Does Cabot's (CBT) Growth Investment Strategy Outweigh Declining Sales in Shaping Its Future?

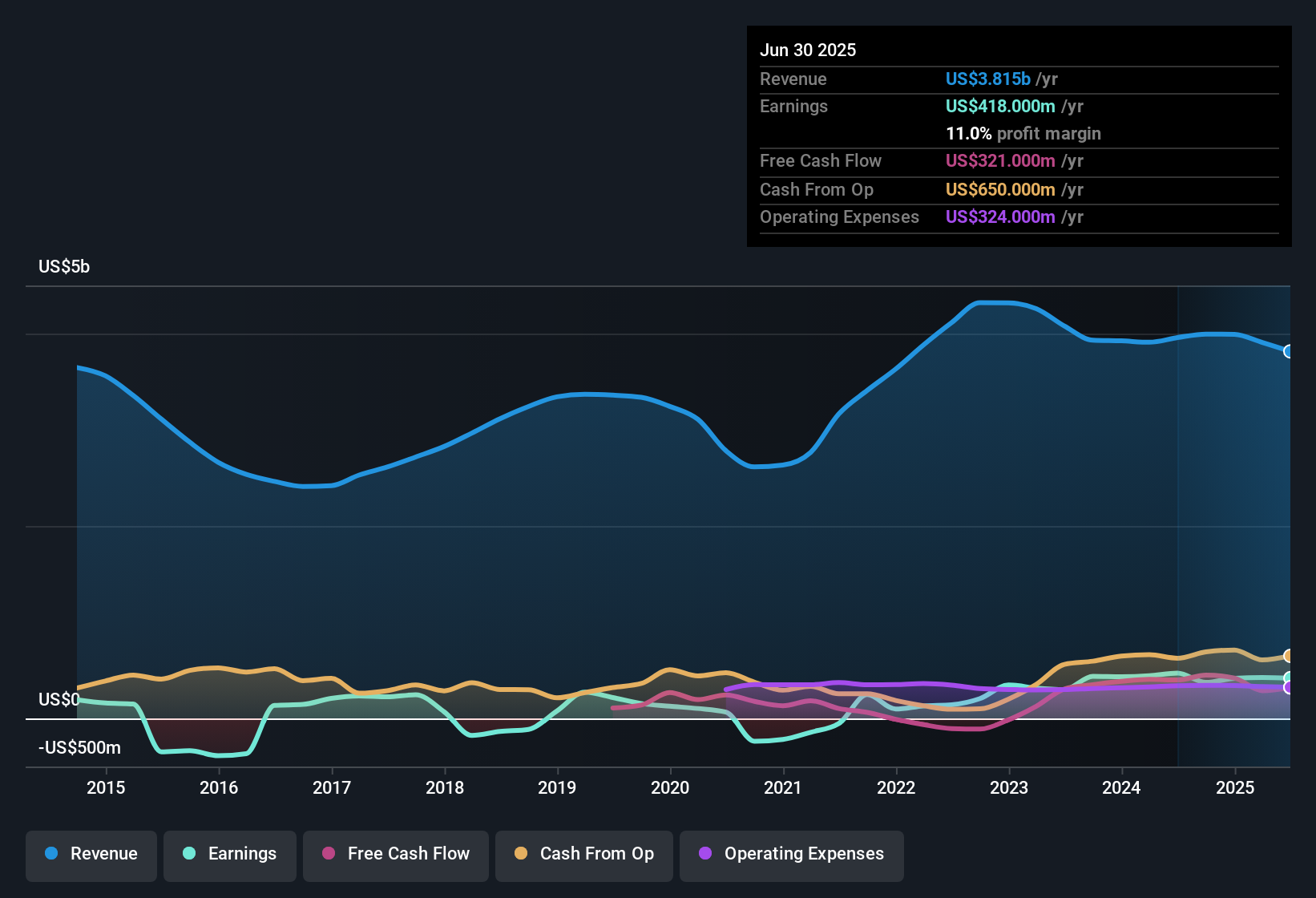

- Cabot Corporation recently reported third-quarter fiscal 2025 earnings above analyst expectations, with adjusted earnings per share reaching US$1.90 despite a 9.2% year-over-year decline in net sales to US$923 million.

- In addition to reaffirming its fiscal 2025 guidance, Cabot has outlined plans for acquisitions and investments targeting growth areas such as batteries and conductive materials, while highlighting robust cash flow and a disciplined capital allocation approach.

- We'll explore how Cabot's focus on high-growth investments and disciplined M&A may shape its investment narrative moving forward.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Cabot's Investment Narrative?

For shareholders considering Cabot Corporation, the big-picture thesis revolves around the company’s disciplined capital allocation, healthy operating cash flows, and targeted investment into high-growth areas like battery materials and conductive additives. The recent push for acquisitions and organic expansions, highlighted by new capacity in Mexico and Indonesia, suggests that management aims to bolster competitive positioning and margin prospects even as headline sales remain under pressure. The third-quarter earnings beat and maintained guidance reinforce some confidence in the financial baseline, but softening volumes due to broader economic uncertainty and tariffs linger as near-term risks. Recent buybacks and the growing dividend signal commitment to returning capital, which may provide support if market sentiment weakens. Overall, the latest strategic moves fit squarely into Cabot’s existing ambitions, but the impact on short-term catalysts appears limited, with the largest headwinds still stemming from demand challenges and external economic pressures. Despite resilient earnings, external risks like tariffs and soft demand are crucial for investors to consider.

Despite retreating, Cabot's shares might still be trading 21% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on Cabot - why the stock might be worth less than half the current price!

Build Your Own Cabot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cabot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cabot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cabot's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English