Should Triumph Group's (TGI) Voluntary Delisting and Index Removal Require Action From Investors?

- Triumph Group, Inc. recently announced that it has filed a Form 15 with the U.S. Securities and Exchange Commission to voluntarily deregister its common stock, which has triggered its removal from numerous major Russell indices.

- This voluntary deregistration can have broad implications for institutional ownership, as index removals often require certain funds to sell their holdings in the company.

- With Triumph Group's decision to deregister prompting a wave of index removals, we'll assess how this development shapes its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Triumph Group's Investment Narrative?

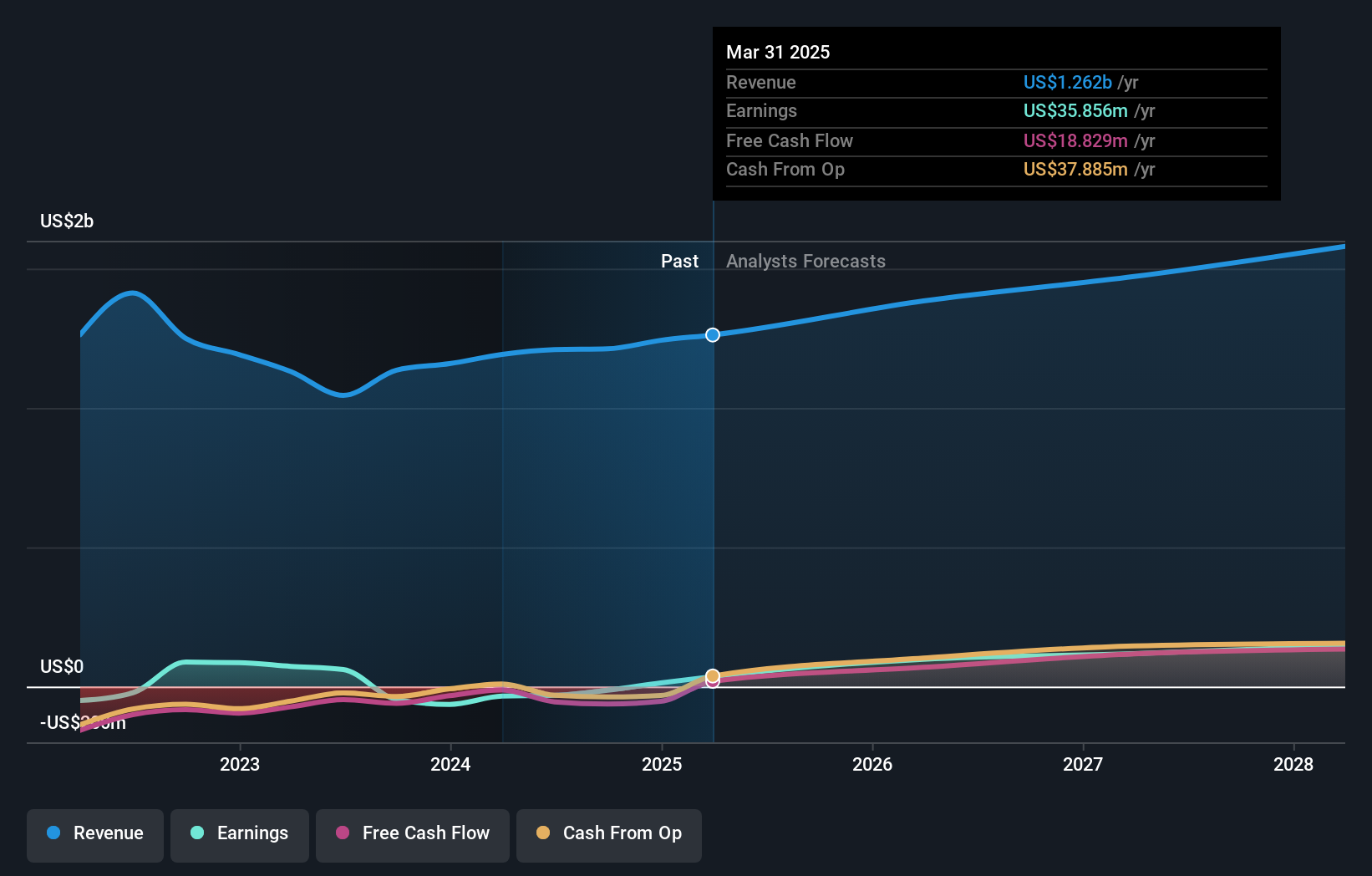

For anyone considering Triumph Group as a long-term investment, the core belief hinges on the company’s ability to continue expanding its aerospace partnerships and delivering consistent earnings growth, even as it faces sector-specific challenges. The recent announcement to voluntarily deregister and exit public trading, following its acquisition by Warburg Pincus and Berkshire Partners, marks a pivotal shift for Triumph Group’s narrative. While past catalysts such as new leadership, major aerospace contracts, and impressive profit growth have fueled optimism, the immediate removal from all Russell indices and loss of public listing status now recalibrate both risks and potential rewards. Institutional exits, reduced liquidity, and limited transparency may shape the near-term outlook far more than previously anticipated. Moving forward, company performance will likely depend more on private market dynamics and less on public investor sentiment or traditional analyst coverage. However, the company’s transition to the private market could mean much less transparency for shareholders.

Triumph Group's shares have been on the rise but are still potentially undervalued by 28%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Triumph Group - why the stock might be worth just $26.00!

Build Your Own Triumph Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Triumph Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Triumph Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Triumph Group's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English