What Cathay General Bancorp (CATY)'s Q2 Profit Jump and Risk Focus Means For Shareholders

- Cathay General Bancorp recently released its second quarter 2025 Form 10-Q, reporting higher net interest income and net income of US$77.5 million, mainly due to increased net interest metrics and reduced expenses.

- The company emphasized proactive credit risk management and the importance of monitoring economic conditions affecting its loan portfolio as a forward-looking priority.

- We'll look at how these stronger interest metrics and credit risk focus may shift Cathay General Bancorp's investment narrative going forward.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

Cathay General Bancorp Investment Narrative Recap

Being a shareholder in Cathay General Bancorp means believing in its core franchise, serving business and retail banking needs in key Asian-American markets, managing credit quality, and focusing on loan growth. The latest earnings update, showing higher net interest income and net income, reinforces the importance of disciplined credit risk management as a short-term driver, but ongoing increases in net charge-offs and classified loans remain the most important risk; the news does not materially shift this balance. Among recent announcements, the company’s July completion of a significant share repurchase program, totaling US$35.6 million in Q2, is a relevant marker of its commitment to returning value to shareholders, especially as improved interest margin supports these capital actions. Yet, as catalysts like disciplined capital allocation create value, rising net charge-offs highlight that risk management will be just as crucial to watch in the quarters ahead. But despite appealing metrics, here’s what investors should keep in mind about the company’s loan portfolio exposure and...

Read the full narrative on Cathay General Bancorp (it's free!)

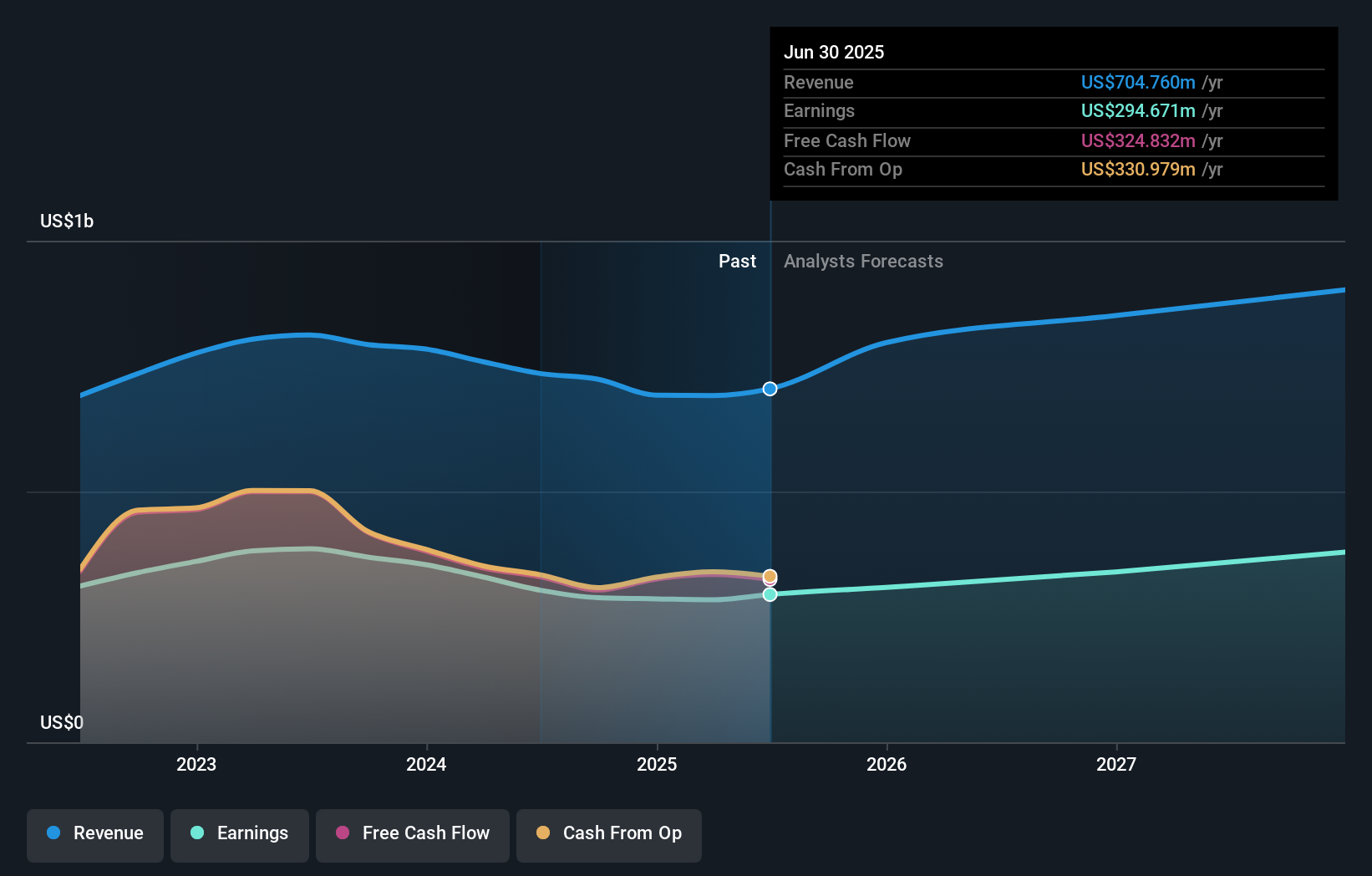

Cathay General Bancorp is projected to reach $964.1 million in revenue and $393.8 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 11.0% and an earnings increase of about $99 million from the current earnings of $294.7 million.

Uncover how Cathay General Bancorp's forecasts yield a $50.60 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided one fair value estimate for Cathay General Bancorp at US$50.60 per share, prior to recent results. While community views are limited in diversity, ongoing increases in net charge-offs remind you to weigh those confidence signals against evolving credit quality trends.

Explore another fair value estimate on Cathay General Bancorp - why the stock might be worth as much as 11% more than the current price!

Build Your Own Cathay General Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cathay General Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cathay General Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cathay General Bancorp's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English