Should Aptiv's Rising Sales and Share Buybacks Amid Lower Profits Prompt Action From APTV Investors?

- Aptiv PLC recently reported its second quarter 2025 results, showing higher sales of US$5.21 billion compared to the previous year but a significant decline in net income and earnings per share; the company also announced updated financial guidance for both the third quarter and full year, and completed a share buyback of 6.1 million shares.

- This combination of increased revenue and weaker profitability, along with ongoing share repurchase activity, highlights the company's efforts to balance growth initiatives with shareholder returns amid persistent earnings pressures.

- We'll explore how Aptiv's lower net income, despite stable revenues and active share buybacks, could affect its investment narrative and future outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Aptiv Investment Narrative Recap

To be a shareholder in Aptiv, you need to believe that the company can maintain industry leadership as demand increases for advanced vehicle electronics and electrical architectures, while simultaneously navigating margin pressures and earnings volatility. The recent second-quarter results, which showed higher sales but a marked drop in net income and earnings per share, did not materially shift the short-term catalyst, the global adoption of electric vehicles and automation, while ongoing profitability headwinds remain the biggest risk in the months ahead. Among Aptiv’s recent announcements, the completed buyback of 6.1 million shares stands out as it underscores ongoing commitment to returning capital to shareholders, even while earnings remain under pressure. This approach aligns with the company’s focus on balancing near-term shareholder returns with the long-term need to invest in new growth areas, reinforcing the importance of Aptiv’s ability to scale advanced systems for future revenue growth. However, against this backdrop, investors should also be mindful that, despite continued revenue growth and share repurchases, the sharp decline in net income could signal...

Read the full narrative on Aptiv (it's free!)

Aptiv's outlook points to $23.3 billion in revenue and $1.9 billion in earnings by 2028. This implies a 5.5% annual revenue growth rate and an $0.9 billion increase in earnings from $1.0 billion today.

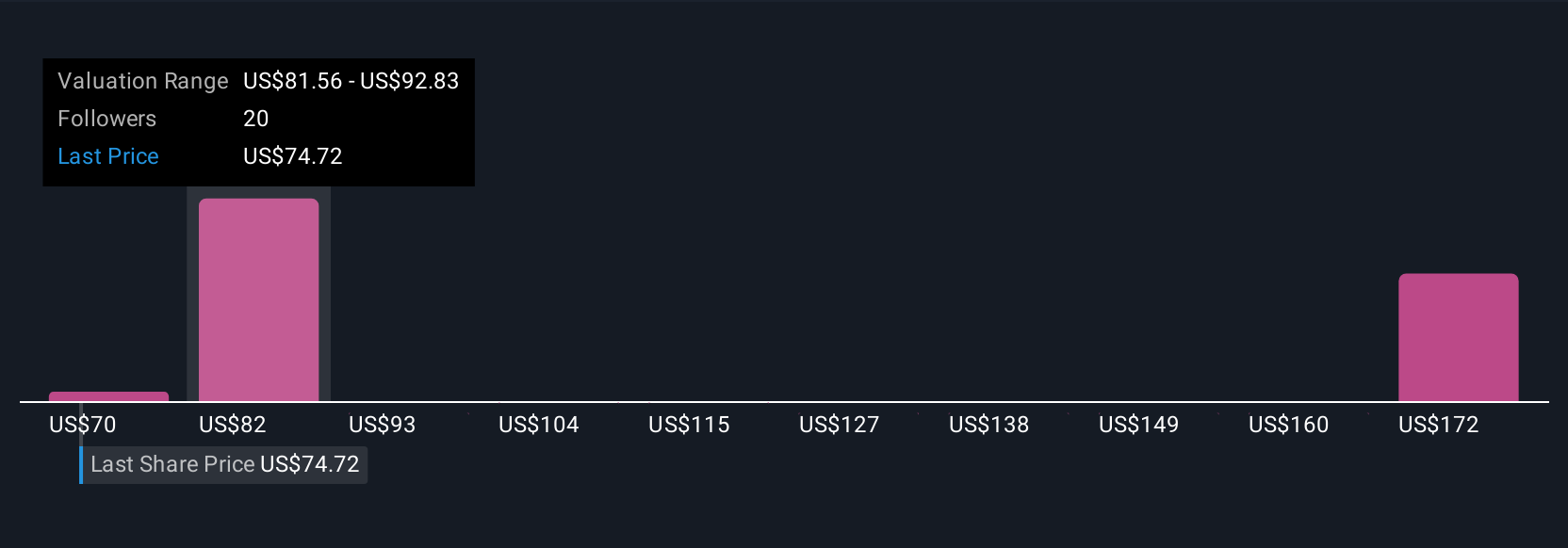

Uncover how Aptiv's forecasts yield a $82.94 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Six community fair value estimates for Aptiv range widely from US$70.29 to US$181.11. While investors can draw on many viewpoints, persistent margin headwinds may affect how these targets play out in practice.

Explore 6 other fair value estimates on Aptiv - why the stock might be worth over 2x more than the current price!

Build Your Own Aptiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aptiv research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aptiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aptiv's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English