How Investors Are Reacting To HASI Missing Estimates Despite Higher Net Income in Q2 Results

- HA Sustainable Infrastructure Capital, Inc. recently reported its second quarter 2025 financial results, with revenue of US$85.69 million and net income of US$98.45 million, both measured against figures from the previous year.

- Despite higher net income, the company faced a revenue decline and missed analyst expectations for both revenue and earnings per share, highlighting a disconnect that has drawn investor attention.

- We'll examine how the revenue shortfall, despite increased net income, frames HA Sustainable Infrastructure Capital's investment narrative moving forward.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is HA Sustainable Infrastructure Capital's Investment Narrative?

HA Sustainable Infrastructure Capital appeals to investors who believe in the long-term need for private finance in green infrastructure and energy transition projects. The company’s latest results, though mixed, don't fundamentally shake the case for backing its mission; however, the revenue miss and softer-than-expected earnings per share have sharpened the focus on whether growth can keep pace with expectations. Recent weakness in the share price shows that markets are weighing this shortfall against the solid jump in net income and an affirmed dividend, which continues to be a key draw for income-oriented holders. At the same time, debt coverage and dividend sustainability remain under the microscope, especially as the payout isn’t fully covered by earnings or cash flows. The biggest shift in risks now is the market’s attention to execution after this quarter’s revenue slip, with the core catalyst staying tied to new project funding and asset growth.

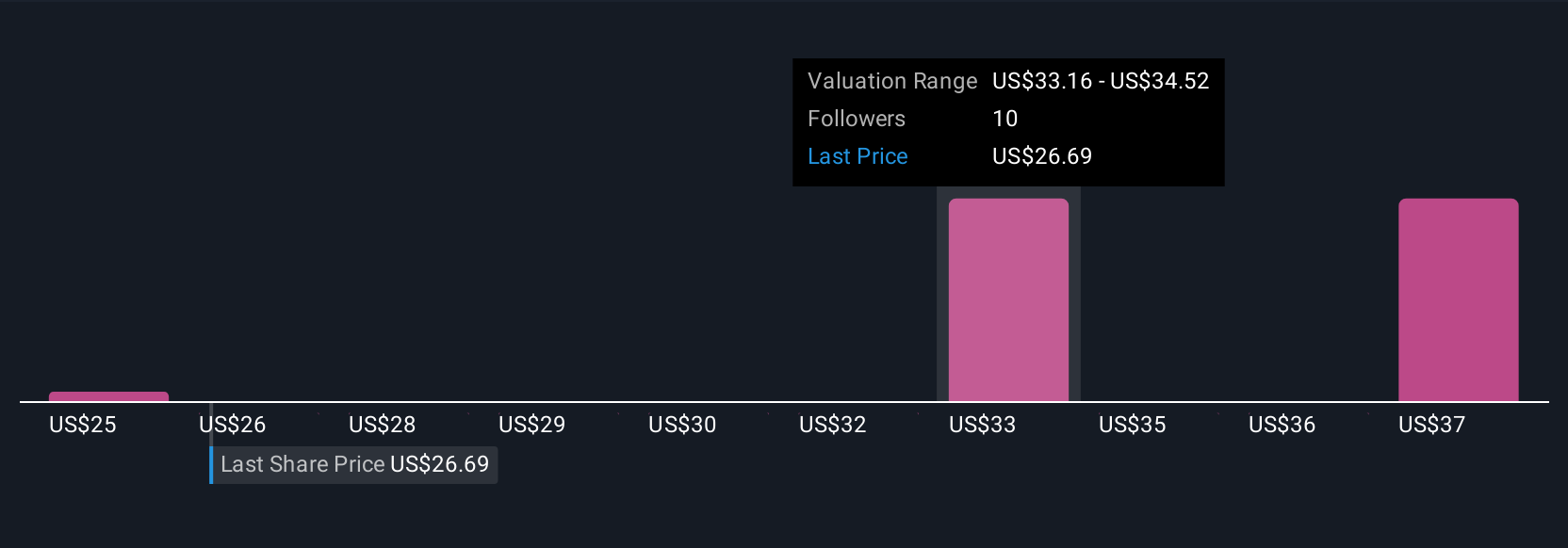

Yet, weaknesses in covering the dividend could mean more than a short-term dip for shareholders. HA Sustainable Infrastructure Capital's shares have been on the rise but are still potentially undervalued by 19%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on HA Sustainable Infrastructure Capital - why the stock might be worth as much as 50% more than the current price!

Build Your Own HA Sustainable Infrastructure Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HA Sustainable Infrastructure Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HA Sustainable Infrastructure Capital's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English