Is Apple Stock a Buy After Appeasing President Trump?

Aiming to shift manufacturing back to the United States, President Trump had previously made Apple AAPL his main target of companies that would face steep penalties if they continued to ramp up production outside of domestic soil.

This threat includes a 100% tariff on imported semiconductor chips, which would have dramatically increased the cost to produce Apple products, as most of the tech giant’s iPhones and components are manufactured in India and China.

That said, Apple has continued to make swift moves to appease the Trump administration, with a calculated blend of economic investment and political diplomacy.

This makes it a worthy topic of whether Apple stock can finally move past tariff concerns surrounding its global supply chain.

Apple’s Investment Pledge to Avoid Tariffs

On Wednesday, Apple CEO Tim Cook met with President Trump at the White House to announce that the company will be investing an additional $100 billion in U.S. manufacturing, bringing its total domestic commitment to $600 billion over the next four years.

Notably, the funding will support new data centers, smart glass production in Kentucky, and semiconductor partnerships in Utah and Texas. Apple has also opened a manufacturing academy in Detroit, administered by Michigan State University, to train U.S. workers in AI and smart manufacturing.

Magnifying Apple's appeasement and political diplomacy, Tim Cook presented a custom-made glass sculpture engraved with President Trump’s name and mounted on a 24-karat gold base. Most importantly to investors, the gesture was symbolic and strategic, as it coincided with Trump’s announcement that Apple would be exempt from the 100% tariff on foreign-made semiconductors.

AAPL is Gaining Momentum

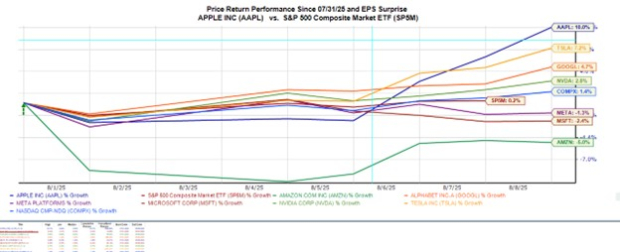

Attributed to the tariff exemptions, Apple stock has now spiked +10% in August, with these month-to-date gains leading its “Magnificent Seven” big tech peers.

However, AAPL is still toward the bottom of the group for the year, down 9% to only top Tesla’s TSLA -18%, with Nvidia NVDA up more than +30% and leading the pack.

Image Source: Zacks Investment Research

AAPL Valuation Comparison

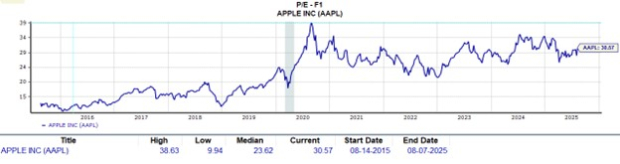

In terms of valuation, Apple currently checks in with the third cheapest P/E ratio among the Mag 7 at 30.5X forward earnings, only trailing Alphabet’s GOOGL 19.7X and Meta Platforms META 27.2X.

Image Source: Zacks Investment Research

Apple also has the third-lowest P/S ratio among these big tech peers at 8.1X forward sales, trailing Amazon’s AMZN 3.3X and Alphabet’s 6.4X.

Image Source: Zacks Investment Research

Still, AAPL does trade at premiums to its decade-long forward P/E and P/S medians of 23.6X and 5.4X, respectively.

Apple Intelligence Updates

One of the stock performance barriers holding Apple back relative to its Mag 7 peers outside of Tesla has also been the perception that the company isn’t capitalizing on artificial intelligence like the others. While Apple may not have the ability to streamline its operations with AI at the moment, its hybrid AI system, Apple Intelligence, does have more than 20 features across its platforms/operating systems.

These include visual intelligence features, writing tools, and continued upgrades to Apple’s personal voice assistant Siri, which includes integration with OpenAI’s ChatGPT. Coinciding with its investment in domestic chip manufacturing, Apple has worked with Broadcom AVGO to build a custom AI server chip called Baltra, designed to power and enhance its cloud-based services, including for Apple Intelligence and the revamped Siri.

Furthermore, Baltra will handle AI inference tasks in Apple’s data centers that are expected to include high-bandwidth memory (HBM) and tensor/matrix units optimized for generative AI workloads. Mass production for these operations is targeted for 2026, with full deployment by 2027, and will help Apple maintain control over its AI ecosystem while competing with Nvidia, Alphabet, and Microsoft in the AI infrastructure race.

Bottom Line

For now, Apple stock currently lands a Zacks Rank #3 (Hold). To the delight of long-term investors, Apple does appear to be moving past tariff concerns surrounding its global supply chain with strategic investments in the U.S. and a very beneficial collaboration with Broadcom.

Considering such, Apple should be on track to hit its expectations of single-digit top and bottom line growth in fiscal 2025 and FY26. Plus, earnings estimate revisions (EPS) have started to move higher in the last week, which could lead to a buy rating.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English