OPENLANE (KAR) Is Up 17.1% After Raising 2025 Earnings Guidance on Strong Q2 Results

- On August 6, 2025, OPENLANE, Inc. raised its full-year 2025 earnings guidance, projecting income from continuing operations of US$132 million to US$140 million, up from its previous range of US$100 million to US$114 million, alongside reporting strong quarterly results with net income for the second quarter of US$33.4 million and increased earnings per share.

- This upward revision in outlook, combined with significant year-over-year growth in net income and improved diluted earnings per share, underscores notable business momentum and strengthened management confidence in future performance.

- We'll now explore how the raised full-year earnings guidance strengthens OPENLANE's investment narrative and outlook for digital marketplace growth.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

OPENLANE Investment Narrative Recap

For investors to see OPENLANE as a compelling opportunity, belief in the ongoing digital transformation of wholesale vehicle auctions is key, with digital marketplace adoption driving revenue growth and margin expansion. The recent upward revision in full-year earnings guidance positively impacts the main short-term catalyst, increasing digital share and margin gains, while the chief risk remains future dilution from the 2026 planned conversion of Series A preferred shares, which this update does not materially alter.

The raised 2025 earnings guidance, announced alongside strong second quarter results, directly reflects recent progress in operating leverage and digital growth. This is especially relevant given the company’s momentum in digital volumes and efficiency initiatives, both highlighted by the positive shift in earnings outlook.

Yet, in contrast, investors should be aware of the share dilution risk posed by the Series A preferred shares conversion in 2026...

Read the full narrative on OPENLANE (it's free!)

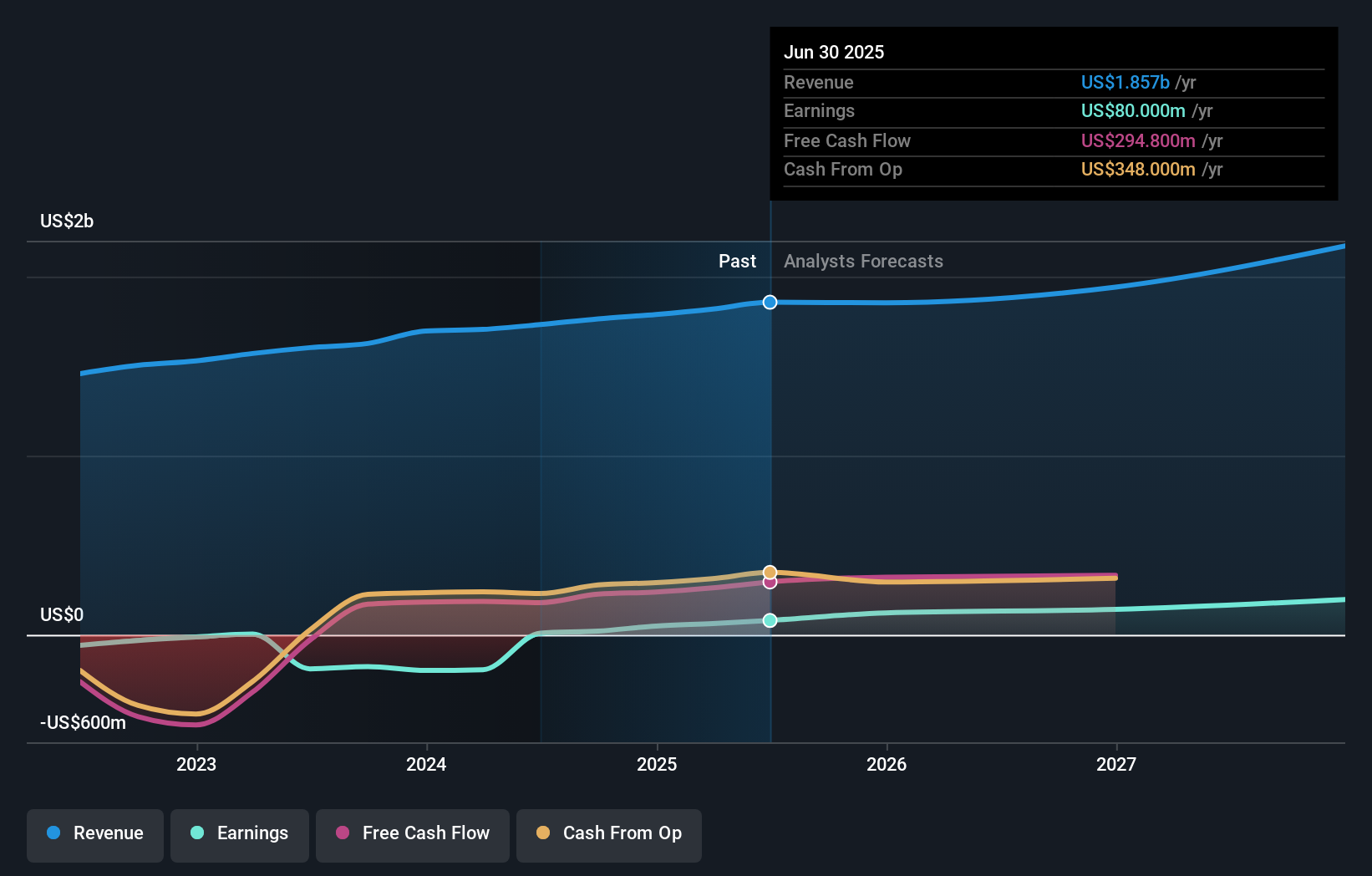

OPENLANE's narrative projects $2.0 billion revenue and $203.0 million earnings by 2028. This requires 1.9% yearly revenue growth and a $112.7 million earnings increase from $90.3 million today.

Uncover how OPENLANE's forecasts yield a $26.17 fair value, a 8% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided one fair value estimate for OPENLANE at US$70.08 per share. While positive digital growth trends support the investment narrative, future share dilution could impact how these fair values play out, consider how these perspectives may differ as circumstances evolve.

Explore another fair value estimate on OPENLANE - why the stock might be worth over 2x more than the current price!

Build Your Own OPENLANE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPENLANE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OPENLANE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPENLANE's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English