Can Exclusive Partnerships Shape Mattel (MAT)'s Long-Term Brand Power Beyond the Toy Aisle?

- Last week, Mattel's partners announced new collaborations: a Barbie-themed beauty line with Quo Beauty available exclusively in Canadian retailers, and a 7-Eleven x Hot Wheels collectible series featuring branded die-cast cars and fingerboards now in stores and online.

- These high-profile partnerships highlight Mattel's approach to expanding its brand presence into lifestyle products and exclusive collectibles, connecting with both new and existing audiences beyond traditional toy aisles.

- We'll explore how Mattel's move into exclusive beauty and collectible collaborations could shape its broader investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Mattel Investment Narrative Recap

To be a Mattel shareholder is to believe that the company’s iconic brand power can be leveraged beyond toys to drive growth through product innovation, partnerships, and experiences. While the new Barbie beauty line with Quo Beauty and 7-Eleven x Hot Wheels collectibles showcase Mattel’s ability to expand into lifestyle and collectible markets, these exclusive collaborations do not materially alter the most important short-term catalyst, execution of its multi-year media and content strategy, nor do they eliminate the ongoing risk of overreliance on core brands like Barbie and Hot Wheels.

The recent Barbie x Quo Beauty partnership stands out for reinforcing Mattel’s emphasis on broadening brand relevance with adult consumers, aligning with its aims to tap into new demographic segments and cultural trends. Yet, as the company seeks to diversify, the potential volatility in its core toy segments, especially if consumer habits shift toward digital experiences, remains a consequential risk to monitor.

In contrast, investors should stay alert to the potential impact of increasing digital competition on Mattel’s long-term growth…

Read the full narrative on Mattel (it's free!)

Mattel's outlook anticipates $5.8 billion in revenue and $533.3 million in earnings by 2028. This projection is based on an annual revenue growth rate of 2.7% and a modest earnings increase of $7 million from current earnings of $526.3 million.

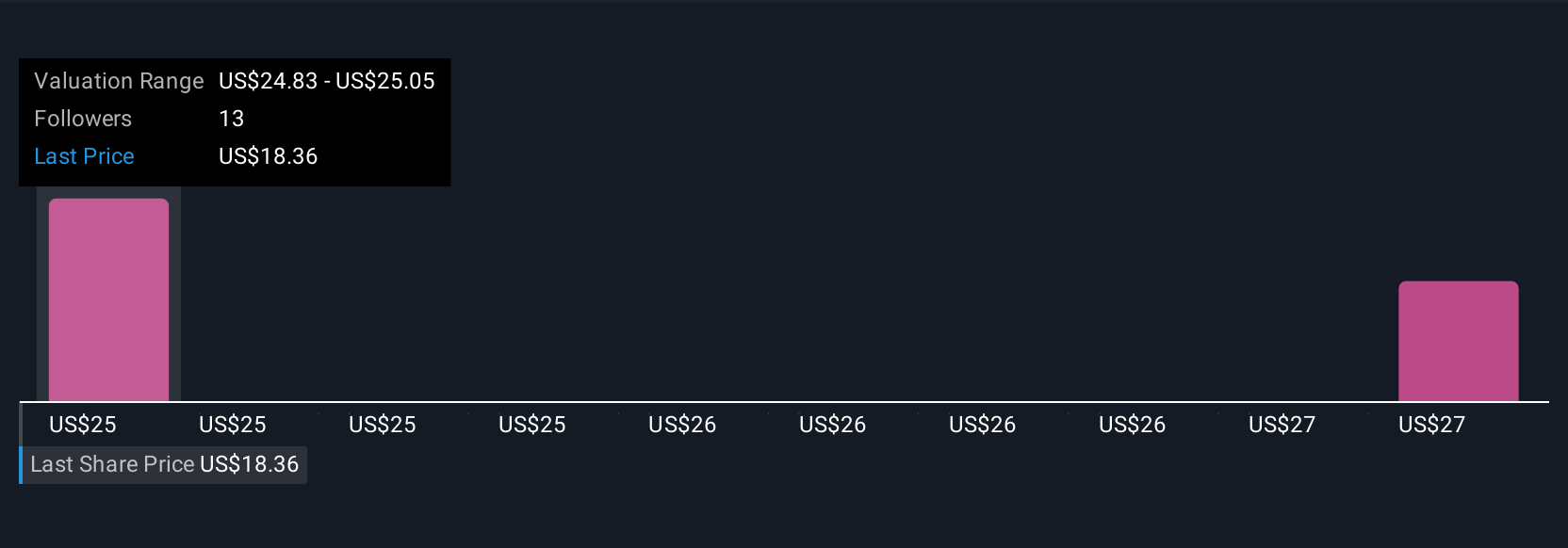

Uncover how Mattel's forecasts yield a $24.83 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimated Mattel’s fair value between US$24.83 and US$27.02. With consensus focusing on growth through brand extensions, keep in mind the ongoing debate about risks from digital entertainment competing for consumer attention.

Explore 2 other fair value estimates on Mattel - why the stock might be worth as much as 56% more than the current price!

Build Your Own Mattel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mattel research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mattel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mattel's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English