How Perella Weinberg Partners’ (PWP) Q2 Profit Surge and Buybacks Could Shape Investor Expectations

- Perella Weinberg Partners has announced a strong earnings turnaround for the second quarter of 2025, completed additional share buybacks, appointed new independent directors, and reaffirmed its quarterly dividend of US$0.07 per share.

- This combination of improved profitability and multiple shareholder-focused actions highlights the firm's efforts to strengthen its governance, capital allocation, and operational performance.

- We'll explore how Perella Weinberg's swing to profitability and sustained buyback activity supports its investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Perella Weinberg Partners' Investment Narrative?

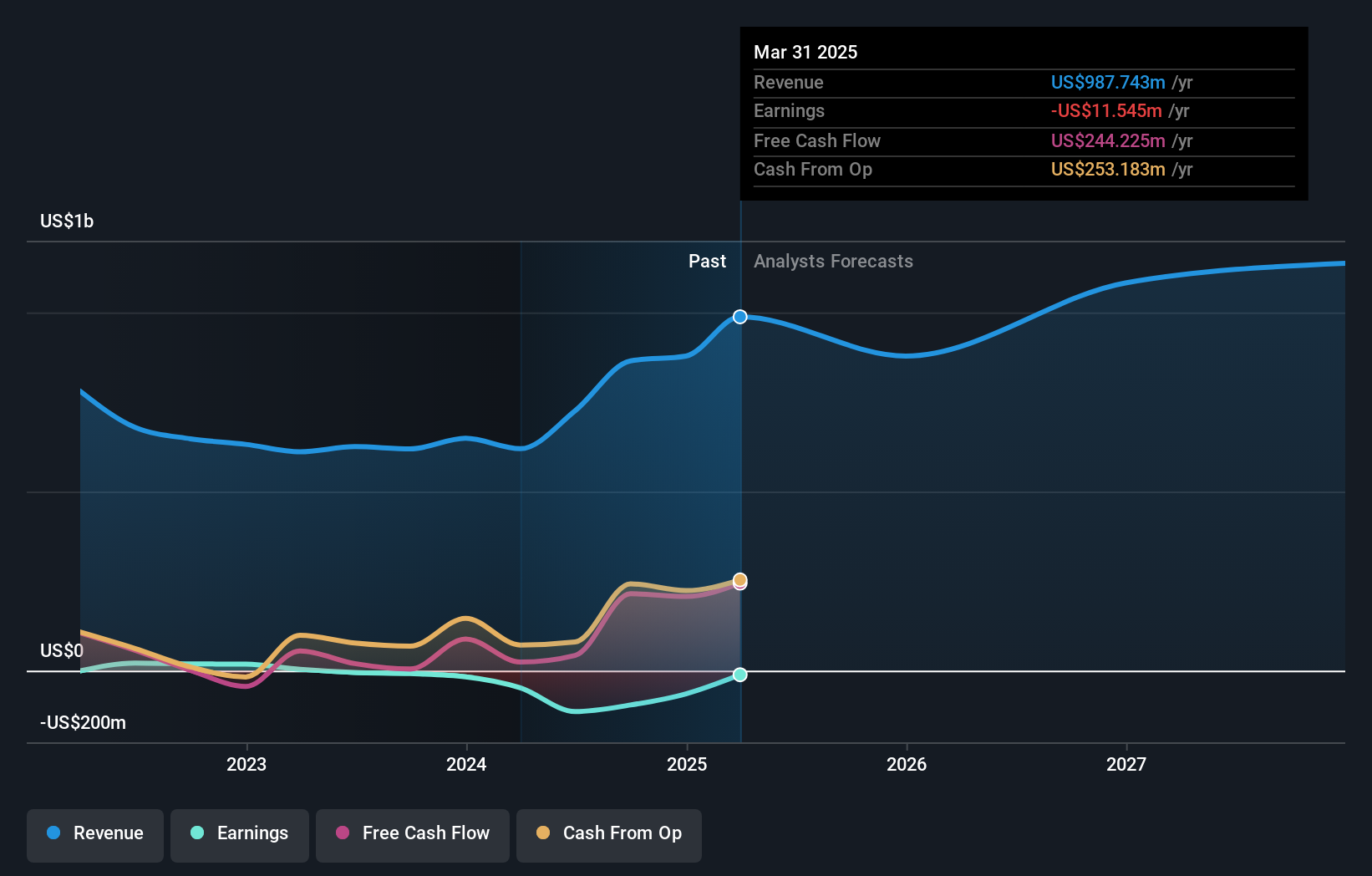

For those considering Perella Weinberg Partners, the investment case leans on a belief in a durable earnings turnaround and prudent capital management, both of which the latest news aims to reinforce. The swing to profitability for the first half of 2025, ongoing share buybacks, and the addition of experienced independent directors all signal a drive toward stronger governance and shareholder returns. These moves could support short-term catalysts by boosting confidence in the firm's operational recovery and financial discipline, especially after a period of losses. Importantly, the influx of board expertise and sector leadership is timely given the management team’s relatively short tenure, possibly helping to address concerns around experience and oversight. While the recent appointments and buyback activity may temper some key risks, issues such as insider selling and historical underperformance against industry benchmarks remain watchpoints. Ultimately, while short-term sentiment may improve with these governance and financial actions, the longer-term story rests on sustaining profit growth and managing competitive pressures.

But some uncertainties around leadership experience could still impact the company’s outlook. The valuation report we've compiled suggests that Perella Weinberg Partners' current price could be inflated.Exploring Other Perspectives

Explore another fair value estimate on Perella Weinberg Partners - why the stock might be worth just $25.75!

Build Your Own Perella Weinberg Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perella Weinberg Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Perella Weinberg Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perella Weinberg Partners' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English