Will Goldman's Strong Liquidity Aid Its Capital Distribution Strategy?

The Goldman Sachs Group, Inc. GS enjoys a strong balance sheet position. As of June 30, 2025, cash and cash equivalents were $153 billion. As of the same date, total unsecured debt (comprising long-term and short-term borrowings) was $349 billion. Out of this, only $69 billion were near-term borrowings.

Moreover, the company maintains investment-grade long-term debt ratings of A/A2/BBB+, and a stable outlook from Fitch Ratings, Moody’s Investors Service and Standard & Poor's, respectively. Thus, the company's decent cash levels and solid credit profile indicate that it will likely be able to continue to meet debt obligations even during economic slowdowns.

Given strong liquidity, Goldman’s capital distribution activities have been impressive over the years. Post-clearing the Federal Reserve's 2025 stress test, the company raised its dividend 33.3% to $4 per share. In the past five years, the company has raised its dividends five times, with an annualized dividend growth rate of 22.04%. It currently sits at a payout ratio of 26%.

The company also has a share repurchase plan in place. In the first quarter of 2025, the board approved a share repurchase program of up to $40 billion of common stock. In February 2023, it announced a share repurchase program, authorizing repurchases of up to $30 billion of common stock with no expiration date. At the end of the second quarter, Goldman had $40.6 billion worth of shares available under authorization.

How GS Competes With JPM & MS in Terms of Liquidity Position

JPMorgan JPM has a decent balance sheet position. As of June 30, 2025, JPM had a total debt of $485.1 billion (the majority of this is long-term in nature). The company's cash and due from banks and deposits with banks were $420.3 billion on the same date. Hence, JPM continues to reward shareholders handsomely. In March 2025, the company raised its quarterly dividend 12% to $1.40 per share. In the last five years, JPMorgan hiked dividends five times, with an annualized growth rate of 7.9%. JPMorgan also authorized a share repurchase program worth $50 billion (effective from July 1, 2025).

Morgan Stanley MS had a long-term debt of $320.1 billion, with only $23.8 billion expected to mature over the next 12 months. The company’s average liquidity resources were $363.4 billion as of June 30, 2025. Given its solid liquidity position, Morgan Stanley rewards shareholders handsomely. Post clearing the 2025 Fed stress test, MS announced an 8% hike in the quarterly dividend to $1.00 per share and reauthorized a multi-year share repurchase program of up to $20 billion (no expiration date). Morgan Stanley has increased its dividend five times in the last five years, with an annualized growth rate of 22.8%.

Goldman’s Price Performance, Valuation & Estimates

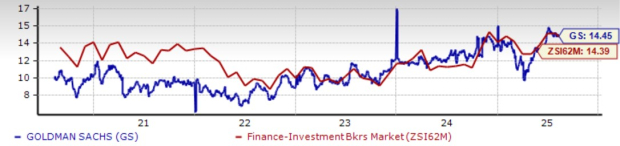

Shares of GS have gained 26.8% year to date compared with the industry’s growth of 22.2%.

Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

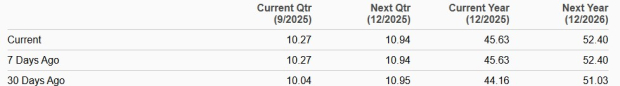

From a valuation standpoint, Goldman trades at a forward price-to-earnings (P/E) ratio of 14.45X, above the industry’s average of 14.39X.

Price-to-Earnings F12M

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for GS’s 2025 and 2026 earnings implies year-over-year increases of 12.6% and 14.9%, respectively. Likewise, the Zacks Consensus Estimate for GS’s 2025 and 2026 sales implies year-over-year rallies of 6.3% and 6.5%, respectively. The estimates for both years have been revised upward over the past 30 days.

Estimates Revision Trend

Image Source: Zacks Investment Research

Goldman currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Morgan Stanley (MS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English