Is Autohome's (ATHM) Share Buyback a Sign of Confidence or Shifting Priorities?

- Autohome recently announced its second quarter 2025 earnings, reporting sales of CNY 746.14 million, revenue of CNY 1.76 billion, and net income of CNY 398.87 million, along with the completion of a share buyback totaling 5,349,886 shares under its previously announced program.

- The combination of improved year-over-year sales and a substantial share repurchase underscores management's focus on operational performance and capital returns for shareholders, despite revenue and net income declines.

- We will explore how the completed share buyback and mixed financial results impact Autohome's business outlook and investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Autohome Investment Narrative Recap

For investors in Autohome, the central belief revolves around the company’s ability to leverage digital innovation and user engagement to drive steady growth, even as intense competition and margin pressures weigh on financials. The recent Q2 2025 results and completed buyback appear to have limited direct impact on the short-term catalyst of expanding digital ad and SaaS revenue, while ongoing risk from continued margin compression remains firmly in focus.

Among recent announcements, the completion of the share buyback program stands out, as it coincides with mixed quarterly financials and highlights management’s approach to capital allocation. However, this move does little to address underlying gross margin pressure, which remains a pivotal concern for near-term profitability and long-term earnings stability.

However, investors should also be aware that the sharp year-over-year drop in gross margin signals ongoing risks to Autohome’s profitability if...

Read the full narrative on Autohome (it's free!)

Autohome's outlook forecasts CN¥7.6 billion in revenue and CN¥1.8 billion in earnings by 2028. This projection is based on an annual revenue growth rate of 3.8% and a CN¥0.3 billion increase in earnings from the current CN¥1.5 billion.

Uncover how Autohome's forecasts yield a $28.87 fair value, in line with its current price.

Exploring Other Perspectives

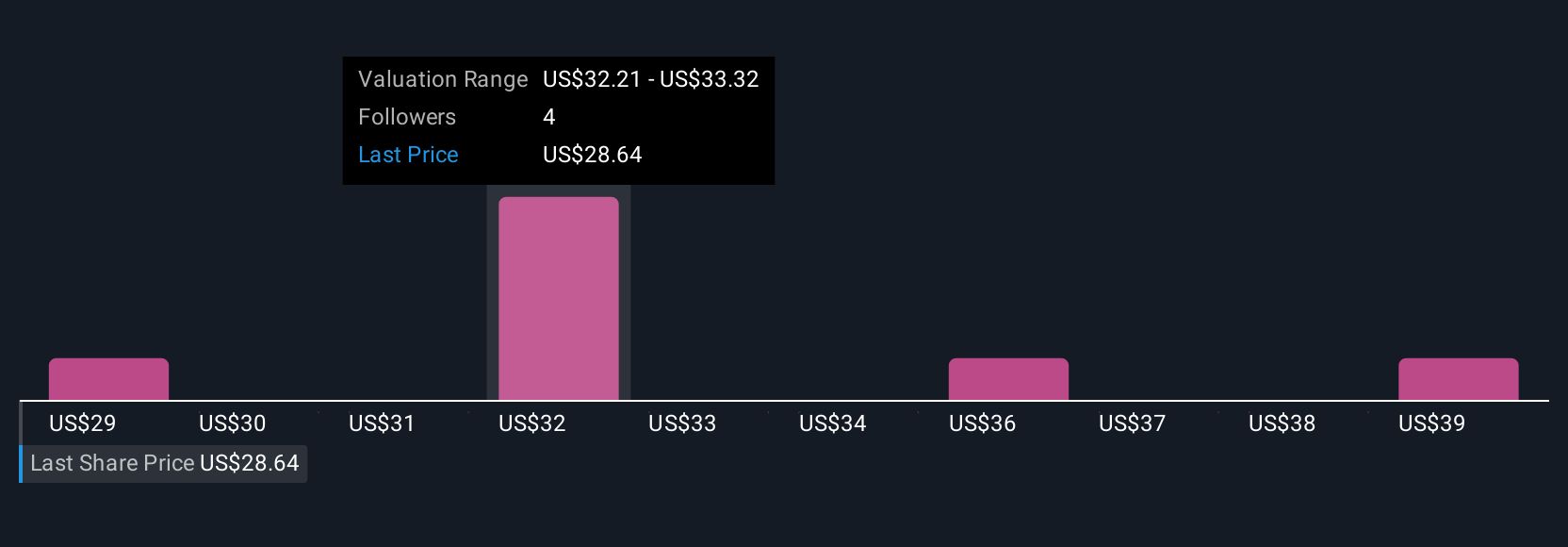

Four individual fair value estimates from the Simply Wall St Community range from CN¥28.87 to CN¥40 per share. As ongoing gross margin pressure persists, these varied perspectives show just how much opinions about Autohome’s future can differ.

Explore 4 other fair value estimates on Autohome - why the stock might be worth as much as 40% more than the current price!

Build Your Own Autohome Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autohome research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Autohome research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autohome's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English