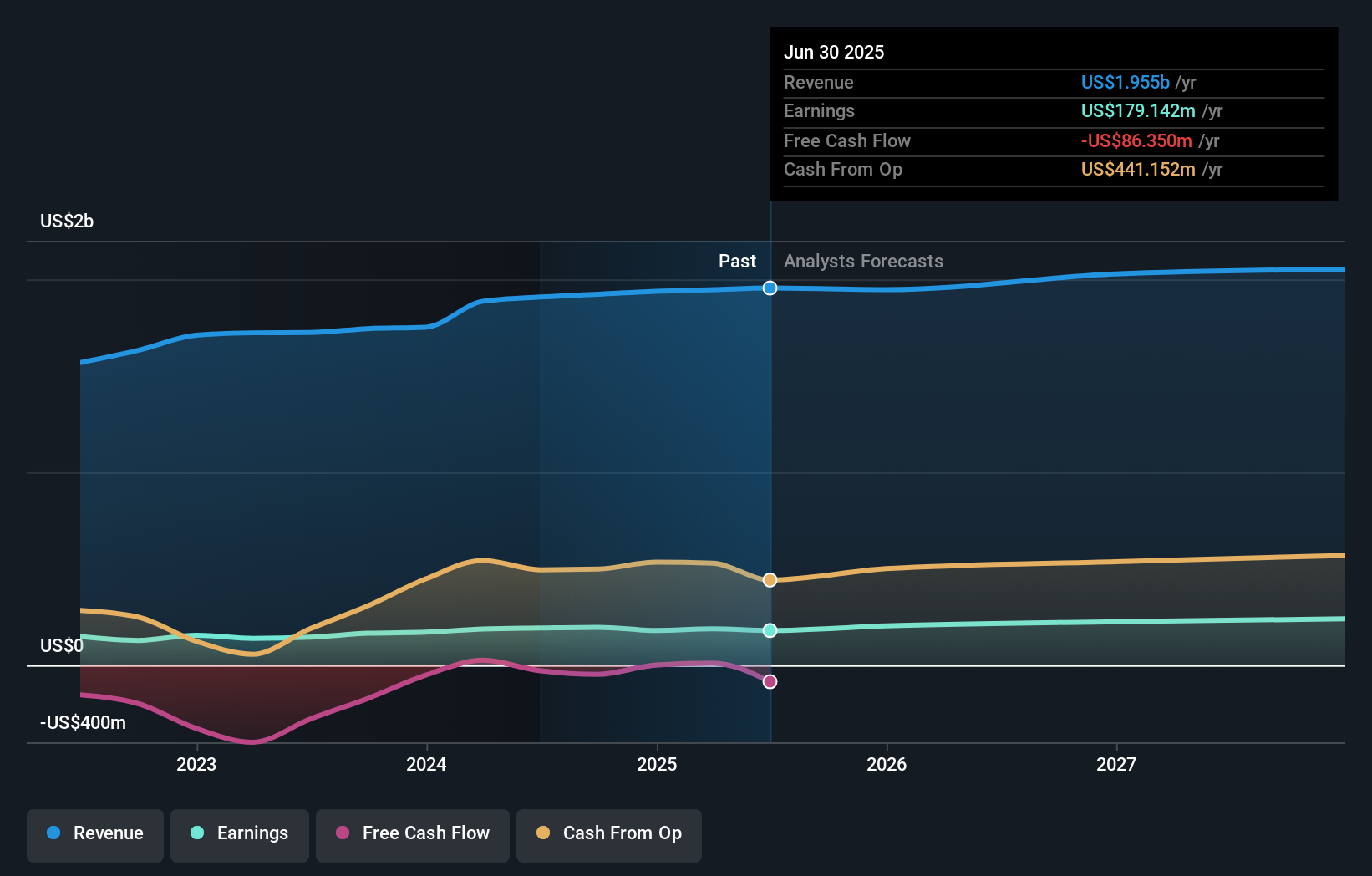

Avista's outlook anticipates $2.1 billion in revenue and $248.7 million in earnings by 2028. This is based on a projected annual revenue growth rate of 2.7% and an earnings increase of $69.6 million from the current $179.1 million.

Uncover how Avista's forecasts yield a $41.75 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Avista range widely from US$35.00 to US$41.75, based on three individual analyses. While outlooks differ, the potential for future earnings growth tied to regulated capital investment continues to shape wider sentiment around the company’s performance potential.

Explore 3 other fair value estimates on Avista - why the stock might be worth as much as 12% more than the current price!

Build Your Own Avista Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avista research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Avista research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avista's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English