Did Genworth Financial’s (GNW) Aggressive Buyback Overshadow Lower Earnings in Its Capital Allocation Strategy?

- Genworth Financial reported second quarter 2025 results, noting net income of US$51 million, a decrease from US$76 million in the prior year's quarter, and announced that it completed repurchasing over 108 million shares for US$629.96 million since launching its buyback in May 2022.

- This substantial buyback represents nearly a quarter of outstanding shares, highlighting the company's commitment to returning capital to shareholders during a period of lower net earnings.

- We'll examine how Genworth Financial’s completion of a major share repurchase program influences its investment case and capital allocation story.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Genworth Financial's Investment Narrative?

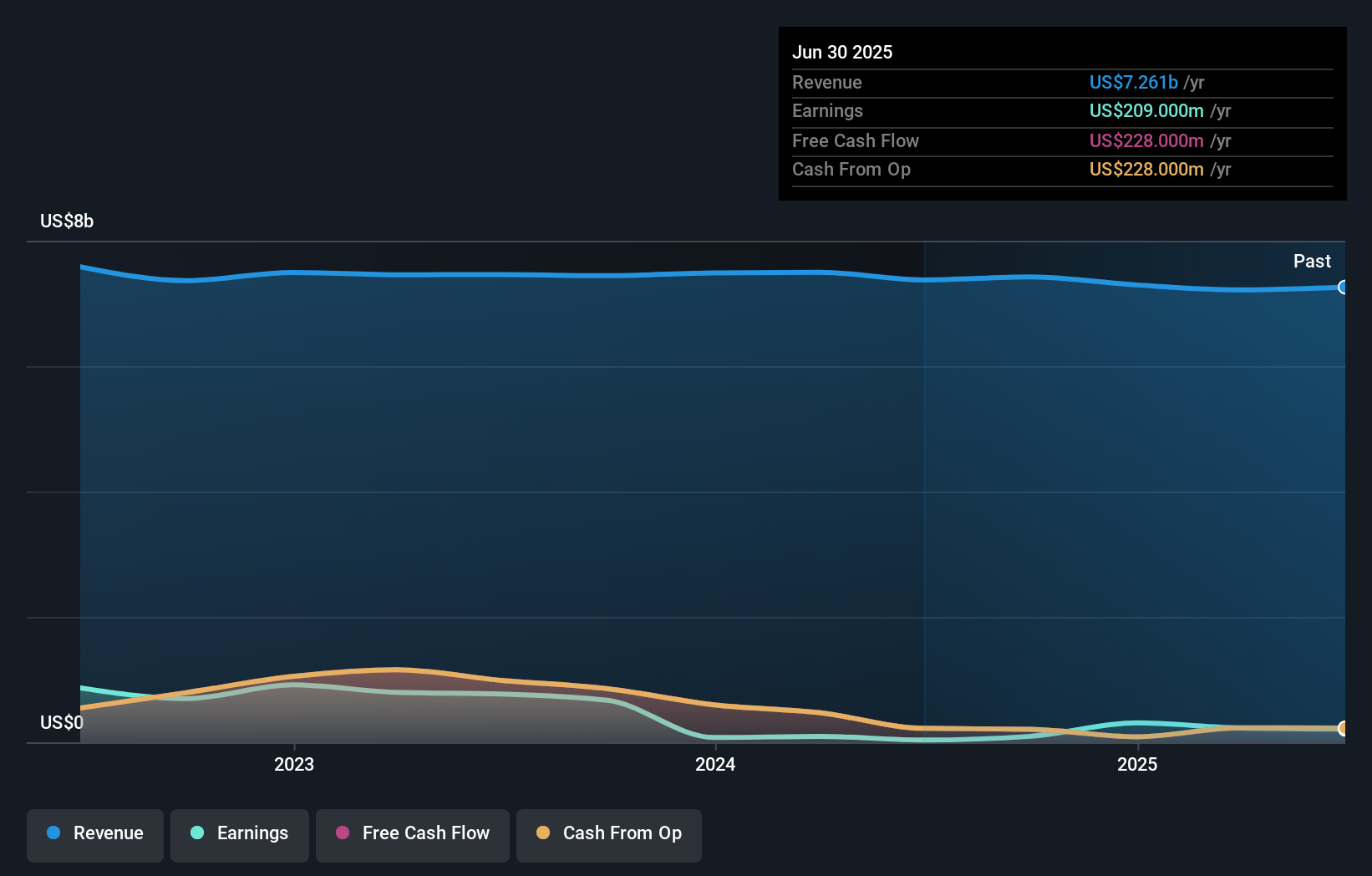

To be a shareholder in Genworth Financial right now, you need to believe in the company’s ability to balance shareholder returns with earnings volatility and muted growth signals. The recent completion of a major share buyback, which retired nearly a quarter of outstanding shares, underscores Genworth’s push to reward shareholders even amid a dip in quarterly net income. This move could enhance per-share metrics in the short term, but with net earnings moving lower this quarter and limited evidence of sustained revenue or profit growth, the focus now shifts to whether Genworth can defend or improve its margins. Short-term catalysts like board and executive refreshes and investor activism over Enact Holdings still matter, but with the buyback now finished, much depends on management’s next steps in capital allocation. Investors should also watch for any impact on valuation as trading multiples look stretched against peers, and the future profit trajectory remains uncertain.

However, keep in mind, valuation compared to peers is still a risk to watch.

Exploring Other Perspectives

Explore 2 other fair value estimates on Genworth Financial - why the stock might be worth 25% less than the current price!

Build Your Own Genworth Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genworth Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Genworth Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genworth Financial's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English