Did Freeport-McMoRan’s (FCX) Indonesian Smelter and Surging Sales Just Shift Its Global Copper Narrative?

- Freeport-McMoRan recently reported strong second-quarter 2025 results, with copper sales volumes increasing about 9% year over year and gold sales volumes rising approximately 45%, alongside the successful startup of a new large-scale copper smelter in Indonesia.

- This operational milestone positions Freeport-McMoRan to further enhance its production capabilities and comes as the company maintains a cautious outlook for copper sales in the near term.

- We’ll explore how the new Indonesian smelter startup strengthens Freeport-McMoRan’s investment narrative and outlook for integrated global copper production.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Freeport-McMoRan Investment Narrative Recap

To be a shareholder in Freeport-McMoRan, you need to believe in the long-term importance of global copper supply, the company’s ability to convert operational milestones like the Indonesian smelter startup into lasting margin improvement, and steady execution in both U.S. and Indonesian operations. The recent strong quarterly results reflect higher sales, but management’s cautious outlook for copper sales volumes and a mixed short-term demand picture mean this milestone does not materially shift the biggest near-term catalyst, successful ramp-up of the Indonesian smelter, or address ongoing risks tied to Indonesian operational complexity.

The most relevant recent announcement is the operational startup of the new Indonesian copper smelter, which now positions Freeport-McMoRan as a more integrated producer. This supports the catalyst of improved downstream margins, production scale, and reduced exposure to export tariffs. While the smelter strengthens Freeport’s investment narrative and integrated value capture, the main short-term uncertainty continues to be whether this new asset achieves reliable, cost-efficient production at scale, given Indonesia’s regulatory and operating environment.

By contrast, investors should not overlook potential changes in Indonesian government policy that could affect Freeport-McMoRan’s long-term license to operate...

Read the full narrative on Freeport-McMoRan (it's free!)

Freeport-McMoRan's outlook anticipates $31.1 billion in revenue and $3.3 billion in earnings by 2028. This scenario is based on a 6.4% annual revenue growth rate and a $1.4 billion increase in earnings from the current $1.9 billion.

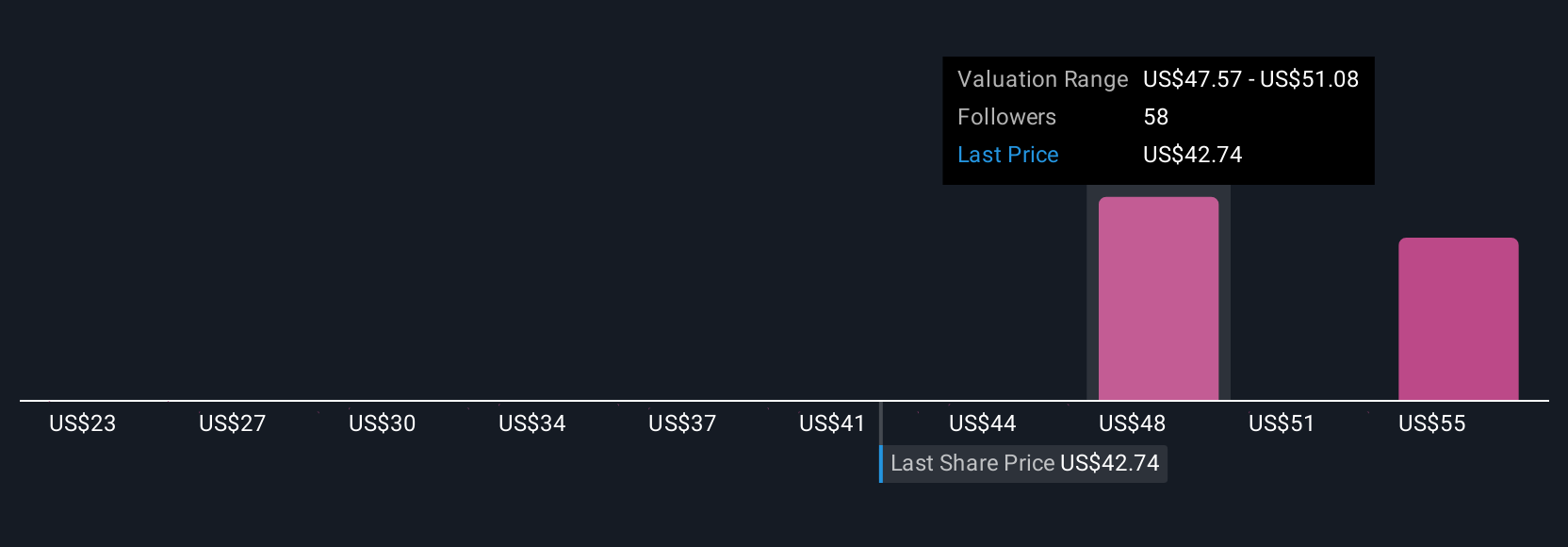

Uncover how Freeport-McMoRan's forecasts yield a $50.74 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted 11 unique fair value estimates for Freeport-McMoRan ranging from US$23.02 to US$58.16 per share. These differing views highlight how optimism around integrated copper production can meet uncertainty about regulatory and operational risks, see how your own perspective compares.

Explore 11 other fair value estimates on Freeport-McMoRan - why the stock might be worth as much as 39% more than the current price!

Build Your Own Freeport-McMoRan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freeport-McMoRan research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Freeport-McMoRan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freeport-McMoRan's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English