What Are Wall Street Analysts' Target Price for Fox Corporation Stock?

With a market cap of $24.5 billion, Fox Corporation (FOXA) is a leading New York-based media company that operates news, sports, and entertainment programming primarily through its flagship brands: Fox News, Fox Sports, and the Fox broadcast network. It focuses on television broadcasting and cable news, with a strong emphasis on live content such as sports and breaking news.

Shares of the company have significantly outperformed the broader market over the past 52 weeks, climbing 38.6%, while the broader S&P 500 Index ($SPX) has rallied 19.3%. Moreover, FOXA shares are up 12.2% on a YTD basis, compared to SPX’s 8.4% gain.

Focusing more closely, it has also outpaced the Communication Services Select Sector SPDR ETF Fund’s (XLC) nearly 27% gain over the past 52 weeks and 11.7% rise in 2025.

On Aug. 5, Fox Corporation reported Q4 2025 earnings, topping Wall Street estimates for quarterly revenue and profit, driven by a surge in advertising, affiliate fees and continued growth at its free ad-supported streaming service, Tubi. Its total revenue rose 6% year-over-year to $3.29 billion. Adjusted net income attributable to Fox stockholders jumped to $581 million ($1.27 per share), versus $423 million ($0.90) in the prior-year quarter. Despite the robust performance, its shares dropped 3.7% post earnings release.

For the fiscal year ending in June 2026, analysts expect FOXA’s EPS to fall 13.6% year-over-year to $4.13. The company's earnings surprise history is strong. It beat the consensus estimates in the last four quarters.

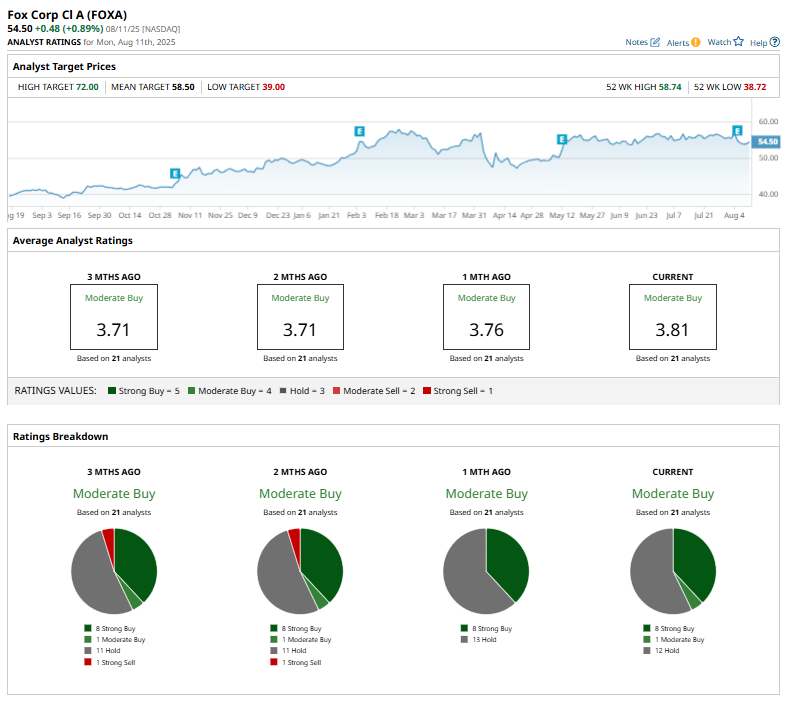

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” and 12 “Holds.”

On Aug. 6, Morgan Stanley (MS) analyst Benjamin Swinburne maintained an "Equal-Weight" rating on Fox and raised the price target from $60 to $65.

FOXA’s mean price target of $58.50 indicates a premium of 7.3% from the current price levels and the Street-high price target of $72 implies a potential upside of 32.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English