Copper and Gold Sales Surge Might Change The Case For Investing In Freeport-McMoRan (FCX)

- Freeport-McMoRan recently reported its second-quarter 2025 results, showing around 9% year-over-year growth in copper sales volumes and approximately 45% growth in gold sales volumes.

- While the company delivered strong volume increases, its forward guidance signaled expectations for flat to modestly lower copper sales in the upcoming quarter, prompting careful analysis of sustainability in future performance.

- We'll explore how Freeport-McMoRan's robust sales growth paired with a cautious copper outlook shapes the broader investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Freeport-McMoRan Investment Narrative Recap

Shareholders in Freeport-McMoRan typically need confidence in copper’s long-term demand and pricing to justify holding the stock, as higher volumes and prices are central to margin expansion. The company’s strong Q2 2025 growth in copper and gold sales supports this narrative, but with management now expecting flat or slightly lower copper sales next quarter, the most important short-term catalyst, sustained high copper volumes, could lose momentum, which may also increase exposure to pricing risk. This latest news hasn’t materially changed the biggest risk, which remains the potential for shifts in Indonesian regulatory or mining policy that could threaten future production at key assets. Among recent developments, the announcement of a new cash dividend totaling US$0.15 per share, split between a base and variable component, stands out. This payout policy underscores Freeport-McMoRan’s commitment to shareholder returns and its flexibility to reward investors despite periods of uneven sales volume, directly supporting the investment case as the company manages its exposure to commodity cycles. Yet, even with robust sales this quarter, investors should pay careful attention to the persistent uncertainty over Indonesian government policy and future mining licenses at Grasberg, since…

Read the full narrative on Freeport-McMoRan (it's free!)

Freeport-McMoRan's outlook anticipates $31.1 billion in revenue and $3.3 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 6.4% and a $1.4 billion increase in earnings from the current $1.9 billion level.

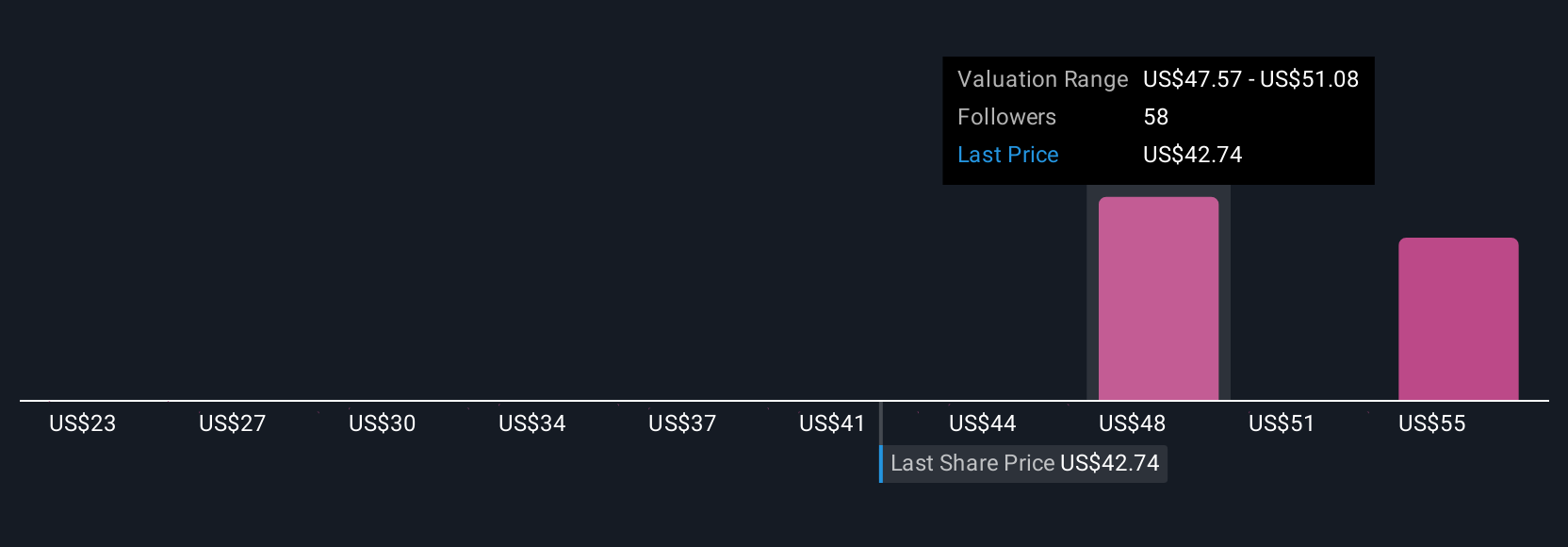

Uncover how Freeport-McMoRan's forecasts yield a $50.74 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 11 Simply Wall St Community members for Freeport-McMoRan range widely from US$23.02 to US$58.21 per share. Consider how this diversity of views stacks up against persistent risks tied to long-term mining rights in Indonesia and what that could mean for company performance.

Explore 11 other fair value estimates on Freeport-McMoRan - why the stock might be worth as much as 39% more than the current price!

Build Your Own Freeport-McMoRan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freeport-McMoRan research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Freeport-McMoRan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freeport-McMoRan's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English