Why Astronics (ATRO) Raised Revenue Guidance Despite Ongoing Test Segment Challenges

- Astronics Corporation recently reported its second quarter 2025 earnings, with sales rising to US$204.68 million year over year and net income of US$1.31 million, while also raising its full-year revenue guidance to a new range of US$840 million to US$860 million.

- This guidance increase, combined with record Aerospace segment sales despite challenges in its Test division, signals management's optimism about ongoing demand for cabin power and inflight entertainment products.

- We’ll examine how Astronics’ improved revenue outlook and record Aerospace sales impact the company's investment narrative and future growth expectations.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Astronics Investment Narrative Recap

For shareholders, the big picture around Astronics is all about capturing rising aerospace demand while navigating cost pressures and transformation risks. The recent bump in full-year revenue guidance reinforces the near-term catalyst of accelerated aircraft production rates, a key pillar for the investment story, while the main risk remains the possibility that additional tariffs and Test segment execution stumbles could undercut margin recovery or earnings stability. At this stage, the updated outlook does not materially reduce the importance of ongoing tariff headwinds as a central risk to watch.

Of the company’s latest announcements, the revenue guidance increase stands out as most relevant. Raising the lower end of forecasts to US$840 million signals management’s confidence despite lingering cost and program risks, and highlights tangible progress on core aerospace opportunities that underpin recent momentum. Despite this positive shift, investors should also consider that ongoing tariff-related costs are not fully resolved and...

Read the full narrative on Astronics (it's free!)

Astronics' narrative projects $954.0 million revenue and $86.1 million earnings by 2028. This requires 5.1% yearly revenue growth and an $89.8 million increase in earnings from -$3.7 million today.

Uncover how Astronics' forecasts yield a $38.58 fair value, a 18% upside to its current price.

Exploring Other Perspectives

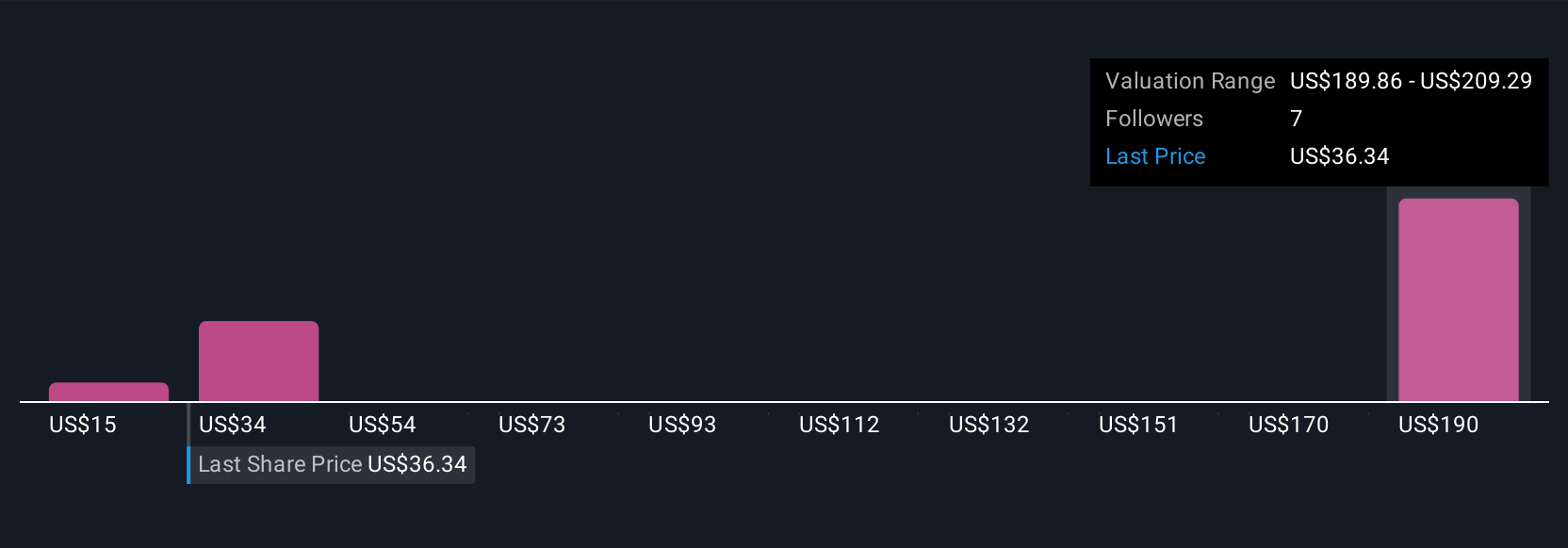

Retail investors in the Simply Wall St Community assessed Astronics’ fair value between US$15 and US$204.84, giving three distinct perspectives. Yet, tariff unpredictability and cost flexibility remain ongoing factors that can sway performance and projections, so review several viewpoints before deciding.

Explore 3 other fair value estimates on Astronics - why the stock might be worth less than half the current price!

Build Your Own Astronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Astronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astronics' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English