Granite Ridge Resources (NYSE:GRNT) Is Due To Pay A Dividend Of $0.11

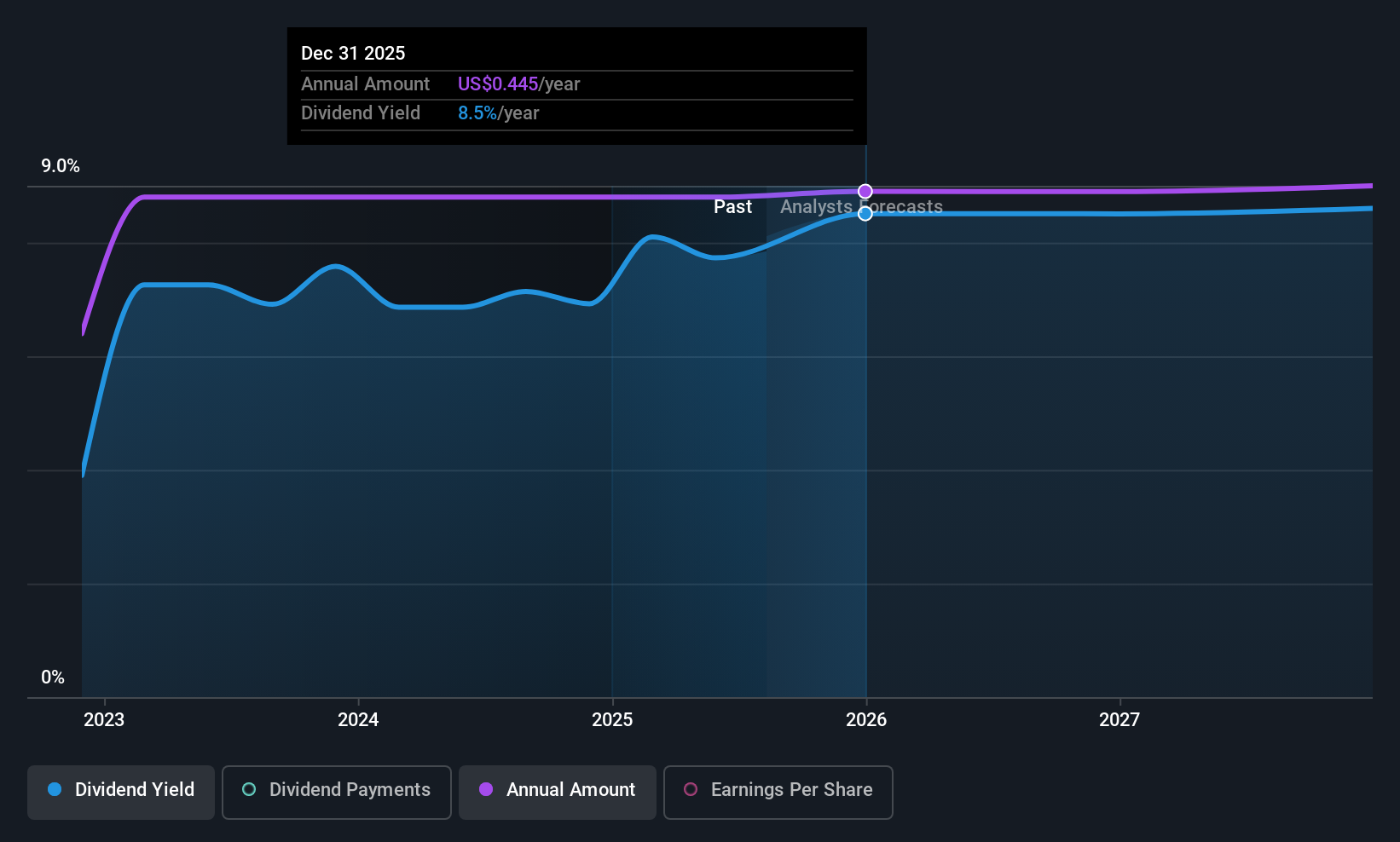

Granite Ridge Resources, Inc. (NYSE:GRNT) will pay a dividend of $0.11 on the 15th of September. This makes the dividend yield 8.4%, which will augment investor returns quite nicely.

Granite Ridge Resources' Projected Earnings Seem Likely To Cover Future Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, earnings were actually smaller than the dividend, and the company was actually spending more cash than it was making. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high.

The next year is set to see EPS grow by 184.7%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 63% which would be quite comfortable going to take the dividend forward.

See our latest analysis for Granite Ridge Resources

Granite Ridge Resources Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The annual payment during the last 3 years was $0.32 in 2022, and the most recent fiscal year payment was $0.44. This implies that the company grew its distributions at a yearly rate of about 11% over that duration. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. Granite Ridge Resources' EPS has fallen by approximately 23% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Granite Ridge Resources' Dividend Doesn't Look Great

Overall, while some might be pleased that the dividend wasn't cut, we think this may help Granite Ridge Resources make more consistent payments in the future. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 4 warning signs for Granite Ridge Resources (1 is a bit concerning!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English