What Southwest Gas Holdings (SWX)'s Reaffirmed 2025 Guidance Amid Q2 Loss Means for Shareholders

- Southwest Gas Holdings, Inc. recently announced its second quarter 2025 results, reporting revenue of US$1,120.37 million and a net loss of US$12.88 million, compared to revenue of US$1,182.17 million and a net income of US$18.33 million a year ago.

- Despite lower quarterly revenue and a net loss, the company reaffirmed its full-year 2025 net income guidance of US$265 million to US$275 million, highlighting management’s confidence in an improved performance ahead.

- We’ll now examine how the company’s reaffirmed annual earnings guidance amid a challenging quarter could affect Southwest Gas Holdings’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Southwest Gas Holdings Investment Narrative Recap

To own shares of Southwest Gas Holdings, an investor needs to have confidence in long-term demand for natural gas in the Southwest and management’s ability to navigate financial headwinds. The recent quarterly net loss is concerning but does not appear to materially affect the main short-term catalyst: reaffirmed 2025 full-year earnings guidance, which suggests management still sees a path to stronger results ahead. The biggest risk currently remains cost pressures and regulatory changes that could restrict the company’s ability to recover investments or grow earnings, a factor that goes beyond a single quarter’s performance.

Of the recent company announcements, the reaffirmation of 2025 net income guidance following a weaker quarter stands out. Management’s confidence in meeting its US$265 million to US$275 million target reflects a view that certain operational or regulatory factors can drive recovery in the near term, despite sizable execution and regulatory risks that persist across the industry.

Yet, in contrast to management’s optimism, investors should pay close attention to tightening regulatory constraints and growing compliance costs that could directly impact...

Read the full narrative on Southwest Gas Holdings (it's free!)

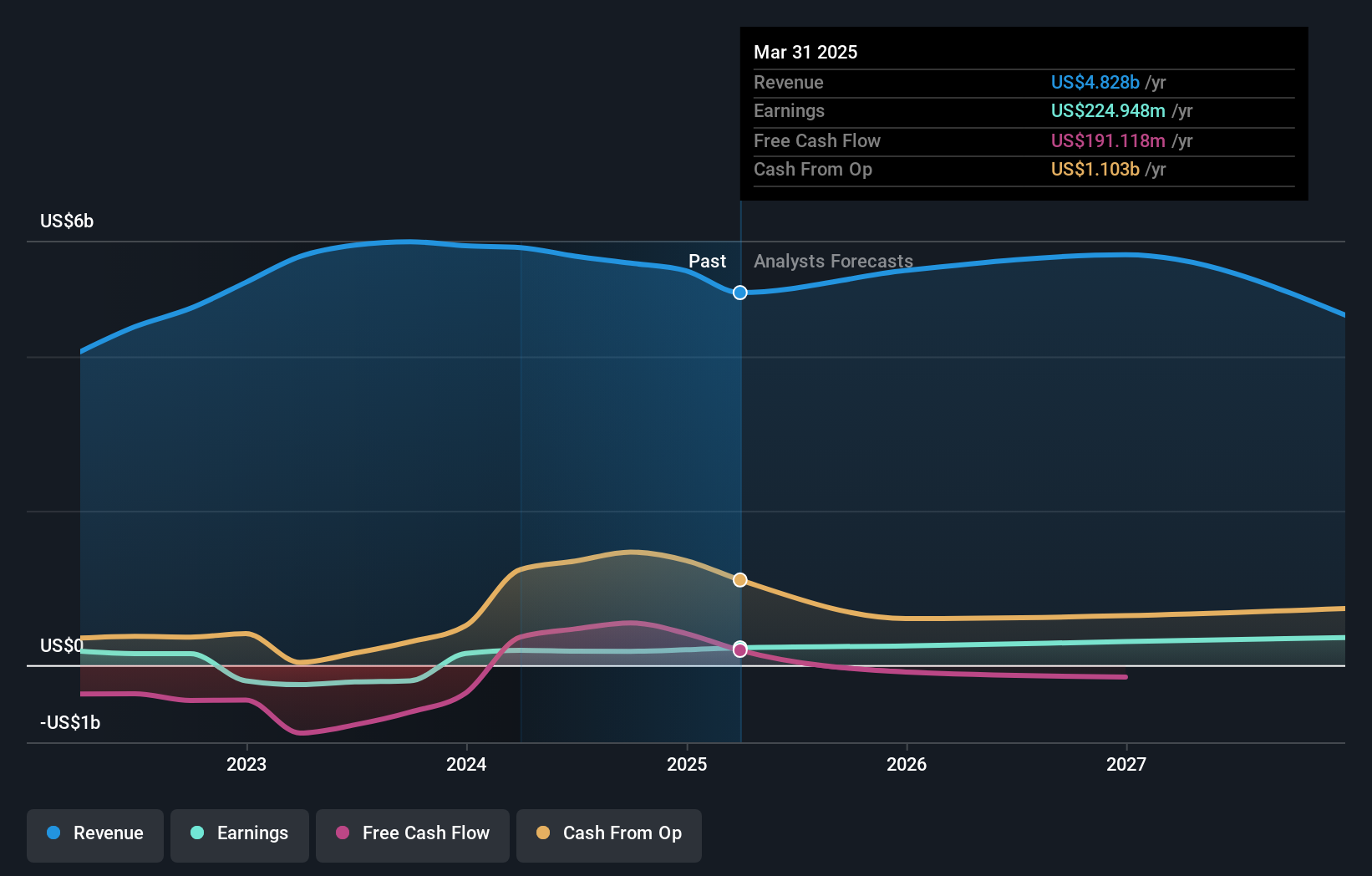

Southwest Gas Holdings' outlook points to $4.5 billion in revenue and $385.3 million in earnings by 2028. This scenario reflects a -1.7% annual revenue decline and a $191.6 million increase in earnings from $193.7 million today.

Uncover how Southwest Gas Holdings' forecasts yield a $79.57 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates for Southwest Gas Holdings from three members of the Simply Wall St Community range widely, from US$33.14 to US$79.57 per share. With ongoing regulatory risks in focus, it is clear that community perspectives can vary sharply, offering you a wide spectrum of views to consider.

Explore 3 other fair value estimates on Southwest Gas Holdings - why the stock might be worth less than half the current price!

Build Your Own Southwest Gas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Gas Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Southwest Gas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Gas Holdings' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English