Is United Rentals’ (URI) Dividend Growth Strategy Reflecting Resilience or Hinting at Slower Expansion?

- United Rentals, Inc. (NYSE:URI) recently traded ex-dividend, with shareholders set to receive a US$1.79 per share dividend on August 27th, 2025, backed by a strong coverage from both earnings and free cash flow.

- The company’s consistent earnings and dividend growth signals underlying strength, even as organic revenue growth has become more moderate in recent years.

- Now, we’ll explore how United Rentals’ sustainable dividend approach impacts its investment narrative as analyst expectations evolve.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

United Rentals Investment Narrative Recap

Shareholders in United Rentals need to believe in the company's ability to deliver steady returns through operational discipline and balanced growth, even as organic revenue has slowed and margin pressures persist. The recent ex-dividend date and strong dividend coverage are positive signs, but this development does not materially impact the biggest near-term catalyst, expansion in specialty rentals, or the key risk of slower large project activity, which could weigh on future revenue growth if not offset elsewhere.

Among the company's recent announcements, the revised full year 2025 revenue guidance stands out, reflecting confidence in overall demand despite more modest organic growth. This new outlook supports the view that disciplined capital allocation and consistent shareholder returns are central to United Rentals’ story, as analysts continue to watch for shifts in project mix and cost efficiency.

By contrast, investors should be aware that if the flow of large construction projects slows unexpectedly...

Read the full narrative on United Rentals (it's free!)

United Rentals' outlook anticipates $18.9 billion in revenue and $3.5 billion in earnings by 2028. This projection is based on a 6.2% annual revenue growth rate and a $1.0 billion increase in earnings from the current $2.5 billion.

Uncover how United Rentals' forecasts yield a $895.28 fair value, a 4% upside to its current price.

Exploring Other Perspectives

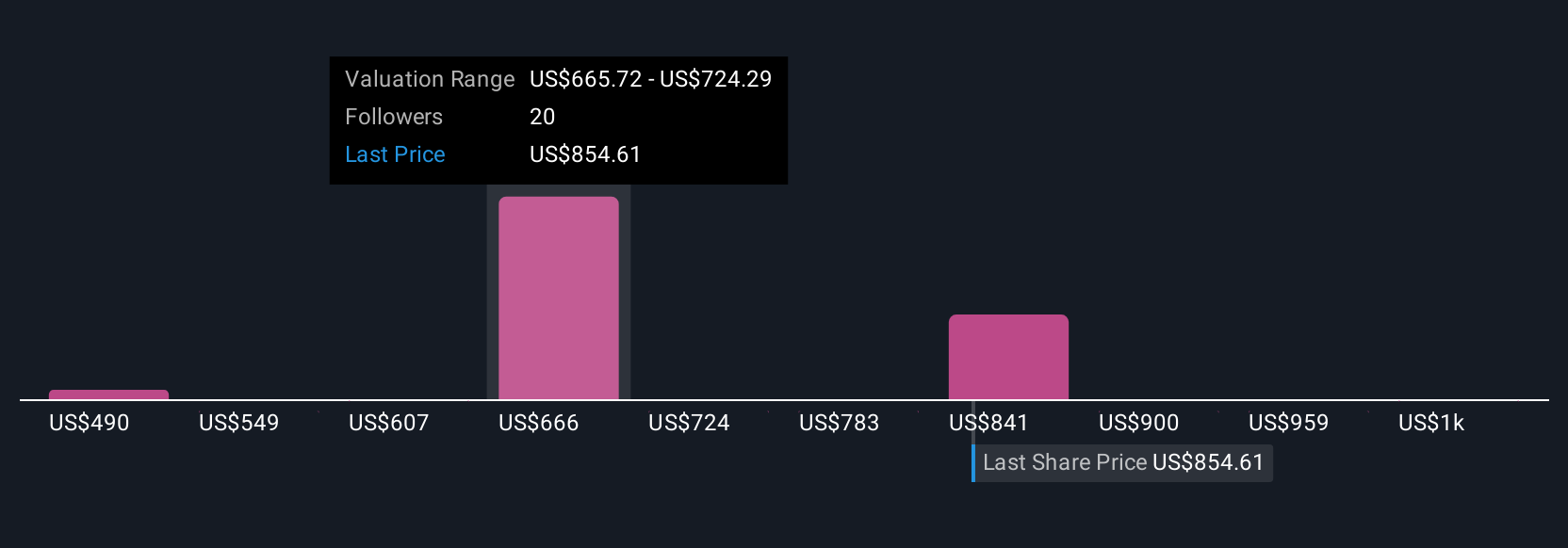

Simply Wall St Community members have posted seven fair value estimates for United Rentals, ranging from US$490 to US$1,075.72 per share. While opinions span a broad spectrum, some see risks in the company’s reliance on large projects to drive revenue, which could affect performance if trends shift, explore a range of alternative views here.

Explore 7 other fair value estimates on United Rentals - why the stock might be worth as much as 25% more than the current price!

Build Your Own United Rentals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Rentals research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free United Rentals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Rentals' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English