Perella Weinberg Partners (PWP) Is Up 12.3% After Profit Return Share Buyback and Board Expansion

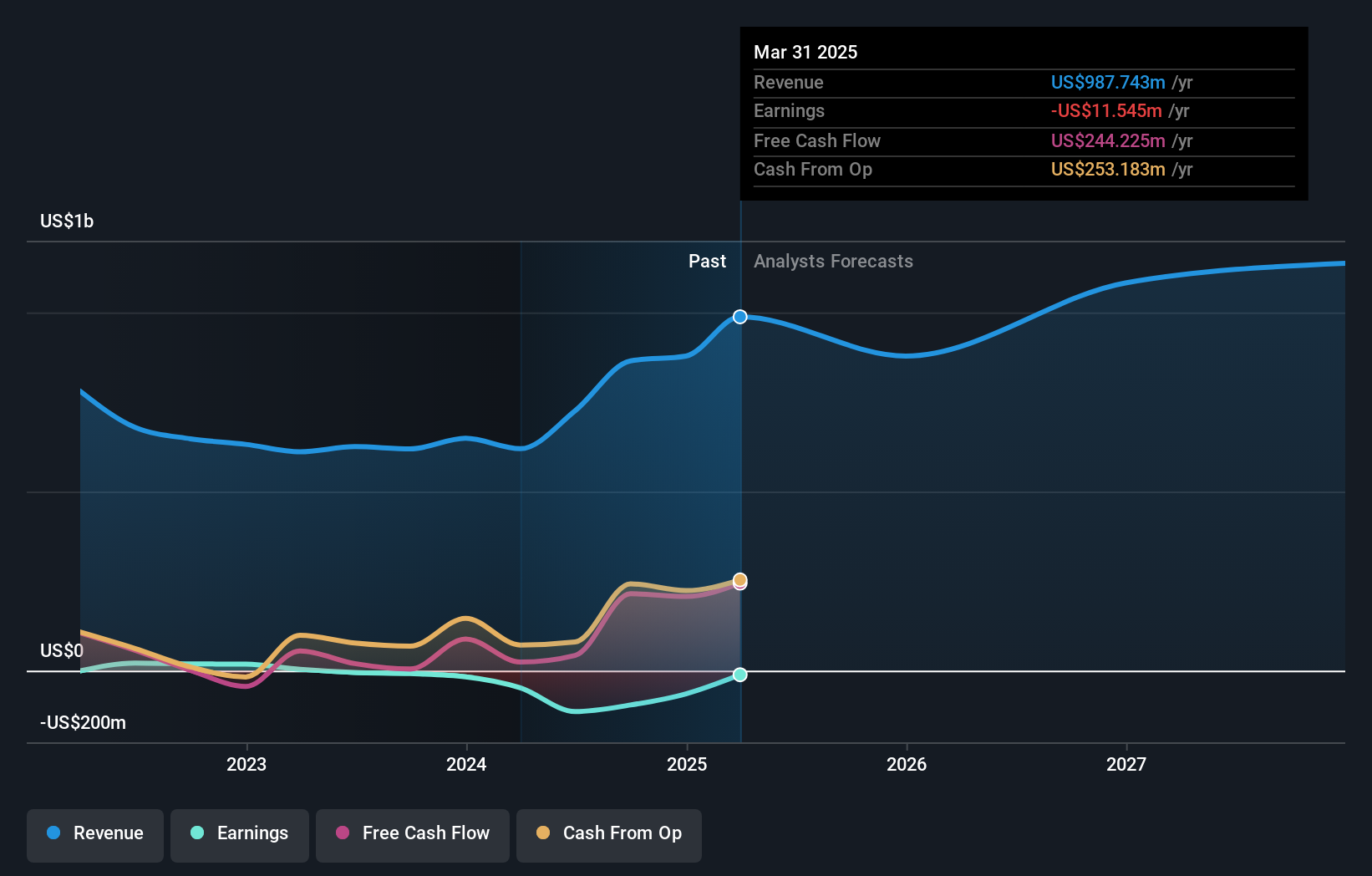

- Perella Weinberg Partners recently reported a return to profitability for the second quarter of 2025, alongside completing a sizable share repurchase, affirming its quarterly dividend, and expanding its board with two experienced independent directors.

- This series of corporate actions reflects management’s confidence and prioritizes shareholder value, highlighted by share buybacks representing over 30% of the company’s total shares since 2022.

- We’ll examine how the return to profitability, paired with a completed buyback and new board appointments, shapes Perella Weinberg’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Perella Weinberg Partners' Investment Narrative?

For investors considering Perella Weinberg Partners, the recent string of developments brings the core themes of capital efficiency, board strength, and profitability into sharper focus. Completing the significant buyback, over 31% of outstanding shares since 2022, combined with returning to profitability this quarter, underscores a clear alignment with shareholder value. These actions help support near-term catalysts like income stability and potential capital returns, while the addition of two seasoned independent directors could enhance oversight and strategy. However, risks around index exclusion, the implications of recent insider selling, and the execution of growth targets remain relevant, although the company’s measured share price reaction suggests the overall impact of these announcements is expected rather than transformational. For now, the investment case still revolves around earnings consistency, disciplined capital allocation, and the board’s ability to drive long-term value. Yet, with leadership changes and insider selling, governance remains a risk investors should not ignore.

The valuation report we've compiled suggests that Perella Weinberg Partners' current price could be inflated.Exploring Other Perspectives

Explore another fair value estimate on Perella Weinberg Partners - why the stock might be worth as much as 15% more than the current price!

Build Your Own Perella Weinberg Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perella Weinberg Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Perella Weinberg Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perella Weinberg Partners' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English