Does ARMOUR Residential REIT's (ARR) Equity Expansion Mark a New Phase in Capital Strategy?

- ARMOUR Residential REIT, Inc. recently completed a follow-on equity offering of 18,500,000 common shares, raising approximately US$302.48 million after amending its authorized share count from 125,000,000 to 175,000,000 shares.

- This sequence of actions expands the company's financial flexibility and alters its future capital structure and potential growth trajectory.

- We'll explore how ARMOUR Residential REIT's expanded authorized shares and completed equity offering shape its overall investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is ARMOUR Residential REIT's Investment Narrative?

For anyone considering ARMOUR Residential REIT, the core investment case has always centered on its capacity to generate income through regular dividends while managing a challenging mortgage REIT environment. The recent US$302.48 million equity raise fundamentally expands the company’s financial toolkit but also increases the share count, with potential short-term pressure on per-share metrics. This move may recalibrate some of the key short-term catalysts, such as dividend coverage and the pace of projected earnings improvement, especially since previous analysis flagged that the dividend was not well covered by earnings. At the same time, the capital infusion could bolster ARMOUR’s resiliency amid ongoing net losses and a recent series of declining total returns. However, dilution risk has shifted from being a hypothetical concern to an immediate factor for current and future shareholders, and may now weigh more heavily against the already heightened volatility and earnings uncertainty reported in earlier periods. The expanded share base and fresh capital certainly change the story, but they also prompt questions about the path to profitability and sustaining those headline dividends. Yet, the new share issuance may mean elevated dilution risk is top of mind for investors.

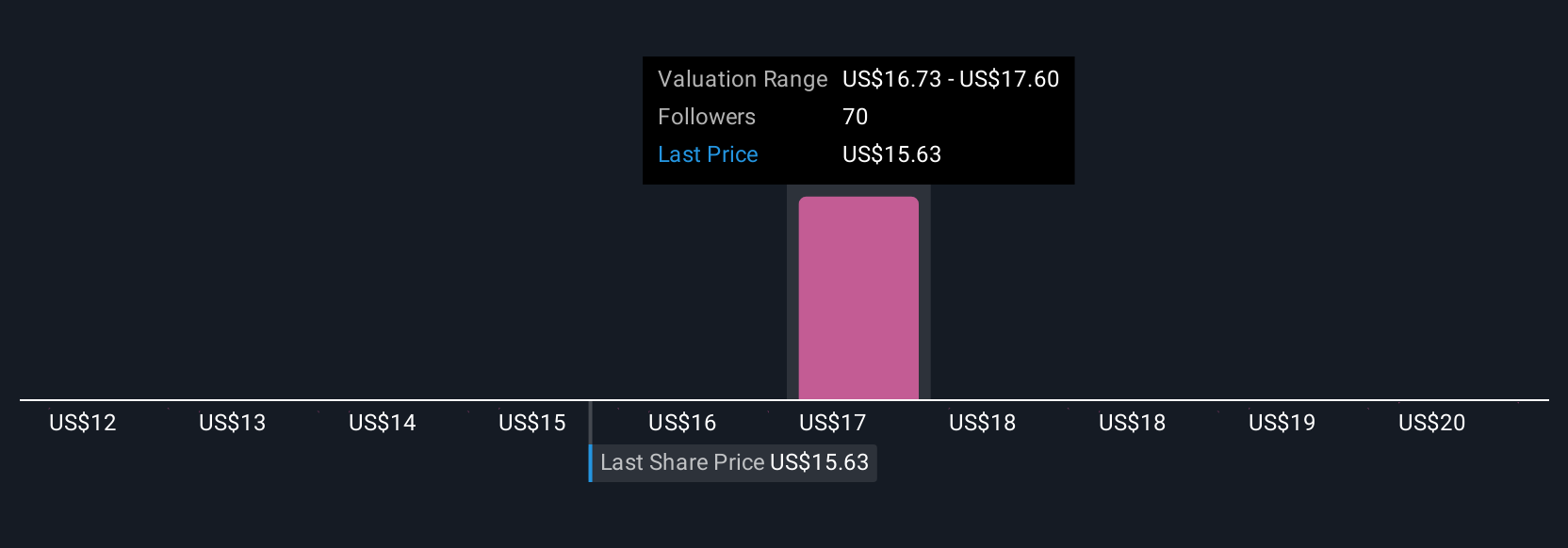

Our valuation report here indicates ARMOUR Residential REIT may be overvalued.Exploring Other Perspectives

Explore 9 other fair value estimates on ARMOUR Residential REIT - why the stock might be worth as much as 37% more than the current price!

Build Your Own ARMOUR Residential REIT Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ARMOUR Residential REIT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ARMOUR Residential REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ARMOUR Residential REIT's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English