Weaker Earnings and Credit Amendments Might Change the Case for Investing in Sunoco (SUN)

- On August 8, 2025, Sunoco LP amended its credit agreement to allow up to US$2 billion in reserved cash for the Parkland Acquisition to be excluded from its net leverage ratio calculation, while also recently reporting significantly lower second-quarter earnings with sales dropping to US$5.39 billion and net income at US$86 million compared to much higher figures a year earlier.

- This combination of materially weaker earnings and financial adjustments connected to a major acquisition signals important changes in Sunoco’s capital strategy and current business momentum.

- Let’s examine how Sunoco’s lower quarterly earnings and credit facility amendments may reshape its previously growth-focused investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Sunoco Investment Narrative Recap

To be a Sunoco shareholder today, you need confidence in the company’s ability to grow through acquisitions and maintain strong earnings in a shifting fuel market. The latest credit amendment and a sharp fall in quarterly earnings may not immediately derail the main catalyst, acquisition-driven growth, but they increase sensitivity to the biggest risk: higher leverage and the challenge of integrating new assets during weaker financial periods.

Of the recent announcements, the August 6 earnings release is most relevant, highlighting a significant year-over-year drop in sales and net income. This directly ties into concerns about the Parkland Acquisition’s scale and whether Sunoco’s current financial flexibility can support both growth ambitions and ongoing distributions.

By contrast, investors should be alert to how sustained earnings pressure could limit Sunoco’s ability to fund its large dividend and...

Read the full narrative on Sunoco (it's free!)

Sunoco's narrative projects $27.1 billion revenue and $1.4 billion earnings by 2028. This requires 7.8% yearly revenue growth and a $1.12 billion increase in earnings from $278.0 million.

Uncover how Sunoco's forecasts yield a $64.83 fair value, a 26% upside to its current price.

Exploring Other Perspectives

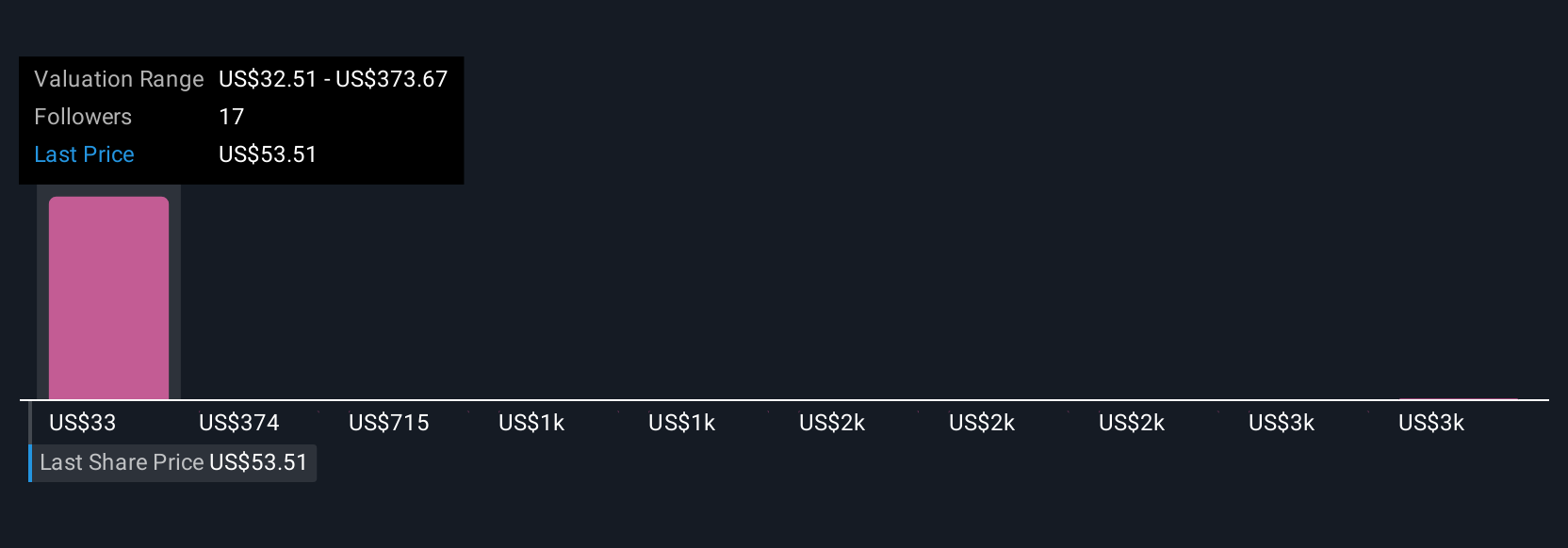

Five individual fair value estimates from the Simply Wall St Community range widely from US$32.51 to US$3,444.12 per share. While expectations about Sunoco’s acquisition-led growth are high, uncertainty over future earnings is causing widely different forecasts and signals the importance of reviewing several perspectives before making any decisions.

Explore 5 other fair value estimates on Sunoco - why the stock might be worth 37% less than the current price!

Build Your Own Sunoco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunoco research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Sunoco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunoco's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English