HEICO (HEI) Mourns Loss Of Longtime Director Frank J. Schwitter

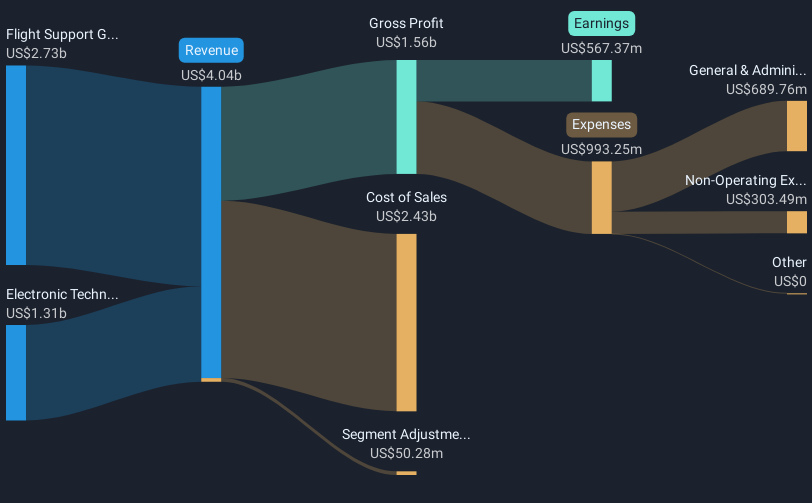

HEICO (HEI) recently announced the passing of long-standing board member Frank J. Schwitter, a significant event in the company's executive team. Within the last quarter, HEICO's stock delivered an 18.64% gain, potentially influenced by strong earnings reports with sales and net income enjoying considerable year-over-year growth. The announcement of a dividend increase and the removal from the Russell 1000 Dynamic Index were crucial corporate developments, possibly affecting investor sentiment. The broader market environment was favorable, with major indexes reaching new highs, adding supportive weight to HEICO's stock movement in alignment with the general upward trend.

You should learn about the 2 risks we've spotted with HEICO.

The passing of board member Frank J. Schwitter, along with HEICO's exclusion from the Russell 1000 Dynamic Index, might slightly alter investor perceptions, though the company's strong quarterly gains suggest resilience. Over five years, HEICO shares achieved a total return of 195.74%, reflecting robust long-term performance. This growth, coupled with the recent dividend increase and favorable market conditions, underscores the company's enduring appeal against industry trends despite underperforming in the past year relative to the Aerospace & Defense sector with its 35.4% performance.

Looking forward, these developments could influence HEICO’s revenue and earnings forecasts, especially given the potential impact on investor confidence and strategic direction. For instance, disruptions like these might influence management decisions or strategic shifts, causing some adjustments in forecast assumptions. The current share price of US$313.39 is closely aligned with the analyst consensus price target of US$322.65, indicating that the market views HEICO's current valuation as relatively fair, with a modest 2.9% room upwards based on analyst projections. This alignment suggests that despite recent changes, analysts expect stability in HEICO's valuation trajectory.

Learn about HEICO's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English