The Bull Case For VSE (VSEC) Could Change Following Return to Profitability and Raised Revenue Guidance

- In the past week, VSE Corporation announced significantly improved second quarter 2025 earnings, reaffirmed its full-year revenue growth guidance, declared a regular cash dividend, and scheduled a conference presentation with senior leaders at the Canaccord Genuity’s 45th Annual Growth Conference in Boston.

- These developments highlighted a return to profitability, robust revenue growth driven in part by recent acquisitions, and ongoing communication with shareholders, underscoring investor confidence and the company’s expanding role in aviation aftermarket services.

- We’ll explore how VSE’s strong quarterly results and guidance confirmation reinforce its investment narrative around aftermarket aviation growth.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

VSE Investment Narrative Recap

To be a shareholder in VSE today, you have to believe in the company’s pure-play aviation aftermarket focus, ongoing integration of acquisitions, and the strength of industry demand for aftermarket services. The recent earnings announcement, with a return to quarterly profitability and affirmed double-digit revenue growth guidance, supports the near-term growth story but does not fundamentally change the main short-term catalyst or address the biggest risk: execution in integrating new acquisitions and managing sector concentration.

Among the latest announcements, VSE’s reaffirmation of its 2025 revenue growth outlook of 35% to 40% is most relevant. This guidance directly connects to the main catalyst: the expectation that expansion into higher-margin aviation services and new customer segments will translate into sustained revenue increases, particularly as the company continues to absorb and align recent large acquisitions, such as TCI and Kellstrom.

Yet, it is important to remember that despite this revenue momentum, the company’s transformation has increased its reliance on the aviation sector and exposed it to...

Read the full narrative on VSE (it's free!)

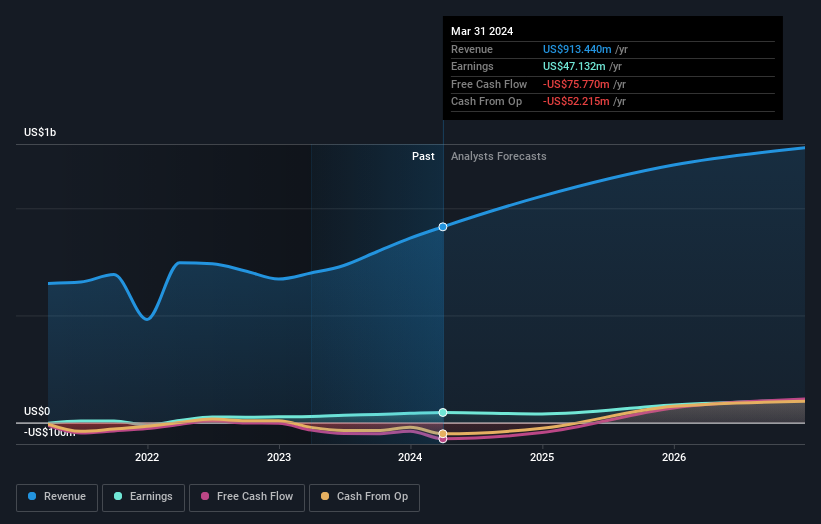

VSE's narrative projects $1.6 billion revenue and $139.2 million earnings by 2028. This requires 7.4% yearly revenue growth and a $75.4 million earnings increase from $63.8 million today.

Uncover how VSE's forecasts yield a $169.58 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Community members’ fair value estimates for VSE range widely from US$106.53 to US$169.58, with just two opinions represented. While some expect strong growth from acquisitions, others caution that sector concentration may heighten risk. Consider the range of these diverse viewpoints as you form your own perspective.

Explore 2 other fair value estimates on VSE - why the stock might be worth as much as $169.58!

Build Your Own VSE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VSE research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free VSE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VSE's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English