Eve Holding (EVEX) Is Down 9.5% After Quarterly Losses Widen Sharply - Has Sentiment Shifted?

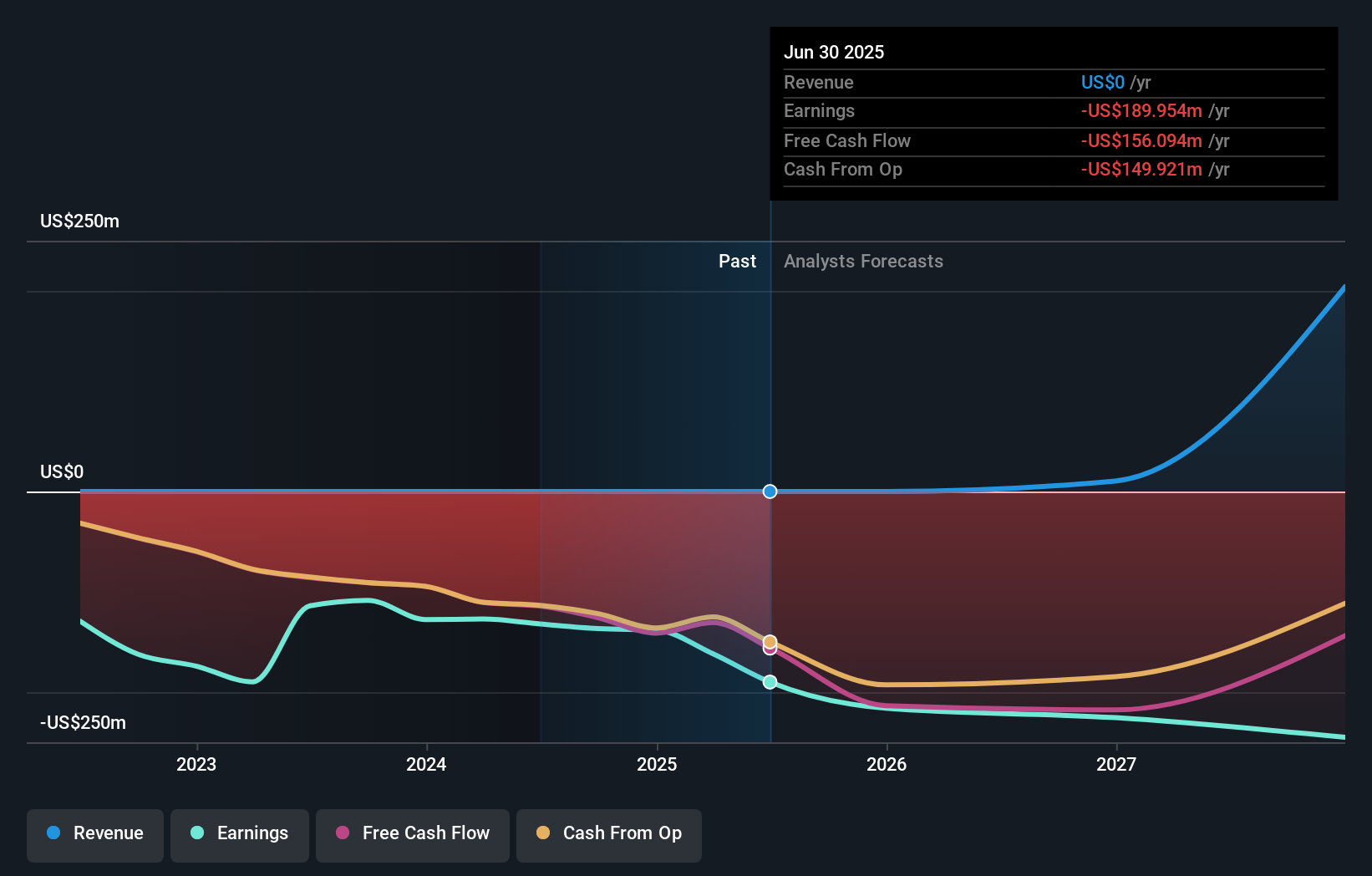

- Eve Holding, Inc. recently reported its second quarter 2025 earnings, showing a net loss of US$64.69 million, a year-on-year increase from a net loss of US$36.39 million for the same period in 2024.

- This marks a substantial widening of losses, with basic loss per share from continuing operations rising to US$0.21 from US$0.13 one year ago, highlighting mounting operational pressures.

- We'll explore what Eve Holding's increased quarterly losses mean for its investment narrative and long-term business execution.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Eve Holding's Investment Narrative?

To be a shareholder in Eve Holding right now, I think you have to believe in the company’s vision of eVTOL (electric vertical takeoff and landing) aircraft transforming urban mobility, as well as its ability to transition from design breakthroughs and early customer commitments to meaningful commercial revenue. The big news this quarter is the expanding net loss, now US$64.69 million in the second quarter, which has grown much faster than previously flagged and could put pressure on the company’s cash needs or timeline to profitability. While the recent LOIs and the first binding sales agreement are encouraging signs that Eve is progressing with partners in key markets, these wins seem unlikely to offset near-term financial pressures or change the company’s biggest catalyst: a successful move from orders and prototypes to full-scale production and initial deliveries. The risk profile may have shifted, with the rising losses adding urgency for Eve to secure more funding or demonstrate tangible commercial milestones in the short term. If this loss trajectory continues, investor attention may turn sharply to the sustainability of its balance sheet and pace of cash burn. In contrast, the speed of the increasing net loss is something investors should have on their radar.

Despite retreating, Eve Holding's shares might still be trading 39% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Eve Holding - why the stock might be worth as much as 63% more than the current price!

Build Your Own Eve Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eve Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Eve Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eve Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English