Puma Biotechnology, Inc. (NASDAQ:PBYI) Stock Catapults 43% Though Its Price And Business Still Lag The Market

Despite an already strong run, Puma Biotechnology, Inc. (NASDAQ:PBYI) shares have been powering on, with a gain of 43% in the last thirty days. The last 30 days bring the annual gain to a very sharp 40%.

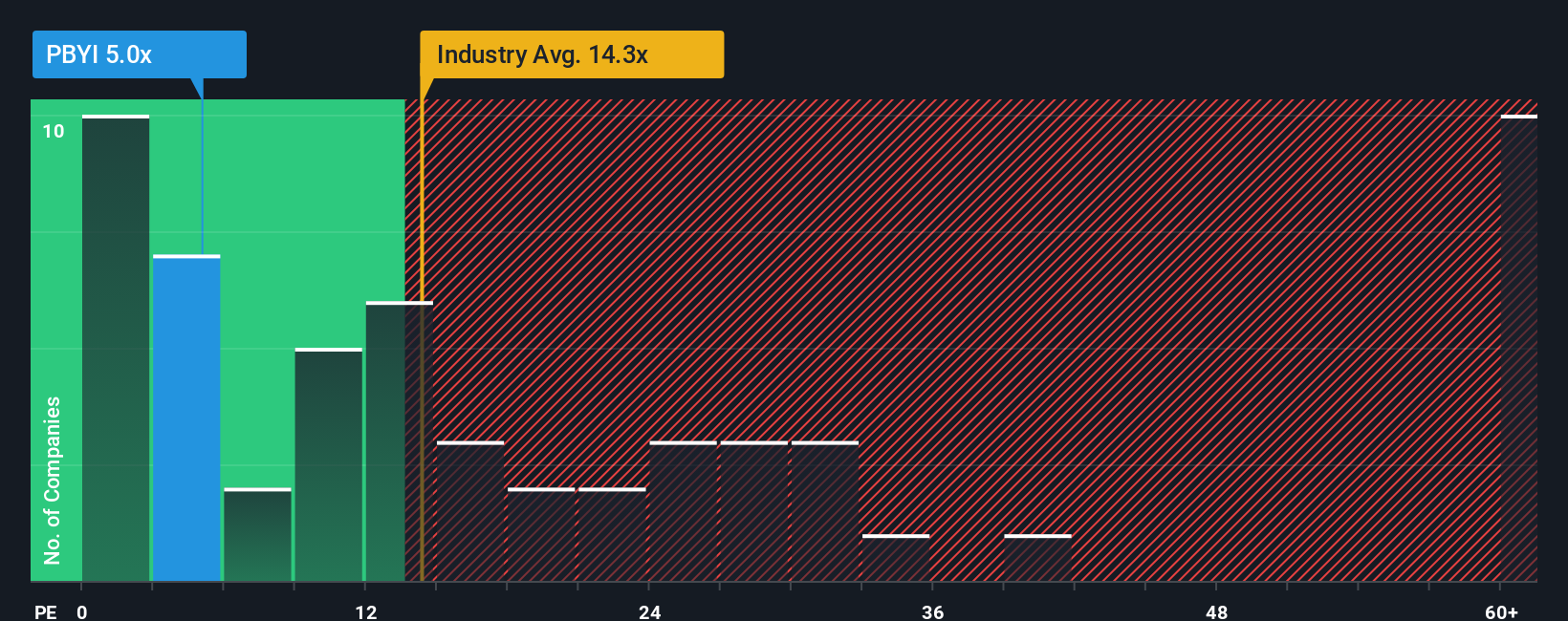

In spite of the firm bounce in price, Puma Biotechnology's price-to-earnings (or "P/E") ratio of 5x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Puma Biotechnology has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Puma Biotechnology

How Is Puma Biotechnology's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Puma Biotechnology's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 439% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 33% per year during the coming three years according to the one analyst following the company. That's not great when the rest of the market is expected to grow by 10% per annum.

With this information, we are not surprised that Puma Biotechnology is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Puma Biotechnology's P/E

Shares in Puma Biotechnology are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Puma Biotechnology maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Puma Biotechnology you should be aware of, and 1 of them makes us a bit uncomfortable.

If you're unsure about the strength of Puma Biotechnology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English