Does Autohome's (ATHM) Recent Buyback Reflect Management Confidence or Growth Challenges Ahead?

- Autohome Inc. recently announced its second quarter 2025 earnings, reporting revenue of CNY 1,758.12 million and net income of CNY 398.87 million, both lower than the prior year, while also completing a buyback of 4.44% of shares for US$142.4 million.

- Options market activity around Autohome has shown high implied volatility, indicating investors are uncertain about the company’s future performance amid declining earnings and revenue.

- We’ll explore how the year-over-year drop in net income affects Autohome’s outlook in light of its previous growth narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Autohome Investment Narrative Recap

Shareholders in Autohome need to believe in the ongoing shift toward digital auto retail and the company's ability to harness new technology, such as AI tools and platform integration, to drive user engagement and capture digital ad spending. However, the latest earnings update, with declines in revenue and net income, keeps pressure on near-term results; it does not materially change the biggest catalyst, which remains the adoption and monetization of digital auto services, while the primary risk is still margin compression from industry-wide pricing pressure and cost increases.

Among Autohome’s recent announcements, the completion of its US$142.4 million share buyback, repurchasing 4.44% of shares, stands out. While buybacks can stabilize short-term share performance and reflect some management confidence, their impact is limited if underlying profit and revenue trends do not improve, especially as earnings remain under pressure.

But with margins falling more sharply this quarter than before, investors should be aware of what that means for...

Read the full narrative on Autohome (it's free!)

Autohome is projected to reach CN¥7.6 billion in revenue and CN¥1.8 billion in earnings by 2028. This requires annual revenue growth of 3.8% and an increase in earnings of CN¥0.3 billion from the current level of CN¥1.5 billion.

Uncover how Autohome's forecasts yield a $28.87 fair value, in line with its current price.

Exploring Other Perspectives

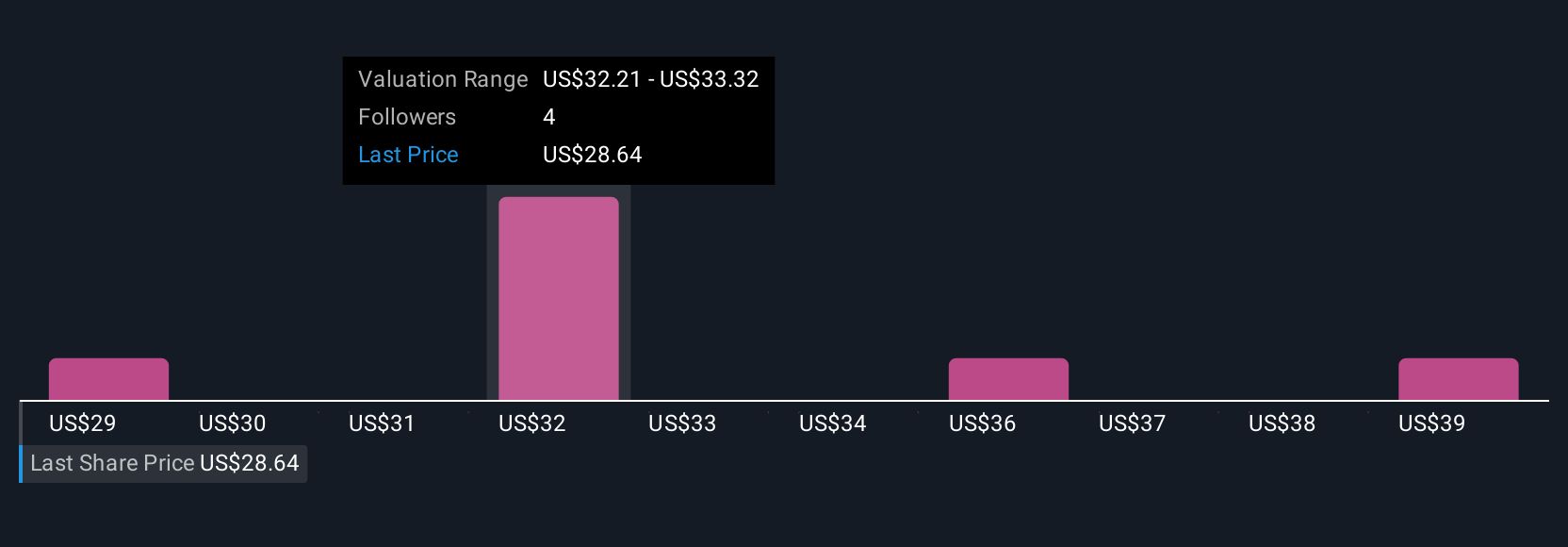

Four Simply Wall St Community members estimate Autohome’s fair value between CNY 28.87 and CNY 40, reflecting wide differences in market outlook. While forecasted digital growth remains a key catalyst, recent earnings declines invite readers to weigh these perspectives and consider the full picture.

Explore 4 other fair value estimates on Autohome - why the stock might be worth just $28.87!

Build Your Own Autohome Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autohome research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Autohome research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autohome's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English