Does Zions Bancorporation’s (ZION) Dividend Hike Reflect Enduring Strength in Its Capital Allocation Strategy?

- On August 1, 2025, Zions Bancorporation, N.A. announced a 5% increase in its regular quarterly dividend to US$0.45 per common share, with payment scheduled for August 21, 2025 to shareholders of record as of August 14, 2025.

- This dividend increase suggests the board's confidence in the bank’s financial position and may signal ongoing support for shareholder returns amid sector uncertainties.

- We'll examine how the higher dividend payment reflects Zions Bancorporation's commitment to rewarding shareholders and impacts its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Zions Bancorporation National Association Investment Narrative Recap

To be a shareholder in Zions Bancorporation, you need to believe that the bank’s disciplined risk management and targeted growth in the Western United States can outpace ongoing regional and regulatory headwinds. The 5% increase in the quarterly dividend supports confidence in Zions' financial strength, but it does not fundamentally shift the primary catalyst, digital transformation, or lessen heightened risks tied to commercial real estate and net interest margin pressure.

The announcement of a higher quarterly dividend payment on common shares stands out against recent volatility in sector profitability and margin trends. While steady dividend growth appeals to income-focused investors, Zions’ recent charge-offs and the continued concentration in commercial real estate mean that dividend sustainability still relies on stable credit quality and solid asset performance in the months ahead.

However, investors should be aware that if regional economic conditions deteriorate, Zions faces concentrated exposure that...

Read the full narrative on Zions Bancorporation National Association (it's free!)

Zions Bancorporation National Association's projections indicate $3.5 billion in revenue and $818.0 million in earnings by 2028. This scenario assumes 3.7% annual revenue growth and a $10 million increase in earnings from $808.0 million currently.

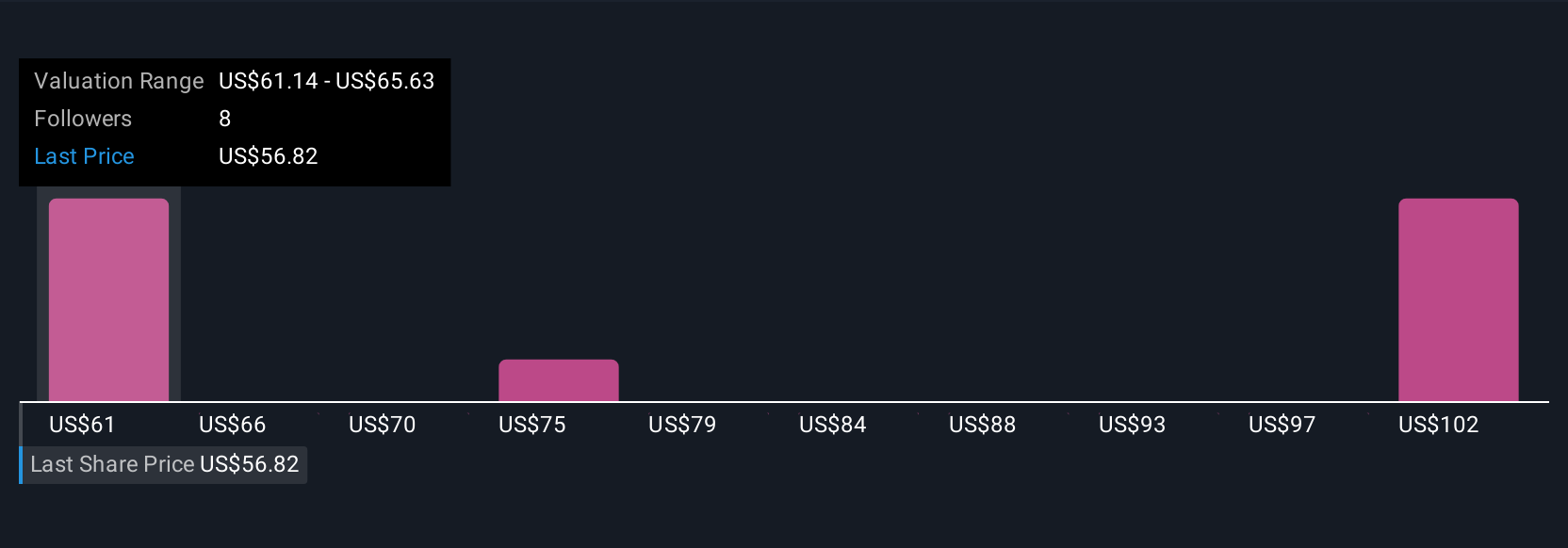

Uncover how Zions Bancorporation National Association's forecasts yield a $61.14 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted 3 fair value estimates for Zions Bancorporation, ranging from US$61.14 to US$107.11. Despite strong earnings growth last year, the risk of regional credit losses remains a concern for future business stability, compare your forecast with others to see where your view fits in.

Explore 3 other fair value estimates on Zions Bancorporation National Association - why the stock might be worth just $61.14!

Build Your Own Zions Bancorporation National Association Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zions Bancorporation National Association research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zions Bancorporation National Association research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zions Bancorporation National Association's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English