Did the Gentuity Partnership Just Shift GE HealthCare’s (GEHC) Trajectory in Cardiology Innovation?

- Gentuity LLC recently announced a collaboration agreement with GE HealthCare Technologies to enhance access and integration of advanced interventional cardiology imaging solutions, including machine learning-powered OCT systems and high-resolution catheters, for the U.S. market.

- This partnership closely follows GE HealthCare's release of stronger-than-prior-year second quarter earnings and an upward revision in its full-year revenue guidance, signaling operational momentum and active investment in product innovation.

- We'll assess how the expanded partnership with Gentuity and new product avenues could influence the outlook for GE HealthCare Technologies.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

GE HealthCare Technologies Investment Narrative Recap

To be a GE HealthCare Technologies shareholder, you would likely need to believe that the company's ability to form new partnerships and accelerate innovation in imaging and AI-driven healthcare solutions will outweigh the current competitive and supply chain pressures. While the Gentuity collaboration highlights a push for product expansion in interventional cardiology, the most important near-term catalyst remains execution on its product pipeline, and the most significant risk continues to be the impact of tariffs and supply chain volatility. The impact of this news on either is likely incremental, rather than material.

Among the company's recent announcements, the raised full-year organic revenue growth guidance stands out as most relevant. This uptick in expectations follows strong second-quarter results and shows that management remains confident in both operational momentum and demand for new products like those from the Gentuity alliance, underpinning the short-term catalyst of pipeline execution.

Yet, in contrast to these positives, investors should pay close attention to the ongoing risks stemming from potential tariff impacts and...

Read the full narrative on GE HealthCare Technologies (it's free!)

GE HealthCare Technologies is projected to reach $22.7 billion in revenue and $2.5 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.3% and an earnings increase of $0.3 billion from the current $2.2 billion.

Uncover how GE HealthCare Technologies' forecasts yield a $88.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

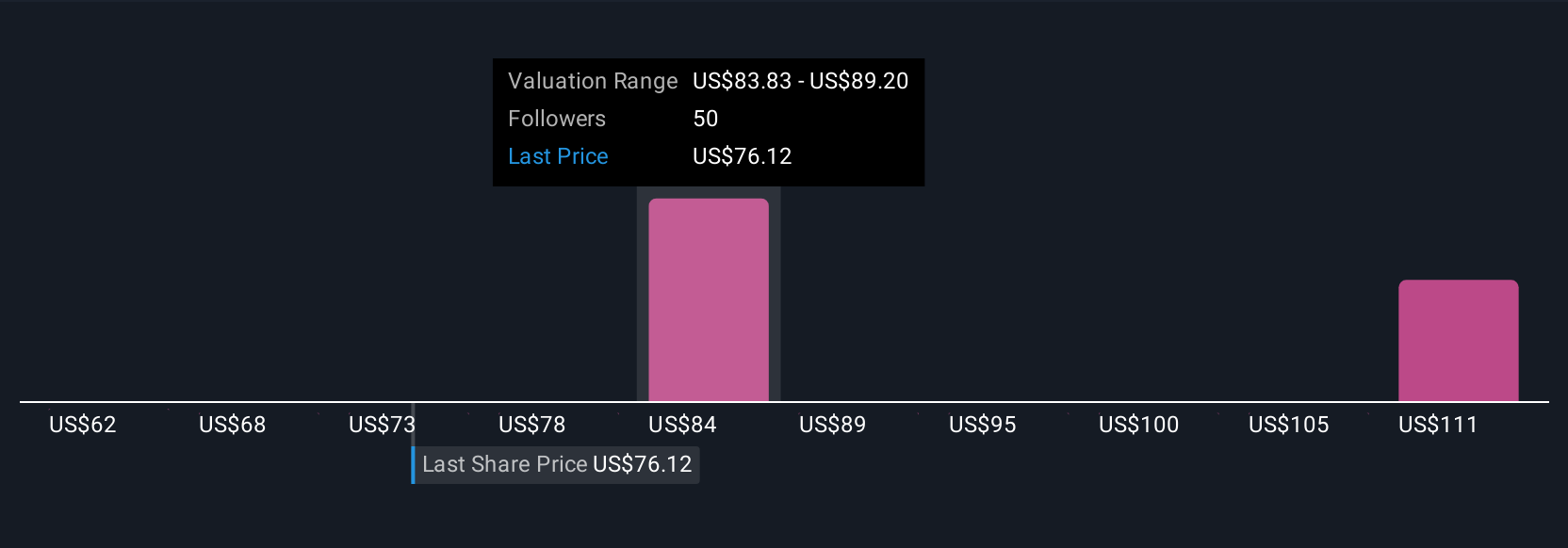

The Simply Wall St Community shared 3 fair value estimates for GE HealthCare Technologies ranging from US$62.35 to US$119.86. Many see new product launches and collaborations as pivotal for future revenue, but global trade policies could introduce substantial margin risks.

Explore 3 other fair value estimates on GE HealthCare Technologies - why the stock might be worth 13% less than the current price!

Build Your Own GE HealthCare Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE HealthCare Technologies research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GE HealthCare Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE HealthCare Technologies' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English