Did ESPN’s Exclusive WWE Deal and Guidance Raise Just Shift TKO Group Holdings' (TKO) Investment Narrative?

- TKO Group Holdings reported strong second quarter 2025 results, raising full-year revenue guidance after increasing sales and net income, while announcing a major multi-year rights deal that makes ESPN the exclusive U.S. home of WWE Premium Live Events from 2026.

- The collaboration between ESPN and WWE marks the first time all of ESPN’s digital and linear platforms will deliver WWE’s highest-profile events through direct-to-consumer streaming and enhanced app integration.

- Given the expanded ESPN partnership, we’ll explore how strengthened content distribution may influence TKO’s investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is TKO Group Holdings' Investment Narrative?

Owning TKO Group Holdings stock requires conviction in the company’s ability to expand its premium sports and entertainment content to broader audiences, leveraging new distribution channels and partnerships. The recent multi-year rights deal with ESPN, making it the exclusive U.S. home for WWE Premium Live Events from 2026, could reshape TKO’s short-term catalysts by enhancing reach, providing cross-platform integration, and offering greater visibility to its flagship events. This development comes alongside raised full-year revenue guidance and a strong second quarter, suggesting momentum may be accelerating from content monetization and renewed consumer demand. On the risk side, questions remain about the sustainability of outsized earnings growth after large one-off gains and ongoing legal challenges, such as the MMA antitrust lawsuit. Additionally, recent rapid changes in board composition and concerns about valuation levels add uncertainty to the outlook. For investors, the ESPN deal is a meaningful shift; how quickly TKO can capitalize on it and deliver consistent profit growth will likely become key questions from here. However, unresolved legal matters could affect future financial stability and investor confidence.

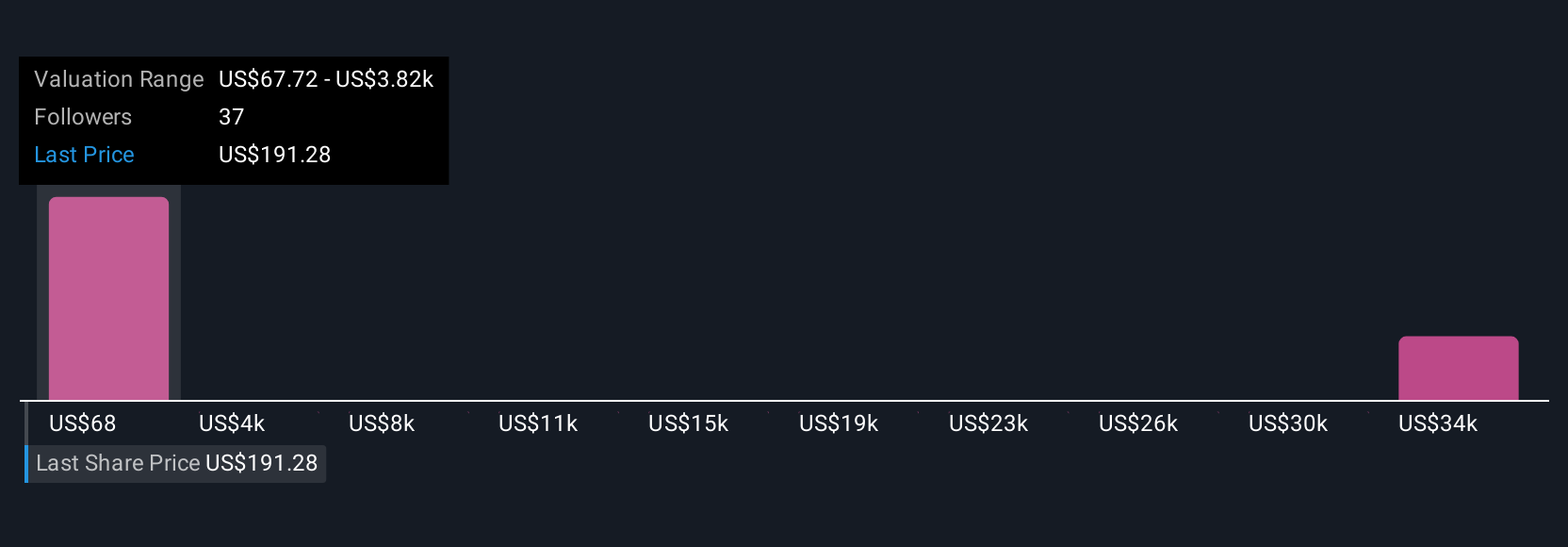

TKO Group Holdings' share price has been on the slide but might be up to 11% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 9 other fair value estimates on TKO Group Holdings - why the stock might be a potential multi-bagger!

Build Your Own TKO Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TKO Group Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TKO Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TKO Group Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English