Will HASI's Rising Net Income Amid Lower Revenue Shift the Narrative for HA Sustainable Infrastructure Capital?

- HA Sustainable Infrastructure Capital, Inc. recently reported second quarter results for 2025, showing net income of US$98.45 million despite revenues declining to US$85.69 million.

- Meanwhile, the company's Board of Directors approved a regular quarterly cash dividend of US$0.42 per share, underscoring their commitment to shareholder returns even as revenue trends change.

- We'll now examine how the rise in net income, despite lower revenue, adds a new dimension to the company’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is HA Sustainable Infrastructure Capital's Investment Narrative?

For anyone considering HA Sustainable Infrastructure Capital, it's clear the investment case centers on embracing the company's blend of sustainability focus, long-term growth ambition, and attractive dividends, even when near-term financials can be unpredictable. The latest results reveal a sharp gain in net income despite declining revenue, which raises questions about one-off items or cost management shifts but doesn't appear to change the more fundamental catalysts: robust projected revenue growth and management's ongoing shareholder returns policy. The Board's approval of a steady dividend provides reassuring continuity, and a market price jump following earnings suggests investors may be weighing stronger profitability over weaker top-line trends. However, persistent issues like the dividend’s low coverage by cash flows, high debt obligations, and relative underperformance vs peers remain the key risks. The recent earnings surprise could cool concerns temporarily, but it doesn't erase these underlying challenges.

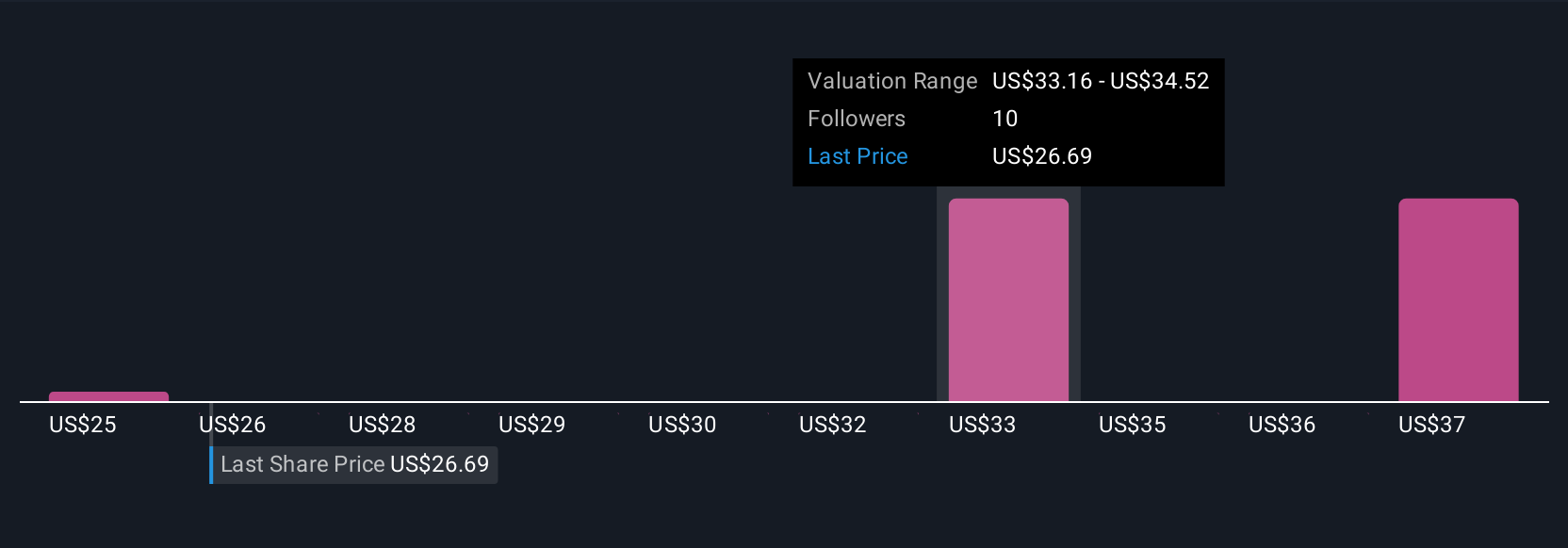

Yet, dividend coverage concerns continue to be important for those holding for income. HA Sustainable Infrastructure Capital's shares have been on the rise but are still potentially undervalued by 15%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on HA Sustainable Infrastructure Capital - why the stock might be worth as much as 50% more than the current price!

Build Your Own HA Sustainable Infrastructure Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HA Sustainable Infrastructure Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HA Sustainable Infrastructure Capital's overall financial health at a glance.

No Opportunity In HA Sustainable Infrastructure Capital?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English