JPM or MS: Which Investment Banking Powerhouse is the Better Buy Now?

For investors eyeing the heart of Wall Street’s deal-making engine, JPMorgan JPM and Morgan Stanley MS are standout options. From advising on multibillion-dollar mergers and acquisitions (M&As) to underwriting high-profile IPOs and navigating volatile capital markets, these investment banking (IB) powerhouses shape the flow of global finance.

While the long-term outlook for IB remains robust, near-term momentum is less certain. This year began on a wave of optimism, but market sentiment cooled sharply after Trump’s ‘Liberation Day’ tariff policies took effect. Since then, deal-making has regained traction, with IB fees climbing steadily through the first half of the year.

Against this backdrop, the question arises: Which IB firm – JPMorgan or Morgan Stanley – offers the better upside potential?

The Case for JPMorgan

JPMorgan, while more diversified across banking and lending, remains a dominant force in the IB business, ranking #1 for global IB fees. In 2024, the company’s total IB fees soared 36% to $8.91 billion after declining in 2023 and 2022.

Despite tariff-related ambiguity and extreme market volatility, momentum persisted in the first half of 2025, with JPMorgan having a wallet share of 8.9%. During the first six months of 2025, IB fees rose 10% year over year to $4.68 billion, driven by higher advisory fees and underwriting income.

While the near-term macro prospects are cloudy, clarity on tariff plans and other economic data shows that IB business is picking up pace. The healthy IB pipeline, an active M&A market and JPMorgan’s leadership position ensure even stronger growth once the macro situation changes.

Further, JPM has been benefiting from heightened market volatility and rising client activity. This has been driving the company’s trading business. The markets revenues jumped in 2024 and the first half of 2025 on the back of tariff-related ambiguity and massive volatility. So, economic volatility is not necessarily bad for this business, although it makes forecasting difficult.

Beyond IB business, JPMorgan, the largest U.S. bank, spans the full spectrum of financial services. Nearly half its revenue comes from net interest income (NII), which is set to rise as the rates remain steady. Management projects NII to be roughly $95.5 billion for 2025 (up more than 3% year over year), while net yield on interest-earning assets is likely to stabilize.

The Case for Morgan Stanley

Morgan Stanley has leaned heavily into the IB business, though it has been diversifying into more stable revenue-generating sources like asset and wealth management businesses, creating a more balanced revenue stream across market cycles. Similar to JPM, the company’s IB revenues surged 36% last year to $6.71 billion after plunging in 2023 and 2022.

However, unlike JPMorgan, the performance of the company’s IB business has been subdued this year, with the metric rising just 1% from the prior-year quarter. Nonetheless, MS remains cautiously optimistic about the performance of the IB business this year, supported by a stable and diversified M&A pipeline. Hence, once the macroeconomic uncertainty eases, the company will be able to capitalize on it.

Moreover, Morgan Stanley’s trading business performance has been stellar over the past several months, attributable to uncertainty surrounding the tariff plans and macroeconomic headwinds. As market volatility and client activity are expected to remain decent, the company’s trading business will likely continue to grow.

As mentioned above, MS is focusing on expanding its wealth and asset management operations, which supported its financials during the post-pandemic slowdown in the IB business. Both businesses’ aggregate contribution to total net revenues jumped to more than 55% in 2024 from 26% in 2010. The momentum persisted in the first six months of 2025, with total client assets across both segments reaching $8.2 trillion. This brings the company closer to its longstanding $10 trillion asset management goal set by former CEO James Gorman.

JPM & MS: Price Performance, Valuation & Other Comparisons

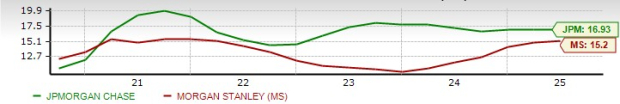

While 2025 started on a positive note, Trump’s tariff plans and resultant massive market volatility upended bullish investor sentiments. So far this year, shares of JPMorgan and Morgan Stanley have gained 20.8% and 14.4%, respectively.

JPM & MS YTD Price Performance

Image Source: Zacks Investment Research

JPM has outpaced the Zacks Investment Bank industry and the S&P 500 Index. On the other hand, MS has outperformed the broader index while lagging the industry. Hence, in terms of investor sentiments, JPMorgan clearly has the edge.

In terms of valuation, JPMorgan is currently trading at a 12-month forward price-to-earnings (P/E) of 14.52X. The MS stock, on the other hand, is currently trading at a 12-month forward P/E of 15.56X.

P/E F12M

Image Source: Zacks Investment Research

Therefore, JPMorgan is inexpensive compared to Morgan Stanley.

Also, JPMorgan’s return on equity (ROE) of 16.93% is above Morgan Stanley’s 15.20%. Also, both outscore the industry’s ROE of 14.32%. This reflects JPM’s efficient use of shareholder funds to generate profits.

ROE

Image Source: Zacks Investment Research

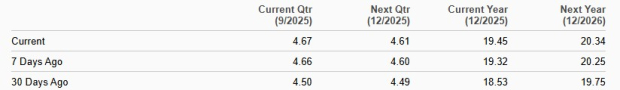

How Do Estimates Compare for JPMorgan & MS?

The Zacks Consensus Estimate for JPM’s 2025 revenues implies a marginal year-over-year decline, while for 2026, revenues are expected to grow 3.4%. Likewise, the consensus estimate for 2025 earnings indicates a 1.5% fall, while the same is anticipated to rise 4.6% for 2026. Earnings estimates for both years have been revised upward over the past week.

JPM Estimate Revision

Image Source: Zacks Investment Research

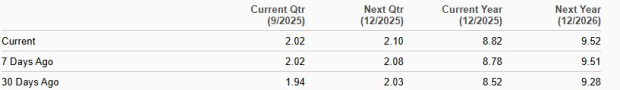

On the contrary, analysts are more bullish on Morgan Stanley’s prospects. The consensus mark for 2025 and 2026 revenues suggests a year-over-year increase of 8.3% and 4.2%, respectively. Also, the consensus estimate for earnings suggests a 10.9% and 8% increase for 2025 and 2026, respectively. Earnings estimates for both years have been revised north over the past seven days.

MS Estimate Revision

Image Source: Zacks Investment Research

JPM vs. MS: Which IB Stock Deserves a Spot in Your Portfolio?

JPMorgan stands out over Morgan Stanley for its ability to pair IB dominance with broad-based revenue streams. The company’s IB fees have been steadily improving, with it securing the #1 global market share at 8.9%. Its trading arm thrives in volatile conditions, turning tariff-driven uncertainty into revenue growth, while its diversified model cushions against IB cyclicality.

Nearly half of JPM’s revenues come from net interest income, projected to touch $95.5 billion in 2025, up more than 3% year over year. Trading at a lower P/E and delivering stronger ROE and stock gains, JPM offers compelling upside with reduced risk.

At present, JPMorgan sports a Zacks Rank # 1 (Strong Buy) and Morgan Stanley carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Morgan Stanley (MS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English