CRCL Stock Drops 6% After Hours Even As Circle CEO Doubles Down On 'Big-Tent' Crypto Strategy, Backs Coinbase-Shopify Deal

Circle Internet Group Inc. (NYSE:CRCL) CEO Jeremy Allaire supported Coinbase Global Inc.’s (NASDAQ:COIN) partnership with Shopify Inc. (NASDAQ:SHOP) on Tuesday, emphasizing the company’s broad-minded approach to the evolving stablecoin payment landscape.

CRCL is feeling the pressure from bearish momentum. See the market dynamics here.

A ‘Valuable’ Step Toward Increasing Stablecoin Adoption

During the company’s second-quarter earnings call, Allaire was asked whether the Coinbase-Shopify partnership, which allows retailers to accept USDC (CRYPTO: USDC) payments, competes with or complements its own Circle Payments Network.

“We've got a big tent mentality here and we want to see a lot of success across many different types of companies,” he replied. “When a Shopify launches USDC payment acceptance and they're using a product from Coinbase to do that, that's great.

Alliare said the company sees USDC integration in commerce and other applications as a “valuable” step toward expanding use cases and increasing adoption of the stablecoin

See Also: Circle Stock Pops On Q2 Earnings: USDC Hits $65.2 Billion In Mainstream Stablecoin Adoption

CPN: An Important Initiative For Circle

In the same breath, Alliare underlined Circle Payments Network as a” very important initiative” for the company.

“We believe that the model we're putting forward with CPN is going to be very attractive to financial institutions and ultimately to the customers that they serve,” he added.

Why CRCL Fell After-Hours

Circle reported its first earnings as a public company on Tuesday morning, with quarterly revenue beating analyst estimates and USDC circulation surging 90% year-over-year.

The company also announced plans to launch Arc, a new enterprise-focused Layer-1 blockchain for stablecoin payments, foreign exchange and capital markets applications.

Price Action: Shares of Circle closed 1.27% higher at $163.21 during the regular trading session.

However, the stock plummeted 6% in after-hours trading after the company announced a public offering of 10 million shares of its Class A common stock.

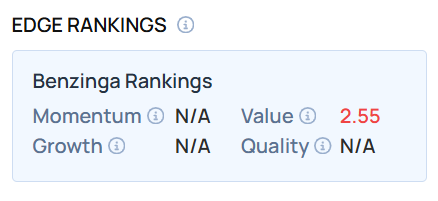

CRCL exhibited a low value score — a percentile-ranked composite metric that evaluates a stock’s relative worth by comparing its market price to fundamental measures — as of this writing. Visit Benzinga Edge Stock Rankings to filter out the best performers on this metric.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo by PJ McDonnell via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English