Why Inter & Co (INTR) Is Gaining After Earnings Beat and Strong Net Interest Income Growth

- Earlier this week, Inter & Co reported its second-quarter and first-half 2025 earnings, highlighting net interest income of R$1.47 billion and net income of R$315.13 million for the quarter, reflecting significant year-over-year increases.

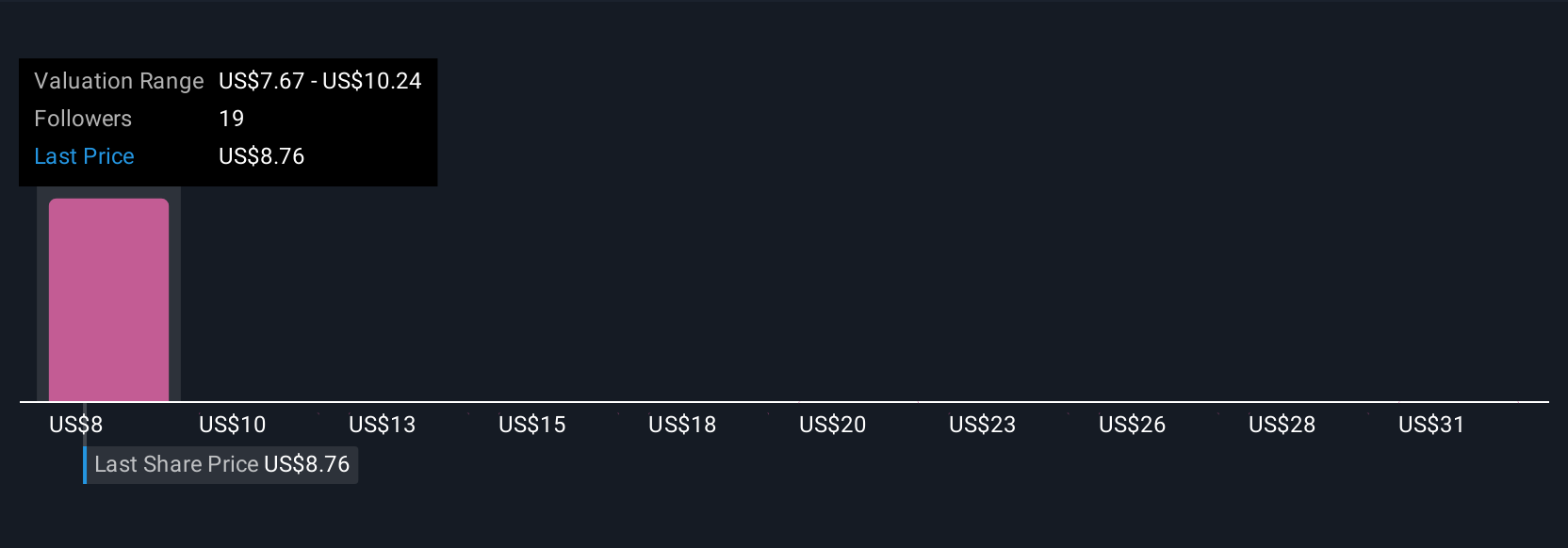

- Analyst discussions have noted that the company is trading slightly below its estimated fair value despite this strong operational and financial performance through the first half of the year.

- We'll now explore how Inter & Co's robust net interest income growth impacts its future investment narrative and earnings outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Inter & Co Investment Narrative Recap

To be a shareholder in Inter & Co today, you need confidence in the company’s ability to convert rapid client and digital payment growth into sustained profit expansion, despite intensifying competition and evolving credit risks. The latest earnings release confirms robust net interest and net income growth, but this positive momentum does not fundamentally change the key short-term catalyst, the pace of active customer engagement and cross-sell of high-margin financial products, or the persistent risk of elevated bad loans from fast loan book expansion in higher-risk segments.

The most relevant recent announcement is the Q2 2025 results, which showed net interest income rising to R$1.47 billion and net income reaching R$315.13 million, both up significantly year-on-year. While this underscores management’s execution on profitability and engagement at scale, it remains important for investors to watch the bad loan ratio and NPL trends, as asset quality pressures could affect the durability of earnings growth and the outlook for portfolio expansion.

By contrast, investors should be aware that a high proportion of riskier loans leaves Inter & Co especially sensitive to ...

Read the full narrative on Inter & Co (it's free!)

Inter & Co's narrative projects R$13.6 billion revenue and R$2.9 billion earnings by 2028. This requires 36.8% yearly revenue growth and an increase of R$1.8 billion in earnings from the current R$1.1 billion.

Uncover how Inter & Co's forecasts yield a $7.34 fair value, a 6% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community values Inter & Co between R$7.34 and R$33.30, with five unique forecasts. Many expect ongoing digital banking adoption to drive revenue, but competitive and credit risks remain key watchpoints for future returns. Explore their perspectives for a richer context.

Explore 5 other fair value estimates on Inter & Co - why the stock might be worth 6% less than the current price!

Build Your Own Inter & Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inter & Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inter & Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inter & Co's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English