Will Avista's (AVA) Leadership Succession Drive a New Era of Growth and Innovation?

- Avista recently announced upcoming leadership changes, effective October 1, 2025, as part of a planned succession strategy, which includes expanded roles for Jason Thackston, Wayne Manuel, and Alexis Alexander to focus on growth, operations, and digital infrastructure.

- These executive appointments reflect Avista's intention to strengthen its operational capabilities and support future growth through deeper expertise in policy, technology, and external relations.

- We will explore how Avista’s leadership transition, particularly the greater emphasis on company-wide growth initiatives, may influence its investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Avista Investment Narrative Recap

Avista’s investment case hinges on stable regulated utility returns, long-term electrification-driven load growth, and constructive regional regulation. The recent leadership succession plan signals a strengthening of operational and digital expertise but does not materially change the company’s most important short-term catalyst: the acceleration of large new load requests. The most pressing risk, exposure to Pacific Northwest regulatory and wildfire uncertainties, remains unchanged by these management changes and continues to play a central role in Avista’s near-term outlook.

Among Avista’s latest company developments, the reaffirmed 2025 earnings guidance of US$2.52 to US$2.72 per diluted share is particularly relevant alongside leadership changes. This announcement maintains clarity for investors focused on earnings stability in the face of evolving company priorities and highlights management’s view that the leadership transition will not disrupt near-term performance expectations.

However, investors should be aware of the ongoing wildfire risk and related regulatory exposure tied to Avista’s concentrated service area, as even…

Read the full narrative on Avista (it's free!)

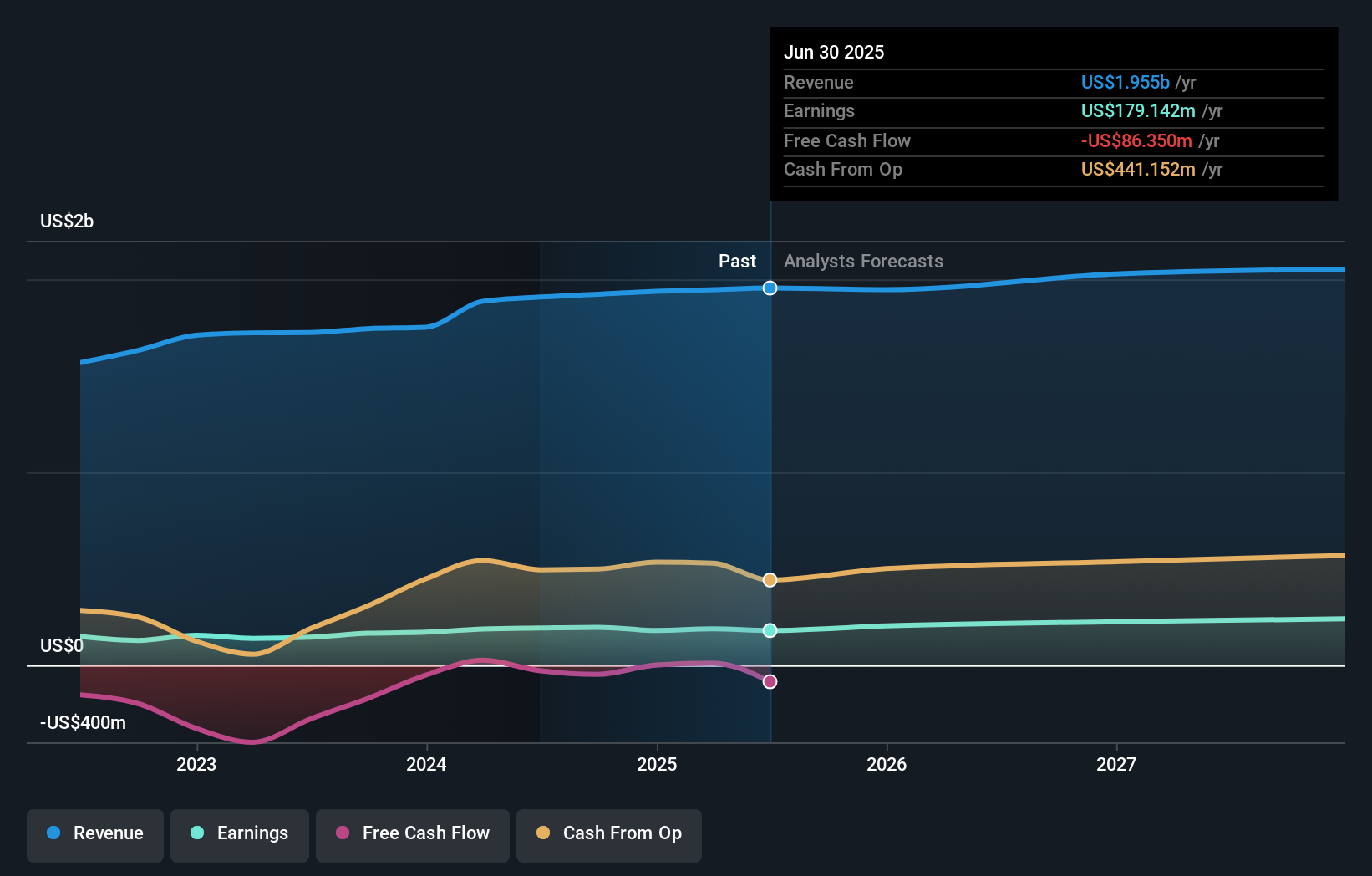

Avista's narrative projects $2.1 billion revenue and $248.7 million earnings by 2028. This requires 2.7% yearly revenue growth and a $69.6 million earnings increase from $179.1 million today.

Uncover how Avista's forecasts yield a $41.75 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community placed their fair value estimates for Avista between US$35.00 and US$41.75 per share. With regional regulation and wildfire exposure lingering as key uncertainties, it’s clear that viewpoints on Avista’s future can vary greatly and warrant consideration from multiple angles.

Explore 3 other fair value estimates on Avista - why the stock might be worth as much as 10% more than the current price!

Build Your Own Avista Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avista research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Avista research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avista's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English